Personal Finance: Smart Ways to Grow and Protect Your Money

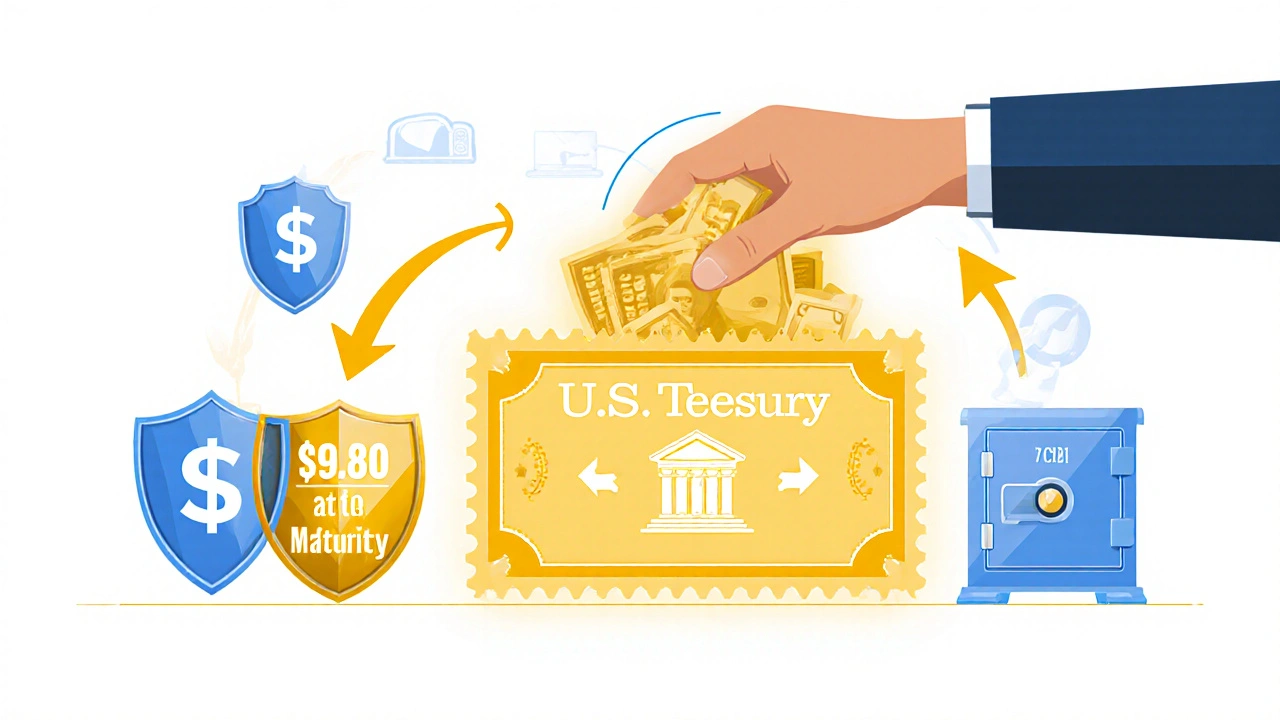

When you think about personal finance, how you manage your money to build wealth, reduce stress, and plan for the future. Also known as individual financial planning, it's not just about budgeting—it’s about making every dollar work harder for you over time. Most people focus on saving more, but the real game-changer is knowing where to save and invest. That’s where account types like a taxable brokerage account, an investment account where you can buy stocks, ETFs, or funds without contribution limits, but you pay taxes on gains and dividends come into play. Unlike retirement accounts, this one gives you full control—no early withdrawal penalties, no income limits—so you can use it for goals like a down payment on a house or funding a side business.

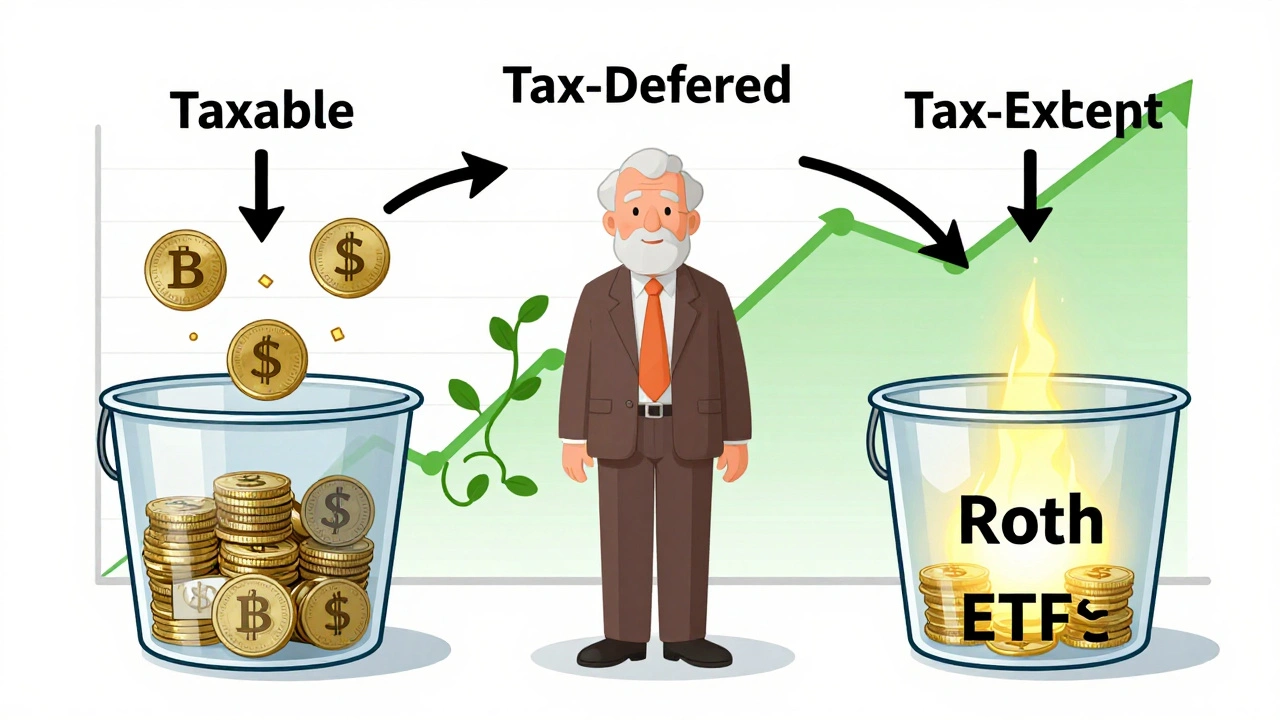

But here’s the catch: just having a taxable account isn’t enough. What matters is how you pair it with other accounts. That’s the core of tax coordination, the strategy of placing different types of investments in the right accounts to minimize taxes and maximize after-tax returns. For example, putting high-growth stocks in your Roth IRA and bonds in your taxable account can boost your long-term returns by up to 0.75% a year. And if you’re also managing a 401(k), a tax-deferred employer-sponsored retirement account where contributions lower your taxable income today, you need to rebalance smartly. Rebalancing in your 401(k) doesn’t trigger taxes, but doing it in your taxable account might—so you do it differently. This isn’t wall street jargon. It’s just common sense for anyone serious about keeping more of what they earn.

Your emergency fund is another piece of this puzzle. Is it better to keep it in one big pot or split it across multiple accounts? The answer depends on your habits. Some people need the psychological safety of a separate emergency fund, a dedicated stash of cash for unexpected expenses like car repairs or medical bills to avoid dipping into investments. Others prefer combining it with other savings for better interest. Either way, the goal is the same: make sure your safety net is liquid, safe, and actually accessible when life throws a curveball.

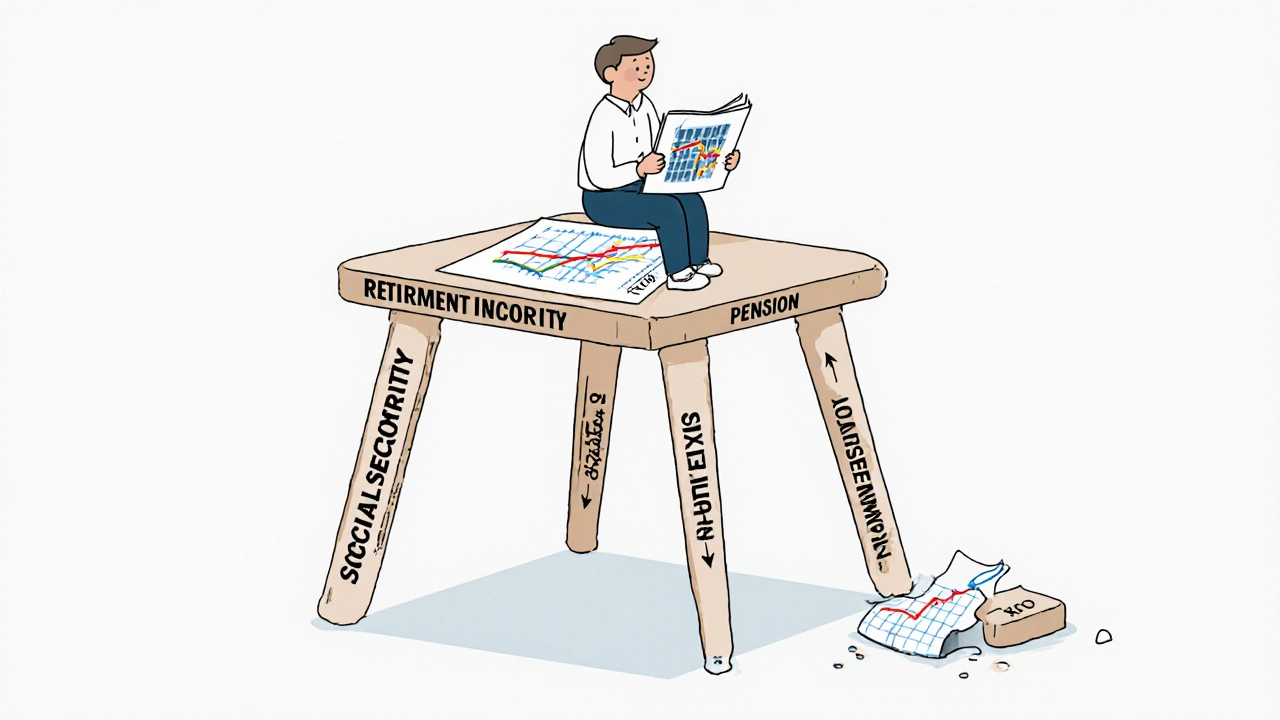

What you’ll find below isn’t theory. These are real, tested moves people are using right now to build wealth without guesswork. Whether you’re just starting out or you’ve maxed out your 401(k), there’s something here that’ll help you make smarter choices with your money—today, not next year.