Emergency Fund Liquidity Calculator

Emergency Fund Calculator

Your Liquidity Allocation

Recommended: 50-70% immediate, 20-30% 1-day, 10-20% 1-3 day. Your allocation (50/30/20) is within the optimal range.

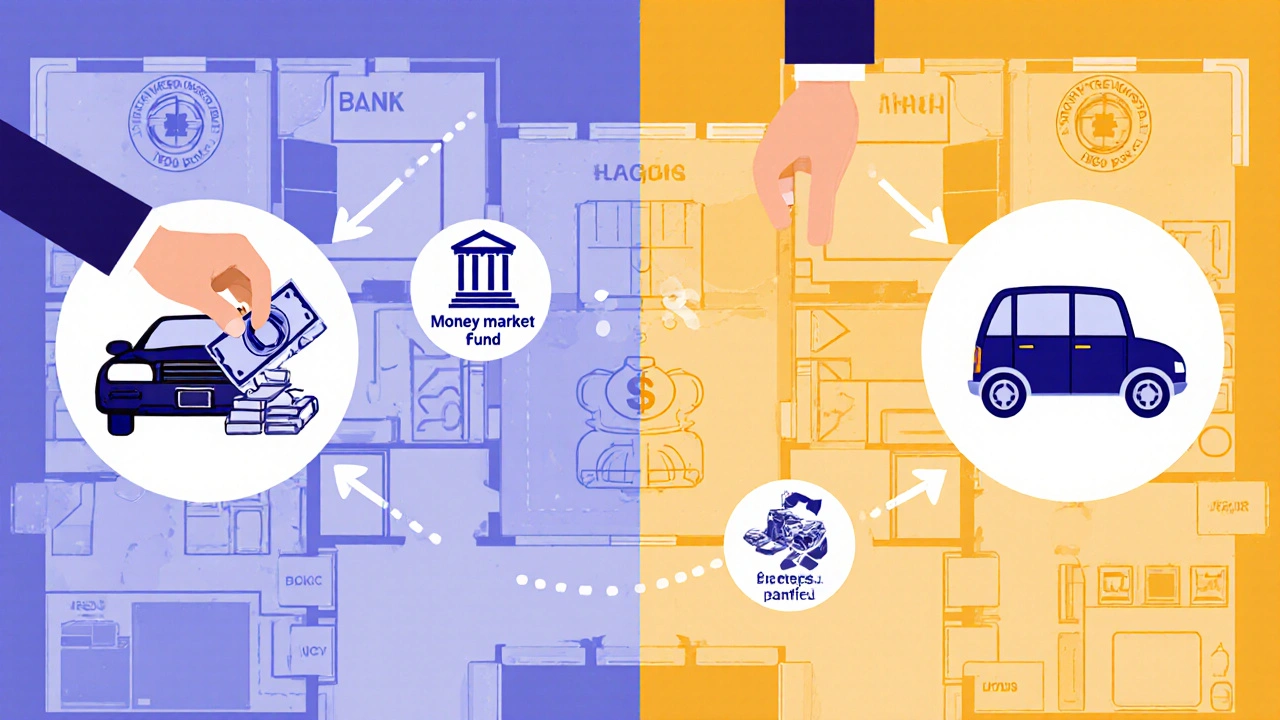

When your car breaks down, your fridge dies, or a medical bill shows up out of nowhere, you don’t want to be scrambling to sell stocks or beg for a loan. You want cash - fast, reliable, and ready. That’s where liquidity diversification comes in. It’s not about getting rich. It’s about not going broke when life hits you sideways.

Most people think their emergency fund is just a savings account with a few thousand dollars. That’s a start. But it’s not enough. If you only keep your emergency money in one place, you’re risking delays, fees, or even losses when you need it most. Liquidity diversification means spreading your accessible cash across different types of assets so you always have a way to get money quickly - no matter what’s happening in the market or your personal life.

What Liquidity Actually Means (And Why It’s Not Just Cash)

Liquidity isn’t just about having money in your wallet. It’s about how fast you can turn something into cash without losing value. Think of it like a fire extinguisher: you don’t use it every day, but when you need it, it better work instantly.

The Federal Reserve and FDIC define liquidity as the ability to meet cash needs at a reasonable cost. For you, that means having funds you can access within hours, not weeks. Not all assets are created equal. Your 401(k)? Not liquid. Selling shares during a market crash? Risky and slow. A credit card? That’s debt, not liquidity.

True liquidity comes in layers. Here’s how the top financial institutions structure it:

- Immediate liquidity (0-24 hours): Cash in checking accounts, FDIC-insured savings accounts. This is your first line of defense.

- 1-day liquidity: Money market funds, high-yield savings accounts. These pay a little more interest and are just as safe.

- 1-3 day liquidity: Large-cap dividend stocks (like Johnson & Johnson or Microsoft), government bond ETFs. These can be sold quickly during normal market conditions.

According to Vanguard’s 2022 research, households that kept their emergency funds in this layered structure had 92% funding continuity during the 2020 economic shock. Those who kept everything in one account? Only 63% made it through without stress or debt.

Why One Account Isn’t Enough

Let’s say you have $10,000 in a regular savings account. Sounds safe, right? But what if your bank’s website crashes? What if you need to wire money internationally for an emergency relative? What if you’re locked out of your app for three days?

Real emergencies don’t wait for perfect conditions. In 2022, during a major cyberattack on a regional bank, thousands of customers couldn’t access funds for over 48 hours - even though their money was FDIC-insured. Insurance doesn’t mean instant access.

Diversifying your liquidity means you’re not betting everything on one system. If your main bank goes down, you still have money in a different institution, or in a money market fund you can access through a different app. It’s like having two keys to your house - one under the mat, one with your neighbor.

And here’s the kicker: 68% of people think their retirement accounts are liquid. They’re not. Early withdrawals from IRAs or 401(k)s come with penalties - often 10% plus taxes. That’s not an emergency fund. That’s a financial trap.

The Right Mix: How Much Goes Where?

There’s no magic number, but there’s a smart range. Most financial planners recommend covering 3-6 months of essential expenses. If you’re self-employed, work in a volatile industry, or have dependents, aim for 9-12 months.

Here’s the breakdown that works for most households:

- 50-70% in immediate liquidity: Keep this in a high-yield savings account or checking account at a major bank. Make sure it’s FDIC-insured. This is your go-to for anything that happens today or tomorrow.

- 20-30% in 1-day liquidity: Put this in a money market fund through a brokerage like Fidelity or Vanguard. These often pay 4-5% APY and let you write checks or transfer funds instantly.

- 10-20% in 1-3 day liquidity: Use this for low-volatility assets like Treasury ETFs (e.g., SHV) or blue-chip dividend stocks. These aren’t for daily spending, but they’re your backup if the first two layers get drained.

For example: If your monthly essentials are $3,000, your emergency fund should be $9,000-$18,000. Split it like this:

- $7,500 in high-yield savings

- $3,000 in money market fund

- $1,500 in Treasury ETFs

This structure lets you cover a $5,000 car repair tomorrow, a $2,000 medical bill next week, and still have $2,000 left for unexpected travel or job loss - without touching your retirement or selling stocks at a loss.

The Hidden Cost of Too Much (or Too Little) Liquidity

Keeping too much cash can hurt you. Inflation eats away at idle money. Vanguard found that households holding more than 12 months of expenses in cash lost an average of 0.8% in annual returns. Over 10 years, that’s over $14,000 on a $100,000 portfolio.

But keeping too little is worse. Aurora Training Advantage found that households with insufficient liquidity paid 28% more in borrowing costs during emergencies - higher interest on credit cards, payday loans, or family loans with strings attached.

The sweet spot? Enough to cover 6 months of essentials, split across the three tiers above. Anything beyond that should go into investments that grow over time. Your emergency fund isn’t meant to make money. It’s meant to keep you from losing everything.

Real-World Examples: What Works

Professional sports teams don’t have the luxury of guessing. When stadiums shut down in 2020, teams with diversified liquidity survived. One NFL franchise kept 40% of its emergency fund in high-yield savings, 30% in money market funds, 20% in short-term Treasury bills, and 10% in liquid dividend stocks. When revenue vanished overnight, they accessed 99% of their emergency cash within 72 hours - and still earned 1.8% annual returns.

Compare that to a college athletic department that kept 80% of its reserves in a single savings account. When their main bank experienced a system outage, they couldn’t pay coaches or vendors for two weeks. They had to delay payroll - and lost key staff.

On the individual level, a single mom in Ohio kept $12,000 split across three accounts: $7,000 in a high-yield savings account, $3,000 in a money market fund, and $2,000 in a Treasury ETF. When her car transmission failed, she transferred $4,000 from savings and $1,500 from the money market fund - all within 24 hours. She didn’t touch the ETF. She didn’t borrow. She didn’t stress.

What to Avoid

Not all “liquid” assets are safe. In 2022, several so-called stablecoins collapsed, losing 72% of their value during market stress. People thought they were holding cash equivalents. They weren’t. They lost everything.

Same with crypto. Bitcoin isn’t liquid in a crisis - it’s volatile. You can’t count on selling it quickly at the price you want.

Also avoid:

- Retirement accounts as emergency funds

- Home equity lines (HELOCs) - they can be frozen during crises

- Brokerage accounts with only growth stocks - selling during a crash means locking in losses

- One-bank reliance - if the bank’s tech fails, so does your access

How to Set It Up - Step by Step

Start today. Here’s how:

- Calculate your essential monthly expenses: Rent, utilities, groceries, insurance, minimum debt payments. Ignore dining out, subscriptions, or luxury spending.

- Decide your target: Multiply by 6 for most people. Multiply by 9-12 if you’re self-employed or in a risky job.

- Open three accounts: One high-yield savings account, one money market fund (through a brokerage), and one brokerage account for Treasury ETFs.

- Automate deposits: Set up a transfer of $200-$500 per month from your paycheck into these accounts.

- Review quarterly: If your expenses change, adjust your target. If one account grows too big, rebalance - move excess to the next tier.

Don’t wait for a crisis to start. The best time to build liquidity was five years ago. The second-best time is today.

What’s Changing in 2025

The FDIC updated its liquidity rules in October 2025 to require banks to plan for climate-related disruptions - like floods or power outages that could knock out ATMs or online systems. That means financial institutions are now forced to think about real-world emergencies, not just market crashes.

Vanguard introduced the “Liquidity Resilience Score” in 2023 - a 100-point scale that measures how prepared your emergency fund is. Scores above 85 mean you’re 73% less likely to experience financial panic during a crisis.

JPMorgan’s Private Bank now uses AI to map your liquidity needs across 47 factors - your job stability, dependents, debt, even your credit score - to optimize where your cash sits. Early users cut opportunity costs by 31% without sacrificing access.

The message is clear: liquidity isn’t static. It needs monitoring. It needs rebalancing. It needs to evolve with your life.

Can I use my credit card instead of an emergency fund?

No. Credit cards are debt, not liquidity. Using them in an emergency means paying high interest, which can trap you in a cycle of payments. An emergency fund is cash you already have - no interest, no penalties, no stress.

Should I keep my emergency fund in the same bank as my checking account?

It’s safer to spread it. If your bank has a system outage, cyberattack, or regional failure, you won’t be locked out of all your cash. Use one bank for checking, another for savings, and a brokerage for money market funds. Diversify access points.

How often should I check my emergency fund?

Every three months. Life changes - your expenses, your income, your family size. Rebalance your liquidity tiers if needed. If you got a raise, increase your deposits. If you lost a side gig, shift more into immediate liquidity.

Is it okay to invest part of my emergency fund?

Yes - but only in low-risk, highly liquid assets like Treasury ETFs or money market funds. Never put emergency money into stocks, crypto, or real estate. Those can drop in value or take days to sell. Your emergency fund must be safe and instantly available.

What if I need more than 6 months of expenses?

If you’re self-employed, work in a volatile industry, or have high medical costs, aim for 9-12 months. Build the extra amount slowly. Keep it in the same three-tier structure - don’t just pile cash into one account. The structure protects you even when the amount grows.

If you’ve ever felt helpless when an emergency hit, you know how valuable fast access to cash is. Liquidity diversification isn’t fancy. It’s practical. It’s simple. And it’s the difference between surviving a crisis - and being crushed by it.

Laura W

November 7, 2025 AT 17:17Okay but let’s be real - if you’re not using a brokerage like Fidelity or Schwab for your money market fund, you’re leaving free interest on the table. I’ve been stacking 4.8% APY in my MMF for 18 months now, and honestly? It’s like getting paid to not be an idiot. Plus, the instant transfers? Chef’s kiss. Stop treating your emergency fund like a savings account your grandma opened in 1997.

Dave McPherson

November 7, 2025 AT 23:52Wow. Just... wow. You’ve basically written a Wall Street whitepaper disguised as a Reddit post. I mean, I appreciate the effort, but do you really think the average person cares about SHV ETFs or ‘liquidity resilience scores’? Most of us are just trying not to eat ramen for three months after our car dies. Your ‘three-tier system’ sounds like over-engineering for people who can’t even afford to max out a Roth IRA. Also - ‘blue-chip dividend stocks’ as emergency cash? Bro, what if Apple crashes 20% tomorrow? That’s not liquidity, that’s gambling with your rent money.

And don’t even get me started on ‘AI mapping your liquidity needs.’ Next you’ll tell me my fridge knows when I’m about to get laid off. Please. Keep your jargon. I’ll stick with $5k in a high-yield account and a credit card with 0% intro APR. Simpler. Less stress. More sleep.

Julia Czinna

November 8, 2025 AT 15:44I really appreciate how grounded this is - especially the part about not using retirement accounts as emergency funds. So many people don’t realize the penalties can be brutal. I’ve seen friends pull from their 401(k) during the pandemic and end up paying 30% in taxes and fees - then spent years clawing back the growth. This breakdown is practical, not performative.

Also, the point about bank outages is critical. My cousin got locked out of her account for 72 hours during a regional cyberattack last year. She had to borrow from her sister to pay her dog’s emergency surgery. That shouldn’t happen. Spreading access points isn’t paranoia - it’s basic risk management.

And yes, stablecoins are a trap. I still can’t believe people thought ‘USDC’ was cash. It’s not. It’s a promise. And promises break.

Graeme C

November 9, 2025 AT 10:30This is the most coherent, actionable financial advice I’ve read in years - and I’ve read a LOT. You’ve nailed the psychological trap: people confuse ‘safe’ with ‘liquid.’ FDIC insurance ≠ instant access. And the 92% vs 63% stat? That’s not a statistic - that’s a moral indictment of the financial literacy crisis.

Also, the NFL team example? PERFECT. Corporations have teams of CFOs doing this. Why don’t we? I’m now restructuring my own fund exactly as you laid out. $7,500 in Ally, $3,000 in Fidelity MMF, $1,500 in SHV. Done. No more ‘I’ll get to it later.’

And for anyone still using credit cards as ‘emergency funding’ - please. Stop. You’re not being resourceful. You’re being financially masochistic.

RAHUL KUSHWAHA

November 9, 2025 AT 21:08