To get a dividend from a stock, you don’t just need to own it-you need to own it at the right time. The ex-dividend date is the make-or-break cutoff that decides who gets paid and who doesn’t. If you buy on or after this date, you won’t get the dividend, no matter how long you hold the stock afterward. And if you think the rule is still "two days before the record date," you’re operating on outdated info. Since May 28, 2024, everything changed.

What the Ex-Dividend Date Actually Means

The ex-dividend date is the first day a stock trades without the right to the upcoming dividend. It’s not a suggestion. It’s a hard cutoff set by the stock exchange, based on how fast trades settle. Before 2024, trades took two business days to settle (T+2). Now, they settle in one (T+1). That means if you want to be on the company’s official shareholder list for the dividend, you have to buy the stock at least one business day before the record date.

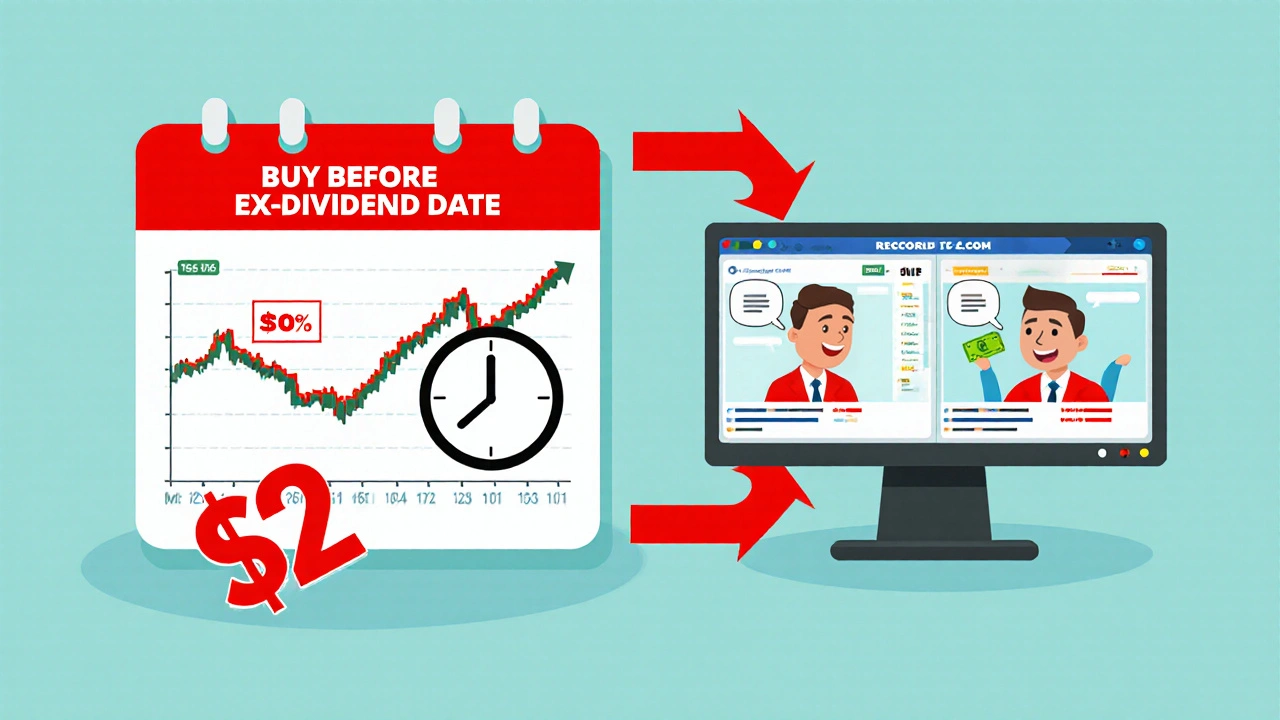

Here’s how it works in practice: Let’s say Company X sets its record date for Thursday, June 5. Under T+1 rules, the ex-dividend date is Wednesday, June 4. If you buy the stock on Tuesday, June 3, your trade settles on Wednesday, June 4-before the record date. You’re eligible. If you buy on Wednesday, June 4, your trade settles on Thursday, June 5-after the record date. You miss the dividend.

The company doesn’t care who bought the stock yesterday or last week. They only look at who owns it at the close of the record date. But because it takes a full business day for your purchase to clear, you have to buy before the ex-dividend date to make sure you’re on the list.

Why the T+1 Change Matters

The shift from T+2 to T+1 wasn’t just a technical tweak. It reshaped how dividend investors plan their trades. Before May 2024, you had two full days to buy before the record date. Now, you have one. That cuts your window in half.

Some investors used to buy stock the day before the record date, knowing the trade would settle in time. Now, that strategy fails. A Reddit user in June 2024 posted about missing a dividend on Johnson & Johnson because they bought the day before the record date-exactly what you’d have done under T+2. Under T+1, that trade settled after the record date. No dividend.

Dr. Robert Johnson of The American College of Financial Services noted that this change reduced opportunities for short-term "dividend capture" traders, but it actually made things simpler for long-term investors. Fewer moving parts. Fewer chances to mess up. The rule is now straightforward: buy before the ex-dividend date. That’s it.

Record Date vs. Ex-Dividend Date vs. Payable Date

There are three key dates in the dividend timeline. Confusing them is the #1 reason people miss payouts.

- Declaration Date: When the company’s board announces the dividend, including the ex-dividend date, record date, and payment date. This is when the company officially commits to paying.

- Ex-Dividend Date: The cutoff. Buy before this date to get paid. Buy on or after, and you’re out.

- Record Date: The day the company checks its books to see who owns the stock. You don’t need to buy on this day-you just need to be settled as the owner by the end of it.

- Payable Date: When the cash actually hits your brokerage account. This can be weeks after the ex-dividend date.

Many investors think the record date is the deadline. It’s not. It’s just the snapshot. The ex-dividend date is the real deadline.

What Happens to the Stock Price?

On the ex-dividend date, the stock price usually drops by roughly the amount of the dividend. That’s not a coincidence. It’s market mechanics. If you buy a $100 stock that pays a $2 dividend, the stock adjusts down to about $98 on the ex-date because the right to that $2 is no longer included in the price.

Some traders try to buy right before the ex-dividend date and sell right after, hoping to pocket the dividend without losing money on the price drop. But that rarely works. The market anticipates the drop. You’re not getting free money-you’re just exchanging price for cash.

Charles Schwab’s data shows that about 84% of S&P 500 companies pay dividends. For income-focused investors, understanding this price adjustment is critical. If you’re buying for dividends, you’re not trying to time the price swing-you’re trying to time the eligibility.

Exceptions to the Rule

Most dividends follow the standard one-business-day-before-record-date rule. But there are two big exceptions.

Large dividends (25% or more of stock value): If a company pays a huge dividend-say, a special one-time payout that’s 25% or more of the stock’s price-the ex-dividend date flips. Instead of being one day before the record date, it’s set as the first business day after the payable date. This gives investors time to settle the trade after the payout. For example, if the record date is August 10 and the payable date is August 31, the ex-date becomes September 1.

Cash settlement trades: Some institutional trades settle on the same day they’re executed. If you’re part of one of those trades and you buy on the record date, you can still get the dividend because your ownership settles immediately. But for retail investors using standard brokerage accounts, this doesn’t apply. Your trade still takes one business day to settle.

What Counts as a Business Day?

Not every calendar day is a business day for dividend purposes. A business day is when both the stock exchanges and banks in New York are open. That means:

- Weekends? Not business days.

- Federal holidays like Thanksgiving, Christmas, New Year’s Day? Not business days.

- Columbus Day and Veterans Day? Even though the market is open, banks are closed-so they don’t count.

If the record date falls on a Sunday, you count backward from the last business day before it. So if the record date is Sunday, June 8, the last business day is Friday, June 6. The ex-dividend date becomes Thursday, June 5-not Friday. If you buy on Friday, June 6, your trade settles on Monday, June 9-after the record date. You miss the dividend.

How to Find the Ex-Dividend Date

You don’t need to calculate it yourself. Your brokerage platform will show the ex-dividend date clearly in the stock’s dividend information. You can also check the company’s investor relations page or financial news sites like Yahoo Finance or Bloomberg.

Always double-check the date. If you’re relying on an old blog post or a Reddit thread from 2023 that says "two days before," you’re at risk. The T+1 rule is now the standard. Outdated advice can cost you real money.

What Happens If You Buy on the Ex-Dividend Date?

You get the stock. You just don’t get the dividend. The seller gets it. That’s how the system is designed. You’re buying the stock without the dividend attached.

Some investors think, "I’ll just buy it anyway-I’ll get the next dividend." That’s fine if you’re holding long-term. But if you’re timing dividends, buying on the ex-date means you’re waiting another full dividend cycle to get paid. For income investors, that’s a lost payout.

And remember: even if you sell the stock the next day, you still won’t get the dividend. Ownership at the close of the record date is the only thing that matters.

Pro Tips for Dividend Investors

- Set calendar reminders for the ex-dividend date of stocks you own. Don’t wait for your broker to notify you.

- Use your brokerage’s dividend calendar tool. Most platforms (like Fidelity, Schwab, or Robinhood) have one.

- Never assume the old T+2 rule still applies. Double-check the settlement cycle.

- Don’t chase high dividends without checking the company’s payout history. A big dividend can signal financial trouble if it’s unsustainable.

- For ETFs that pay dividends, the ex-date is based on the underlying holdings. Check the fund’s prospectus for details.

Frequently Asked Questions

Do I need to hold the stock past the ex-dividend date to get the dividend?

No. You only need to own the stock before the ex-dividend date. Once you’re on the record date list, you’ll get the dividend even if you sell the stock the next day. The payout goes to whoever owned it at the close of the record date.

Can I buy a stock on the record date and still get the dividend?

No. If you buy on the record date, your trade settles the next business day-after the record date. You won’t be on the company’s shareholder list. You need to buy before the ex-dividend date, which is one business day before the record date under T+1 rules.

Why does the stock price drop on the ex-dividend date?

The price drops because the dividend is no longer part of the stock’s value. If a stock is trading at $50 and pays a $1 dividend, the market adjusts the price down to around $49 on the ex-date. It’s not a loss-it’s a transfer of value from price to cash.

Are dividends taxed differently if I buy right before the ex-dividend date?

No. The tax treatment depends on whether the dividend is qualified or non-qualified, not on when you bought the stock. Qualified dividends (held over 60 days during the 121-day period around the ex-date) are taxed at lower capital gains rates. Timing your purchase for the ex-date doesn’t change that.

Do mutual funds and ETFs have ex-dividend dates too?

Yes. Mutual funds and ETFs pay dividends based on the underlying stocks they hold. The fund’s ex-dividend date is set when the fund’s holdings go ex-dividend. Check the fund’s website or prospectus for exact dates. The same T+1 rules apply.

Final Takeaway

The ex-dividend date isn’t a suggestion. It’s a hard rule enforced by settlement timelines. Since May 2024, you have one business day to act before the record date. Miss that window, and you miss the dividend. Use your brokerage tools, check dates early, and ignore outdated advice. Dividend investing works best when you know the rules-and follow them precisely.

Dave McPherson

November 17, 2025 AT 09:27Oh sweet jeebus, another post pretending T+1 is some revolutionary insight. I’ve been screaming this since May 2024 on r/Investing. People still buy on the day before record date like it’s 2023. It’s not even a glitch-it’s a fucking feature. The market didn’t break, you just got lazy. And no, buying the ex-date and selling the next day won’t net you free cash. You’re not a hedge fund, you’re a guy who thinks ‘dividend capture’ is a Netflix documentary.

RAHUL KUSHWAHA

November 18, 2025 AT 11:36Thank you for this clear breakdown 😊

As someone from India, I used to think record date = deadline. Now I check ex-div date religiously. Brokerage apps here still show old info sometimes-so I cross-check with Yahoo Finance. Small habit, big difference in dividends collected. 🙏

Julia Czinna

November 18, 2025 AT 19:37I appreciate how you broke this down without the usual financial jargon overload. So many posts treat dividend dates like a magic trick, but this is just mechanics-clear, logical, and grounded in settlement cycles. I used to panic when my dividend didn’t show up, thinking my broker messed up. Turns out I was just reading last year’s blog. Now I set a calendar alert for ex-div dates two weeks out. No more surprises. Also, the part about Columbus Day not counting as a business day? That’s the kind of detail that saves your portfolio. Thank you.

Laura W

November 19, 2025 AT 09:38Okay but let’s be real-T+1 was the most underrated fintech upgrade since mobile trading. Before this, I was chasing dividends like a dog after a mail truck. Now? I just check the ex-date, buy the day before, and chill. No more frantic Tuesday night trades. Also, the stock drop on ex-date? Totally expected. I don’t care if it dips $1.50-I get $1.80 in cash. That’s a net win. And if you’re buying a stock just for the dividend and selling the next day? Babe, that’s not investing, that’s coupon clipping with extra steps. Stick with the long game. 💸📈