Tax-Aware Rebalancing Calculator

Your Portfolio Details

Tax Strategy Options

Your Tax Savings Report

Key Insight: By rebalancing in your 401(k) instead of taxable accounts, you could save $0 in taxes over 10 years.

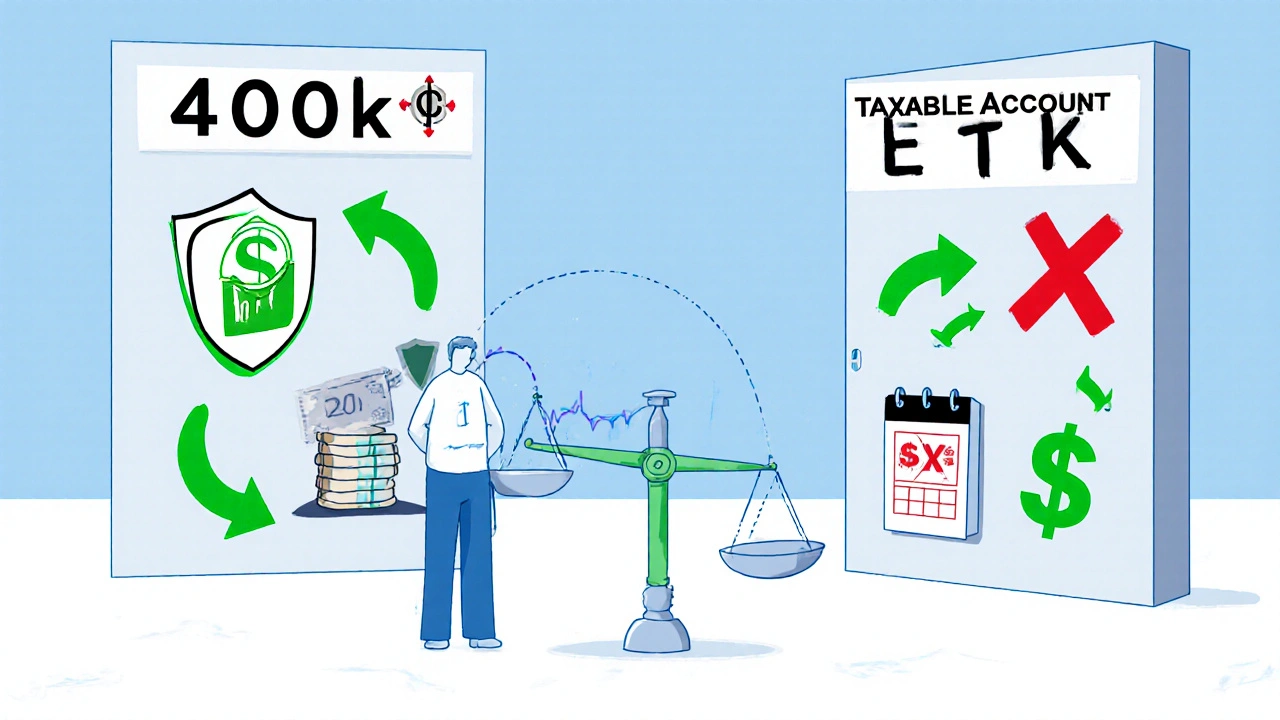

Most people think rebalancing their portfolio is just about buying and selling stocks to keep their allocation in line. But if you have both a 401(k) and a taxable brokerage account, you’re leaving money on the table if you treat them the same. Tax-aware rebalancing isn’t fancy math-it’s simple logic: where you hold assets matters just as much as what you hold.

Why Tax-Aware Rebalancing Isn’t Optional

Imagine you’re driving a car with a flat tire. You keep pressing the gas, hoping it’ll get better. That’s what most people do when they rebalance without thinking about taxes. They sell high in their taxable account and pay 15% to 20% in capital gains tax-just to buy back the same fund. Meanwhile, their 401(k) sits untouched, growing tax-free. The difference isn’t small. Vanguard found that poorly managed taxable accounts lose 0.5% to 1.0% in annual returns just from taxes. Over 30 years, that’s tens of thousands of dollars. Morningstar tracked portfolios over 20 years and found that disciplined rebalancing added 0.4% annually to returns. Combine that with smart tax handling, and you’re talking about a 0.8% boost-enough to turn a $500,000 portfolio into $700,000 by retirement.How 401(k)s and Taxable Accounts Are Totally Different

You can’t treat them like the same account. Here’s why:- 401(k)s (Traditional): You get a tax break today when you contribute. Growth is tax-deferred. When you withdraw in retirement, it’s taxed as ordinary income-up to 37%.

- Roth 401(k): No upfront tax break, but withdrawals after 59.5 are completely tax-free. No required minimum distributions if you roll them into a Roth IRA.

- Taxable accounts: You pay taxes on dividends and interest every year. When you sell, you pay capital gains tax-0%, 15%, or 20% depending on income. If you hold less than a year, it’s taxed as ordinary income (up to 37%). Plus, if you make over $200k (single) or $250k (married), you pay an extra 3.8% Net Investment Income Tax.

Where to Put What: The Asset Location Rule

Financial experts like William Bernstein and Vanguard agree: put the tax-inefficient stuff in tax-advantaged accounts. Here’s the simple breakdown:- Put bonds and REITs in your 401(k)-they generate regular income taxed at your top rate. Holding them in a taxable account means paying taxes every year on dividends, even if you don’t sell.

- Put stock ETFs and index funds in your taxable account-they rarely distribute capital gains, and when you sell, you pay the lower long-term capital gains rate.

- Hold international stocks in taxable accounts-you can claim foreign tax credits on dividends, which reduces your U.S. tax bill. You can’t do that in a 401(k).

- Use Roth 401(k)s for high-growth assets-if you expect to be in a higher tax bracket in retirement, let stocks grow tax-free inside a Roth.

How to Rebalance Without Paying Extra Taxes

You don’t need to sell anything to rebalance. Here’s how to do it tax-smart:- Use new contributions first. If your stocks are up and your bonds are down, direct 100% of your next 401(k) contribution into bonds until you’re back on target. No taxes. No hassle.

- Rebalance inside your 401(k). Since there are no taxes, use it as your main rebalancing tool. Sell high, buy low-freely.

- Only rebalance taxable accounts if you must. If your taxable account is way off, sell the assets you’ve held the longest first (long-term gains are cheaper). Avoid selling anything held under a year.

- Harvest losses to offset gains. If you have losing positions in your taxable account, sell them. You can use up to $3,000 of losses to reduce your ordinary income. Any extra losses carry forward to future years. This is free money.

- Don’t trigger wash sales. If you sell a stock at a loss, you can’t buy it back (or a substantially identical one) within 30 days. Otherwise, the IRS disallows the loss. Use ETFs with different tickers (like VTI instead of VTSAX) to avoid this.

When Roth 401(k)s Are the Better Choice

If you’re young, early in your career, or expect to be in a higher tax bracket later, a Roth 401(k) can be a game-changer. Vanguard modeled this: if you’re in the 22% tax bracket now but expect to be in the 30% bracket in retirement, a Roth 401(k) beats a traditional one by 8% or more over 30 years. That’s because you pay the tax now at 22% and never pay it again-even if tax rates go up. Also, Roth 401(k)s don’t have required minimum distributions (RMDs). Traditional 401(k)s force you to start withdrawing at age 73. That can push you into a higher tax bracket, trigger Medicare surcharges, or even make your Social Security taxable. Roll your Roth 401(k) into a Roth IRA before 73, and you never have to take a penny out.

What to Avoid

Here are the three biggest mistakes people make:- Selling winners in a taxable account after a big market run. One retiree in Florida saw his portfolio jump 40% in 2023. He rebalanced by selling stocks and paid $8,200 in taxes-nearly 20% of his gains. He didn’t realize he could’ve just used new contributions to rebalance.

- Ignoring cost basis. If you’ve held a stock for 10 years and bought shares at different prices, you need to know what you paid for each lot. Brokers like Fidelity and Schwab now auto-select lots to minimize taxes. Turn that feature on.

- Putting high-turnover mutual funds in taxable accounts. Actively managed funds churn stocks frequently, triggering capital gains distributions-even if you don’t sell. Stick with ETFs or index funds in taxable accounts.

Tools That Make It Easier

You don’t have to do this manually:- Brokerage tax tools: Fidelity and Schwab now auto-optimize which shares to sell to minimize taxes.

- Rightway and Blooom: These apps connect to all your accounts and suggest tax-efficient rebalancing moves.

- Mezzi’s platform: Uses AI to scan your entire portfolio across accounts, flagging tax-loss harvesting opportunities and avoiding wash sales.

The Bigger Picture: Why This Matters

More than 63% of private-sector workers now have a 401(k). That means more people are responsible for their own tax planning. The SECURE 2.0 Act raised contribution limits to $23,000 in 2024 and added Roth catch-up contributions for high earners. But none of that helps if you’re paying unnecessary taxes on rebalancing. The trend is clear: tax-efficient investing is no longer optional. Tax-managed funds and ETFs have grown from $142 billion in 2020 to $218 billion in 2023. Robo-advisors are catching up-BlackRock predicts 75% will offer cross-account tax optimization by 2026. The bottom line: tax-aware rebalancing isn’t about being a financial expert. It’s about using the rules you already have to your advantage. You’re not trying to time the market. You’re just trying to keep more of what you’ve earned.Can I rebalance my 401(k) without paying taxes?

Yes. Since 401(k)s are tax-advantaged, you can buy and sell assets inside them anytime without triggering capital gains taxes. That’s why experts recommend using your 401(k) as your primary rebalancing tool. Any adjustments you need to make-selling stocks, buying bonds, shifting allocations-should happen here first.

Should I hold bonds in my taxable account?

Generally, no. Bonds generate interest income that’s taxed at your ordinary income rate every year, even if you don’t sell. That’s tax-inefficient. Better to hold bonds in your 401(k) or Roth IRA, where the income grows tax-free or tax-deferred. If you must hold bonds in a taxable account, choose municipal bonds-they pay interest that’s exempt from federal taxes (and sometimes state taxes too).

What’s the best way to rebalance if my taxable account is way out of whack?

First, look for tax-loss harvesting opportunities. Sell any losing positions to offset your gains. Then, sell assets you’ve held longer than a year to qualify for lower long-term capital gains rates. Avoid selling anything held under a year-it’s taxed as ordinary income. If you still need to rebalance, use new contributions to gradually shift your allocation over time instead of making one big sale.

Do I need to track cost basis myself?

No, not if your broker has it turned on. Fidelity, Schwab, and Vanguard automatically track your cost basis and can even select the lots with the highest cost (to minimize gains) when you sell. Make sure this feature is enabled in your account settings. If you’re using multiple brokers or older funds, you may need to manually track it, but most modern platforms handle this automatically.

Is tax-loss harvesting worth the effort?

Absolutely. In 2022, over 78% of investors who used tax-loss harvesting saved at least $1,500 in taxes. You can use up to $3,000 of losses to reduce your ordinary income each year, and carry forward any excess. It’s like getting a free tax refund just for selling something that lost value. Just avoid buying the same or similar asset within 30 days to prevent a wash sale.

Should I use a Roth 401(k) or a traditional 401(k)?

If you’re in a low or middle tax bracket now and expect to be in a higher one in retirement, go Roth. If you’re in a high bracket now and expect to drop into a lower one later, stick with traditional. Vanguard found Roth accounts outperform traditional ones when your retirement tax rate is at least 8 percentage points higher than your current rate. If you’re unsure, split contributions-some to each.

Julia Czinna

October 30, 2025 AT 01:39I’ve been doing tax-aware rebalancing for two years now, and it’s saved me over $4,000 in capital gains taxes. I keep all my bonds and REITs in my 401(k), and my taxable account is just VTI and VXUS. When my stocks run up, I just pour all new contributions into bonds until I’m back on target. No selling, no taxes. It’s stupid simple, but most people overcomplicate it.

Also, I turned on lot selection in Fidelity - it automatically sells the highest-cost shares first. I didn’t even know that was a thing until I read this post. Game changer.

Laura W

October 31, 2025 AT 21:25OMG YES. I was literally selling stocks in my taxable account every time I rebalanced like a total idiot. Paid $6k in taxes last year on a 12% gain. Then I found Mezzi - now it flags my wash sales and tells me where to shift assets. Saved $2,100 this year just by using my 401(k) as the rebalancing engine. Why does no one teach this in finance 101??

Also, holding international ETFs in taxable? Genius. Foreign tax credits are free money. I’m literally getting a tax refund from Canada and Japan. Who knew?

Graeme C

November 2, 2025 AT 12:08You’re all missing the real kicker - Roth 401(k)s aren’t just for young people. I’m 52, in the 24% bracket, and I switched half my contributions to Roth last year. Why? Because I’m not retiring in 2035 - I’m retiring in 2040, and tax rates are going to explode. The SECURE 2.0 Act doubled the catch-up contributions, and if you’re over 50, you can put in $30,500 this year. I’m maxing it out in Roth. No RMDs. No future tax surprises. No one’s talking about this, but it’s the single biggest leverage point for high earners.

And don’t even get me started on municipal bonds in taxable accounts. If you’re in CA or NY, those are literally the only bonds you should hold outside tax-advantaged accounts. Everything else is just handing cash to the IRS. I’ve been doing this since 2018 - my portfolio’s up 147% since then, and my tax bill? Less than 1.2% of assets annually. That’s not luck. That’s strategy.