Tax-Equivalent Yield Calculator

Compare Bond Options

Calculate how taxable bonds compare to municipal bonds based on your tax bracket. Municipal bonds are tax-free at the federal level (and often state level), so they can provide better after-tax returns for higher income retirees.

By the time you retire, your portfolio might be worth $1 million-or more. But how much of that can you actually spend? If you’re not thinking about tax-aware asset location, the answer could be hundreds of thousands of dollars less than it should be.

Most people focus on asset allocation: how much to put in stocks, bonds, and cash. That’s important. But where you hold those assets matters just as much-maybe more. Two retirees with identical portfolios can end up with wildly different after-tax incomes, simply because one placed their bonds in the right account and the other didn’t.

Why Asset Location Beats Asset Allocation in Retirement

Asset allocation is about what you own. Asset location is about where you own it.

Think of it like this: if you buy a tax-inefficient investment like a bond fund that pays annual interest, putting it in a taxable brokerage account means you pay income tax on every dollar of interest. That’s tax drag-often 0.8% to 1.2% per year. Put that same fund in a traditional IRA, and you don’t pay taxes until you withdraw. That’s a 1% annual boost to your after-tax returns, compounded over 20+ years.

According to Vanguard’s 2025 research, retirees who use tax-aware asset location see median after-tax returns of 5.2% annually, compared to 4.8% for those who don’t. For a $1 million portfolio, that’s $4,000 more per year in spendable income. Over 25 years, that’s $100,000+ extra. And that’s before accounting for the compounding effect of keeping more money invested.

The Three Account Types and What Belongs Where

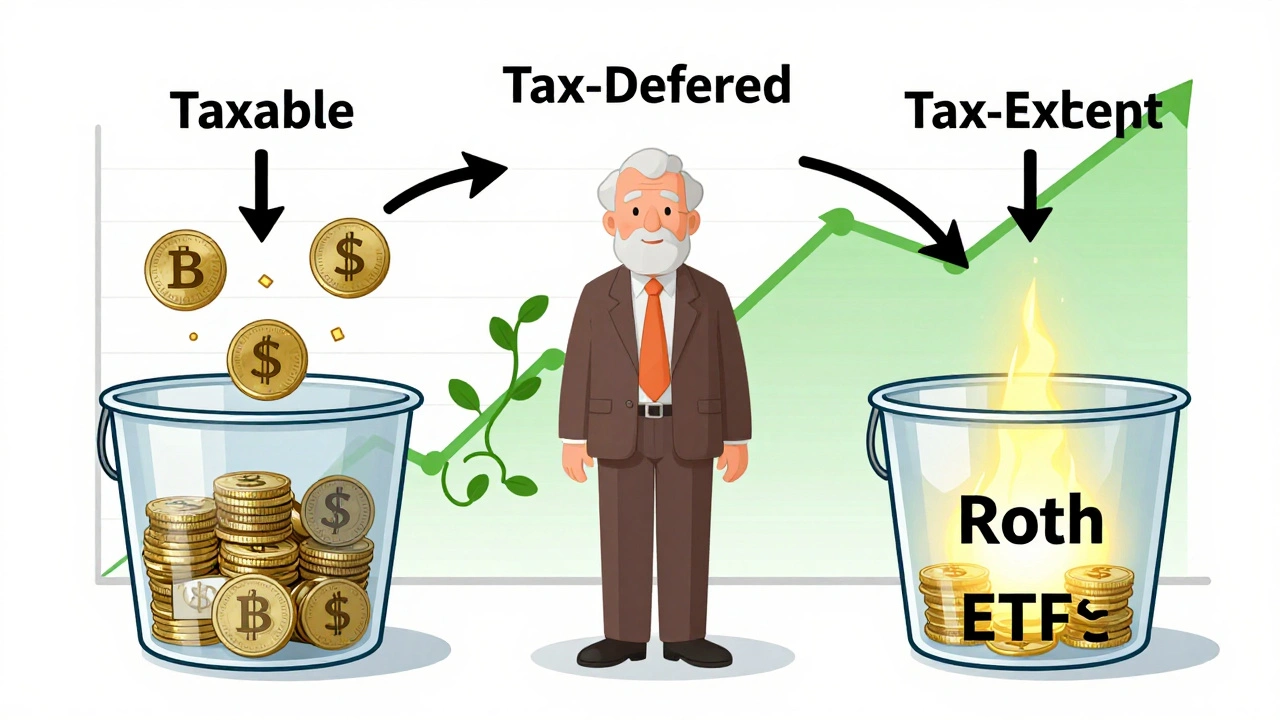

There are three main buckets for your retirement money:

- taxable accounts (brokerage accounts, joint accounts)

- tax-deferred accounts (traditional IRAs, 401(k)s)

- tax-exempt accounts (Roth IRAs, Roth 401(k)s)

Each has different tax rules. The goal is to match the tax efficiency of your investments with the tax treatment of the account.

Tax-inefficient assets (the ones that generate frequent taxable income) should go in tax-deferred accounts. These include:

- Corporate bond funds

- REITs (Real Estate Investment Trusts)

- High-dividend stock funds

- Actively managed mutual funds with high turnover

Why? Because they generate ordinary income-taxed at your top marginal rate-every year. In a tax-deferred account, that income grows without annual tax bites.

Tax-efficient assets (the ones that generate little or low-taxed income) belong in taxable accounts. These include:

- Index funds and ETFs with low turnover

- Individual stocks you plan to hold long-term

- Municipal bonds (especially if you live in the issuing state)

Why? Because capital gains are taxed at lower rates, and qualified dividends get favorable treatment. Municipal bonds are tax-free at the federal level-and often at the state level too. For high-income retirees, they can outperform taxable bonds after taxes, even if their nominal yield is lower.

Roth accounts are the ultimate tax-free growth engine. Put your highest-growth assets here: small-cap stocks, emerging market funds, tech ETFs. Since you’ve already paid taxes on contributions, everything that grows inside is yours to withdraw tax-free. That’s powerful for assets that might double or triple over time.

What Your Tax Bracket Changes

There’s no one-size-fits-all rule. Your optimal asset location depends heavily on your current and projected tax bracket.

For retirees in the top federal bracket (37% income tax + 3.8% net investment income tax), municipal bonds become a no-brainer. A 2.5% municipal bond fund can be better than a 3.25% taxable bond fund if your marginal rate is above 23.08%. The math is simple: Taxable Yield ÷ (1 - Marginal Tax Rate). At 37%, you’d need a taxable bond yielding 3.97% just to match a 2.5% municipal bond after taxes.

For middle-income retirees (22-24% bracket), the sweet spot is 40-50% municipal bonds in taxable accounts, with the rest in taxable bonds. Below that, the tax benefit shrinks. At 10-12% brackets, the difference is minimal-so focus on simplicity.

The IRS 2025 brackets for married couples filing jointly show sharp cliffs: 22% up to $105,000, 24% up to $180,000, 32% up to $300,000, and so on. Where you land on that ladder determines your strategy. If your Social Security + pension + IRA withdrawals push you into the 32% bracket, even small shifts in asset location can save you thousands.

Real-World Examples That Work

A retiree in Florida with a $750,000 portfolio moved all their taxable bond holdings into municipal bonds. Their annual interest income jumped from $22,500 to $36,700-without changing risk. Why? Because the municipal bonds were federally tax-free and Florida has no state income tax. Their after-tax yield went from 3% to 4.9%.

Another retiree in California made the opposite mistake. They bought out-of-state municipal bonds, thinking they were tax-free. But California taxes out-of-state munis. They ended up paying $8,300 in unexpected state taxes-money they could’ve avoided by sticking to California-specific funds.

A couple in their late 60s with $2.1 million across taxable, traditional IRA, and Roth accounts restructured everything. They moved high-growth tech ETFs into Roth, bonds into the traditional IRA, and low-turnover index funds into taxable. Result? Their annual spendable income rose from $94,000 to $106,000-a 12.8% increase-without touching their portfolio’s risk profile.

The Hidden Traps

Tax-aware asset location isn’t magic. It has pitfalls.

State taxes matter. A bond that’s tax-free federally might be taxable in your state. If you live in New York, buy New York munis. If you’re in California, buy California munis. Out-of-state bonds can erase your federal tax savings.

Required Minimum Distributions (RMDs) force you to withdraw money from traditional IRAs starting at age 75 (thanks to SECURE Act 2.0). If your IRA is loaded with bonds, you’re forced to withdraw taxable income. That can push you into a higher bracket, trigger Medicare surcharges, and make Social Security taxable. That’s why it’s smart to keep some stocks in your IRA-so you can sell them strategically to meet RMDs without triggering extra taxes.

“Tax torpedoes” happen when Social Security becomes taxable. If your combined income (adjusted gross income + nontaxable interest + half your Social Security) hits $44,000 (for married couples), up to 85% of your benefits become taxable. A poorly placed bond fund can push you over that line, turning a $1,000 bond payment into $1,850 of taxable income.

Overconcentration is another risk. One Reddit user loaded up on municipal bonds from one state, thinking they were safe. When that state’s credit rating dropped, their portfolio took a hit. Diversify across states and issuers.

How to Get Started

You don’t need a financial advisor to do this-but you do need a system.

- Map your accounts. List every account: taxable, traditional IRA, Roth IRA, 401(k), etc.

- Categorize your holdings. Label each fund or stock as tax-inefficient, tax-efficient, or growth-oriented.

- Match assets to accounts. Put bonds and REITs in IRAs. Put stocks and munis in taxable. Put high-growth assets in Roth.

- Rebalance annually. As your portfolio grows or your tax situation changes, adjust. Don’t set it and forget it.

For a $1 million portfolio, this takes 8-12 hours of work upfront. After that, 1-2 hours per quarter to check for drift.

Tools like BlackRock’s TALS™ and Vanguard’s tax-coordinated portfolios are starting to automate this-but they’re still mostly available to high-net-worth clients. If you’re DIYing, spreadsheets work fine. Just track yields, tax rates, and account types.

The Bigger Picture

Tax-aware asset location isn’t a gimmick. It’s a structural advantage built into the tax code.

Dr. William Reichenstein, the pioneer of this strategy, says it’s the most underused tactic in retirement planning. Dr. David Blanchett calls it as critical as withdrawal sequencing. And with life expectancy rising-now averaging 20 years in retirement-every 0.1% in extra after-tax return compounds into real spending power.

The market is catching on. $4.7 trillion is now managed with tax-aware strategies. 74% of financial advisors prioritize it. And with tax rates set to rise in 2026, the value of getting this right is only going up.

Don’t just plan for how much you’ll withdraw. Plan for how much you’ll keep.

What’s the difference between asset allocation and asset location?

Asset allocation is deciding how much of your portfolio goes into stocks, bonds, and cash. Asset location is deciding which accounts to hold those assets in-taxable, tax-deferred, or tax-exempt. One is about what you own; the other is about where you own it.

Should I put all my bonds in my IRA?

Not necessarily. If you’re in a high tax bracket, it’s often better to hold municipal bonds in your taxable account-they’re tax-free at the federal level and sometimes at the state level. Use your IRA for taxable bonds, REITs, and high-dividend funds that generate ordinary income. That way, you shield the most tax-inefficient assets from annual taxes.

Are municipal bonds always a good choice for retirees?

Only if your tax rate is high enough to make them worthwhile. For someone in the 10-12% bracket, a taxable bond with a 3% yield is better than a 2.5% municipal bond. But if you’re in the 24%+ bracket, the tax exemption makes munis more attractive. Always calculate the tax-equivalent yield: Taxable Yield ÷ (1 - Your Marginal Tax Rate).

Can I use asset location if I only have a 401(k) and no Roth account?

Yes, but your options are limited. If you only have tax-deferred accounts, you can’t take advantage of tax-efficient placement in taxable accounts. Your best move is to minimize tax drag within your 401(k) by choosing low-turnover funds and avoiding high-dividend or actively managed funds. Once you retire and have access to a taxable account, you can start optimizing.

How often should I rebalance my asset location?

Annually, or when your tax situation changes. If you move states, hit a new tax bracket, or start taking Social Security, your optimal placement might shift. Rebalancing once a year is usually enough-just check that your bonds haven’t migrated into your taxable account due to market swings.

Is tax-aware asset location worth it for someone with a $300,000 portfolio?

Absolutely. Even at $300,000, a 0.3% improvement in after-tax returns adds $900 per year. Over 20 years, that’s $18,000 in extra income-not counting compounding. The strategy scales with portfolio size, but the benefit is real even for modest portfolios.

What happens if tax laws change in 2026?

The TCJA tax cuts expire in 2026, and top rates could rise from 37% to 39.6%. That makes municipal bonds even more attractive for high-income retirees. But proposals to cap the tax exemption on munis could hurt their value. Stay flexible. If the tax code changes, adjust your asset location strategy accordingly-don’t lock in too early.

Next Steps

If you’re retired or nearing retirement, start by listing your accounts and your holdings. Group them by tax efficiency. Then ask: Where am I paying the most in taxes? That’s where you need to move assets.

Don’t wait for a financial advisor. You can do this yourself with free tools like Morningstar’s portfolio analyzer or even a simple spreadsheet. The key is awareness. Most retirees don’t realize they’re leaving money on the table because of where their investments sit.

Remember: you’re not just investing for growth. You’re investing for spendable income. Tax-aware asset location turns paper wealth into real retirement freedom.

Jonathan Turner

December 8, 2025 AT 19:19Oh wow, another ‘tax-aware asset location’ guru dropping wisdom like it’s gospel. Let me guess-you also think municipal bonds are magic beans and that REITs in IRAs are the secret to eternal retirement bliss? I’ve seen this exact advice since 2015. The only thing that’s changed? Now they’re charging $15k for a ‘tax-coordinated portfolio’ from Vanguard. Congrats, you just turned finance into a cult.

And don’t get me started on ‘tax torpedoes.’ You think retirees are dumb enough to not know their Social Security gets taxed? Nah, they just don’t care. Most of ‘em are living on $30k a year and paying zero taxes anyway. This whole post reads like a brochure for financial advisors trying to upsell asset location as ‘the one thing you missed.’ Spoiler: you didn’t miss anything. You just got sold a fancy spreadsheet.

Also, why is everyone suddenly obsessed with 2026 tax changes? The law hasn’t even passed yet. Stop treating hypothetical tax hikes like the Rapture. Chill out. Buy the index. Live your life.

Geoffrey Trent

December 10, 2025 AT 09:13Bro, I read this whole thing and my brain hurt. You’re telling me I need to move my bonds to my IRA and my tech stocks to my Roth like it’s some kind of sacred ritual? I just want to retire without having to run a Monte Carlo simulation every time I buy a new pair of socks.

Also, who the hell has a $2.1M portfolio and still needs a spreadsheet? I’ve got $300k and I’m already stressed about whether I can afford a new fridge. This post is like someone giving a TED Talk on rocket science to someone trying to fix a leaky faucet.

Just put your money in a target-date fund and go fishing. The IRS isn’t gonna come after you for being lazy. Trust me, I’ve been there. The only thing I regret? Not doing this sooner. (Wait, no I don’t. I’m fine.)

John Weninger

December 11, 2025 AT 07:34Hey, I just want to say how much I appreciate this breakdown-it’s actually really helpful, especially for folks who aren’t finance nerds but still want to do right by their future selves.

I’m 62, retired in Australia, and I’ve been thinking about this exact thing since I moved my super into a diversified portfolio. The part about state taxes on munis? Huge. I had no idea California taxes out-of-state bonds. That’s the kind of detail that sneaks up on you.

And to everyone saying ‘this is overcomplicated’-I get it. But if you’ve got even $200k saved, a little time now saves a lot of stress later. I spent 4 hours mapping my accounts last weekend. Felt like a nerd. Felt good.

Don’t let the cynics scare you off. This isn’t about being perfect. It’s about being a little smarter than you were yesterday. And honestly? That’s enough.

Omar Lopez

December 11, 2025 AT 19:02While the general framework presented here is broadly consistent with established tax-efficient allocation principles, it exhibits a concerning lack of nuance regarding the interaction between marginal tax rates, state tax regimes, and the time value of tax deferral.

For instance, the assertion that municipal bonds ‘outperform’ taxable bonds above a 23.08% threshold presumes identical credit risk and duration profiles-a condition rarely met in practice. Moreover, the treatment of RMDs as purely mechanical ignores the behavioral economics of withdrawal sequencing, wherein forced distributions may trigger unintended capital gains realizations in taxable accounts.

Furthermore, the omission of state-level estate tax thresholds and the potential for future legislative changes to the stepped-up basis rule renders the ‘set it and forget it’ recommendation dangerously simplistic. One must also account for the liquidity premium of taxable assets in the event of unforeseen medical expenditures.

Recommendation: consult a CFP® with fiduciary obligations, not Reddit.

Kenny McMiller

December 13, 2025 AT 10:10Let’s zoom out. Asset location isn’t about maximizing after-tax returns-it’s about optimizing for *agency*. The tax code isn’t neutral; it’s a system of incentives designed to steer capital. By aligning your assets with the account types that best neutralize their tax drag, you’re not just saving money-you’re reclaiming autonomy over your time, your choices, your dignity in retirement.

Most people think retirement is about having enough money. It’s not. It’s about having enough *control*. When you’re forced to sell a stock to meet an RMD because your IRA is 80% bonds, you’re not managing your portfolio-you’re being managed by the IRS.

And yeah, it takes work. But so does brushing your teeth. You don’t do it because it’s fun. You do it because you don’t want to lose your teeth. Same here. The compounding isn’t just in the returns-it’s in the peace of mind.

Also, if you’re still using a target-date fund because ‘it’s easier,’ you’re outsourcing your future to a machine that doesn’t know you. And that’s the real risk.