Tax-Efficient Portfolio Calculator

See how tax-efficient placement of your investments affects your after-tax returns. This calculator estimates your potential tax savings based on your current portfolio and tax bracket.

Estimated Results

After-tax return on taxable accounts: N/A

After-tax return on tax-deferred accounts: N/A

After-tax return on tax-exempt accounts: N/A

Potential annual tax savings: $0

Estimated annual tax bill: $0

Most investors focus on diversifying their assets-stocks, bonds, real estate-but few think about diversifying their taxes. Yet in taxable accounts, where every dividend, capital gain, and interest payment gets taxed in the year it’s earned, how you place your investments can make a bigger difference than picking the next hot stock. The goal isn’t just to grow your money. It’s to keep more of it.

Why Taxable Accounts Need a Different Strategy

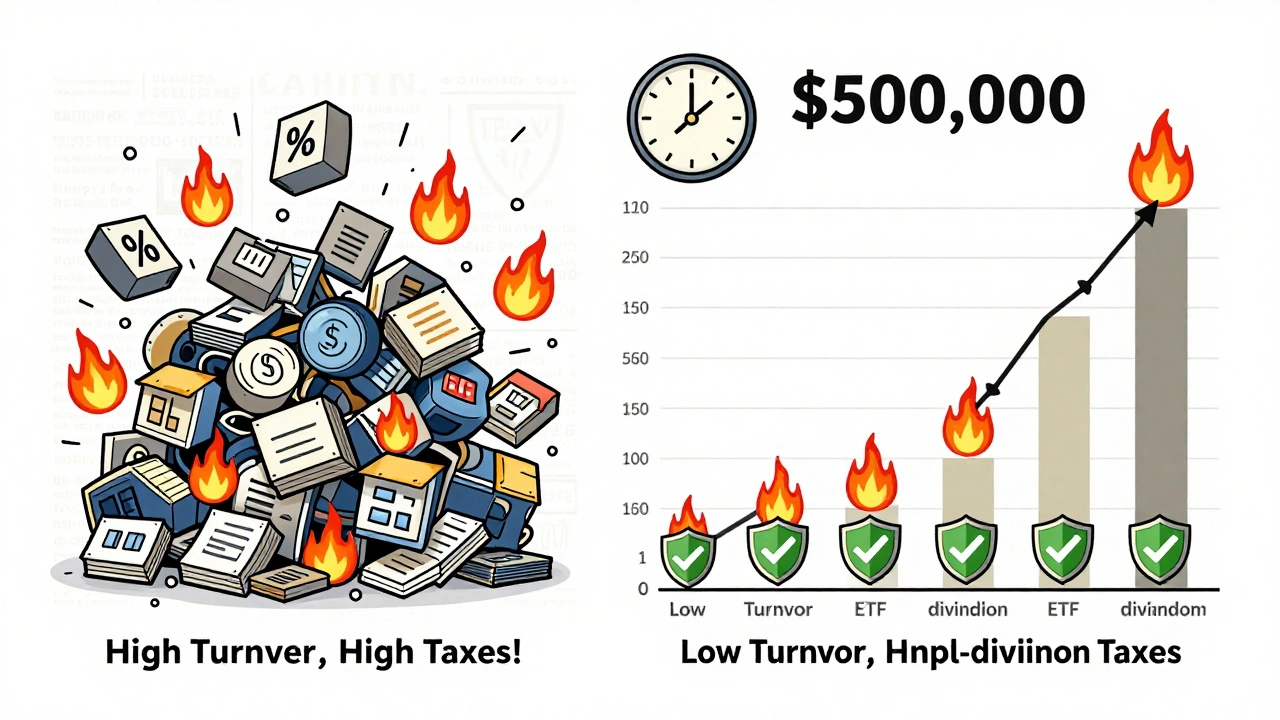

Taxable accounts-your regular brokerage accounts-are the only investment space where you pay taxes every year. Unlike IRAs or 401(k)s, where taxes are deferred or avoided entirely, here you’re on the hook for dividends, interest, and capital gains. That means the same portfolio can deliver wildly different results depending on what’s inside it. Take two investors with $500,000 in taxable accounts. One holds an actively managed mutual fund that turns over 80% of its holdings every year. The other holds a low-turnover S&P 500 ETF. After 10 years, the ETF investor could have 8-12% more in after-tax wealth, simply because they paid less in taxes annually. That’s not performance. That’s tax efficiency. The key is matching the right investments to the right accounts. High-tax investments belong in tax-advantaged accounts. Low-tax ones belong in taxable ones.What Makes an Investment Tax-Efficient?

Not all investments are created equal when it comes to taxes. Here’s what to look for:- Qualified dividends: Taxed at 0%, 15%, or 20%-not your ordinary income rate. These come from U.S. stocks held over 60 days.

- Long-term capital gains: If you hold an asset over a year, gains are taxed at the same low rates as qualified dividends.

- Low turnover: Index funds and ETFs with turnover under 5% generate fewer taxable events. Actively managed funds often turn over 70% or more, triggering annual capital gains distributions.

- Municipal bonds: Interest is exempt from federal taxes, and sometimes state taxes too. For investors in the 32%+ federal bracket, munis can deliver higher after-tax yields than Treasuries.

- Bond funds (especially taxable ones)-they pay ordinary income rates.

- REITs-dividends are taxed as ordinary income, not qualified.

- High-turnover mutual funds-constant buying and selling create taxable gains you didn’t even trigger.

How to Build a Tax-Efficient Portfolio

Start by mapping your accounts into three buckets:- taxable accounts - for tax-efficient assets: low-turnover ETFs, qualified dividend stocks, municipal bonds.

- tax-deferred accounts - for tax-inefficient assets: bond funds, REITs, actively managed funds.

- tax-exempt accounts - for assets you want to grow completely tax-free: Roth IRAs, Roth 401(k)s, HSAs.

Investor A, age 58, in the 32% federal tax bracket, has $800,000 total across accounts. They move their high-dividend utility stocks out of their taxable account and into their Roth IRA. In return, they buy $150,000 in California municipal bonds for their taxable account. Result? Annual tax bill drops from $6,800 to $2,100. After-tax return jumps by 0.87%-a $7,000 gain per year.

That’s not magic. It’s placement.

What Your Tax Bracket Tells You

Your tax rate isn’t just a number-it’s a roadmap. Higher brackets need more tax-exempt and tax-efficient assets. According to First Western Trust’s 2024 analysis:- If you’re in the 22% bracket: Allocate 40% of equities to taxable accounts, 35% to tax-deferred, 25% to Roth.

- If you’re in the 37% bracket: Flip it-25% taxable, 40% tax-deferred, 35% Roth.

Tax-Loss Harvesting: The Hidden Advantage

Tax-loss harvesting isn’t just for hedge funds. It’s a powerful, underused tactic for anyone with a taxable account. The idea: sell an investment that’s down, lock in the loss, and use it to offset capital gains-or up to $3,000 of ordinary income. Then, reinvest in a similar (but not identical) asset to stay invested. Mesirow Wealth Advisors found clients save an average of $1,850 per year using this strategy quarterly. One Reddit user, "RetireEarly2025," saved $4,200 in a single year by harvesting losses in tech stocks and replacing them with similar ETFs. But there’s a catch: the wash-sale rule. You can’t buy the same or "substantially identical" security within 30 days before or after the sale. Many DIY investors get tripped up here-especially with ETFs. Buying an S&P 500 ETF and then selling it to harvest a loss, then buying another S&P 500 ETF 15 days later? That’s a wash sale. The IRS disallows the loss. Solution: Swap to a different index. Sell an S&P 500 ETF, buy a total market ETF. Same exposure, different ticker, no violation.Retirement Withdrawal Strategy Matters Too

Tax diversification doesn’t end when you stop contributing. It peaks in retirement. If you have all your money in tax-deferred accounts, every withdrawal gets taxed as ordinary income. That can push you into higher brackets, trigger IRMAA Medicare surcharges, and make Social Security taxable. But if you’ve built a tax-diversified portfolio, you can control your tax bill. Example: In a year your income is low (maybe you took a sabbatical or had a down market), you withdraw from your taxable account. In a year your income spikes (you sold a house, got a bonus), you pull from your Roth IRA-tax-free. Ameriprise’s case studies show this sequencing can reduce your effective tax rate in retirement by 8-12%. That’s like getting a raise without asking for one.What’s Changing in 2025 and Beyond

Tax rules aren’t frozen. They’re evolving-and fast.- IRS clarified in August 2024: Cryptocurrency losses can now offset capital gains. This opens new tax-loss harvesting opportunities.

- Charles Schwab launched TaxAdvantage Analytics in July 2024-an AI tool that simulates after-tax returns across accounts with 92% accuracy.

- SEC may require advisors to disclose tax efficiency metrics alongside performance by 2025. That’ll force more transparency.

- BlackRock predicts tax diversification adoption will rise from 35% to 52% of portfolios by 2027.

- Risk alert: Congress is considering eliminating the stepped-up basis rule. If it passes, heirs won’t get a fresh cost basis on inherited assets. That could reduce the estate-planning value of tax-diversified portfolios by 30-40%.

Who Shouldn’t Bother?

Tax diversification isn’t for everyone. If you have only one account-say, just a 401(k)-you can’t really diversify your taxes. If you’re in the 10% or 12% bracket, the benefit is minimal. If you’re planning to retire soon and have a small portfolio, the complexity may not be worth it. Also, don’t let tax optimization override good asset allocation. Morningstar found that 12% of investors who hyper-focus on tax placement end up with unbalanced portfolios-and underperform benchmarks by 0.75% a year. Don’t sacrifice diversification for tax savings.Getting Started: Three Simple Steps

You don’t need a PhD in tax law. Start here:- Inventory your accounts. List every brokerage, IRA, Roth, HSA. Note what’s in each. Take 2-3 hours.

- Map your assets. Use a simple spreadsheet: Column A = asset, Column B = tax efficiency, Column C = current account. Flag high-tax items (bonds, REITs) that are in taxable accounts.

- Shift strategically. Move one thing this quarter. Sell a high-turnover fund in your taxable account. Buy a municipal bond ETF. Rebalance your Roth with low-cost index funds. Do it slowly. Track the tax impact.

The Real Benefit: Peace of Mind

Beyond the numbers, tax diversification gives you control. You’re not at the mercy of tax brackets or unexpected IRS bills. You have options. Schwab’s 2024 survey found investors who use tax diversification report 22% higher satisfaction with retirement income and 31% less tax anxiety. That’s priceless. In a world where taxes are getting more complex, not less, knowing where your money is-and how it’s taxed-isn’t just smart. It’s essential.What’s the difference between asset diversification and tax diversification?

Asset diversification spreads your money across different types of investments-like stocks, bonds, and real estate-to reduce risk. Tax diversification spreads your money across different types of accounts-taxable, tax-deferred, and tax-exempt-to reduce how much you pay in taxes. One is about what you own; the other is about where you own it.

Should I put bonds in my taxable account?

Generally, no. Most bond funds pay interest taxed as ordinary income, which can be as high as 37%. Instead, keep taxable bonds in tax-deferred accounts like IRAs. If you want bonds in your taxable account, choose municipal bonds-they’re federally tax-free and sometimes state-tax-free too. For investors in the 32%+ bracket, munis often deliver better after-tax yields than Treasuries.

Can I use tax-loss harvesting in my Roth IRA?

No. Tax-loss harvesting only works in taxable accounts because you need to realize a loss to claim it on your taxes. Roth IRAs grow tax-free and withdrawals are tax-free, so there’s no tax benefit to selling at a loss. Don’t waste time trying to harvest losses in Roth accounts.

How much can tax diversification actually save me?

For most investors, tax-efficient asset placement adds 0.5% to 1.0% in annual after-tax returns. For portfolios over $1 million, that jumps to 1.2%-1.8%. Over 20 years, that’s tens of thousands-sometimes hundreds of thousands-of extra dollars. One Schwab study showed a $2 million portfolio could gain $250,000-$500,000 in after-tax value over two decades just by optimizing placement.

Is tax diversification worth it if I’m under 45?

Yes, but start small. If you’re young and in a low tax bracket, focus on maxing out Roth accounts first. As your income grows and you accumulate taxable assets, gradually shift toward tax-efficient placement. The earlier you begin, the more compounding you gain. Fidelity’s 2024 survey found only 28% of under-45 investors use tax diversification-most don’t realize how much time they have to benefit from it.

Dave McPherson

December 5, 2025 AT 01:15Let’s be real-most people treat taxable accounts like a dumpster fire they’re too lazy to clean up. You’ve got a $2M portfolio and you’re still holding bond funds in your brokerage? Bro, that’s not investing, that’s financial masochism. I once watched a guy pay $14k in taxes on $80k in dividends because he didn’t know qualified dividends existed. He thought ‘dividend’ meant ‘free money.’ Spoiler: it doesn’t. It means ‘tax me harder, IRS.’ Municipal bonds? Yes. Low-turnover ETFs? Obviously. But the real flex? Knowing your wash-sale rule better than your ex’s new partner. Swap S&P for total market. Don’t be that guy who gets audited because he thought ‘similar’ meant ‘same ticker.’

RAHUL KUSHWAHA

December 6, 2025 AT 07:44Thank you for this. 😊 I’m from India and didn’t realize how much tax efficiency matters outside the US. Here, we have different rules, but the core idea-place the right assets in the right place-is universal. I’ve started shifting my REITs to my PPF account (tax-free here) and buying state bonds for taxable. Small steps. But this post helped me see the big picture. 🙏

Julia Czinna

December 6, 2025 AT 21:23One sentence: If you’re not thinking about tax placement, you’re leaving real money on the table-quietly, invisibly, and painfully. Everything else is just noise.