Social Security Claiming Calculator

Estimate Your Social Security Benefits

See how your benefit amount changes based on when you claim. The article explains the critical 8% annual growth for delaying benefits past full retirement age.

Your Social Security Strategy

Benefit Amounts by Claiming Age

Estimated Monthly Income

Impact of Delaying Benefits

For every year you delay past full retirement age, your benefit increases by 8%.

Tax Warning: If your combined income exceeds $25,000 (single) or $32,000 (married), up to 85% of your Social Security benefits may be taxable.

Example: If your total income is $40,000, your Social Security benefits could be taxed at 50%.

Recommended Strategy

Most people think Social Security is just a monthly check that starts when you turn 62. But if that’s all you’re thinking, you’re leaving thousands - maybe tens of thousands - on the table. The truth is, Social Security isn’t just a benefit. It’s the backbone of retirement income for most Americans, and how you time it changes everything. When you pair it with your savings, pensions, and taxes, you’re not just planning for retirement - you’re building a coordinated strategy that lasts as long as you do.

Why Social Security Isn’t Just a Check

Social Security replaces about 40% of your pre-retirement income, on average. That sounds decent - until you realize most retirees need 70% to 80% to live comfortably. If you’re earning $60,000 a year before retiring, Social Security might give you $2,000 a month. But your monthly expenses? They’re probably closer to $3,500. That gap? It’s got to come from somewhere. Your 401(k). Your IRA. Your savings. And if you’re not planning how Social Security fits into that mix, you’re guessing. The system was never meant to be your only source of income. It was designed as one leg of a three-legged stool: Social Security, pensions, and personal savings. But here’s the problem - only 15% of private-sector workers still have a traditional pension. That means for most people, it’s just Social Security and personal savings. And if you don’t manage them together, you’ll run out of money before you run out of time.When to Claim: The 8% Rule That Changes Everything

Your full retirement age (FRA) is 67 if you were born in 1960 or later. That’s the age when you get 100% of your benefit. But you can start as early as 62 - or wait until 70. And the difference isn’t small. For every year you delay past your FRA, your benefit jumps by 8%. That’s guaranteed, tax-deferred growth with zero risk. No stock market, no fees, no volatility. Just pure, inflation-adjusted income for life. Let’s say your benefit at 67 is $2,500 a month. If you claim at 62, it drops to $1,750. If you wait until 70, it rises to $3,100. That’s a $1,350 monthly difference. Over 15 years? That’s more than $240,000. And that’s before inflation. The big question: Is it worth waiting? It depends. If you’re healthy, have a family history of longevity, or don’t need the money right away - wait. If you’re in poor health or need the cash to cover basic expenses - claiming early might make sense. But don’t just pick 62 because it’s the earliest option. Run the numbers.Married Couples Have a Hidden Advantage

If you’re married, you’re not just planning for yourself. You’re planning for two lives - and two benefit streams. There are strategies here that single people don’t get. One common move is the “file and suspend” trick - but that’s gone. What’s still available? Spousal benefits. Your spouse can claim up to 50% of your benefit, even if they never worked or earned less. And here’s the smart part: one spouse can claim a spousal benefit while letting their own benefit grow until 70. Example: John is the higher earner. He waits until 70 to claim his $3,100 benefit. His wife, Jane, claims her own $1,200 benefit at 67. Then, at 70, she switches to a spousal benefit of $1,550 (half of John’s $3,100). That’s a $350 monthly boost - and it lasts for the rest of her life. If John dies first, Jane gets his full $3,100 as a survivor benefit. That’s not luck. That’s strategy.How Taxes Can Eat Your Benefit

You might think Social Security is tax-free. It’s not. Up to 85% of your benefit can be taxed - and it’s not based on your income alone. It’s based on your “combined income”: your adjusted gross income + nontaxable interest + half your Social Security benefit. If you’re single and your combined income is over $25,000, you pay taxes on part of your benefit. If you’re married and over $32,000, same thing. Once you hit $34,000 (single) or $44,000 (married), up to 85% becomes taxable. Here’s where people mess up: they withdraw from their 401(k) or IRA right after retiring, thinking they’re being smart. But that pushes their combined income into the taxable zone - and suddenly, their Social Security is getting taxed. Then, their Medicare premiums go up too, because IRMAA (Income-Related Monthly Adjustment Amounts) kicks in. In 2025, IRMAA can add $408 to $817 extra per month to your Medicare Part B bill if your income is too high. That’s not a small hit. It’s a $10,000-a-year penalty.

The Roth Conversion Window

There’s a sweet spot between retirement and age 73 - when Required Minimum Distributions (RMDs) start. That’s your window to move money from your traditional IRA or 401(k) into a Roth IRA. You pay taxes on the conversion now, but then the money grows tax-free forever. And here’s the kicker: Roth withdrawals don’t count as income when calculating your Social Security taxation or IRMAA. BlackRock found that strategic Roth conversions can reduce lifetime taxes by 15% to 25%. That’s not a bonus. That’s a financial lifeline. Do it too early, and you pay more taxes than you need to. Do it too late, and RMDs force you into higher tax brackets. Timing matters. Most people who do this right wait until they’re retired, have lower income, and aren’t yet taking RMDs. That’s when their tax bracket is lowest - and their opportunity is highest.What Happens When the Trust Fund Runs Out?

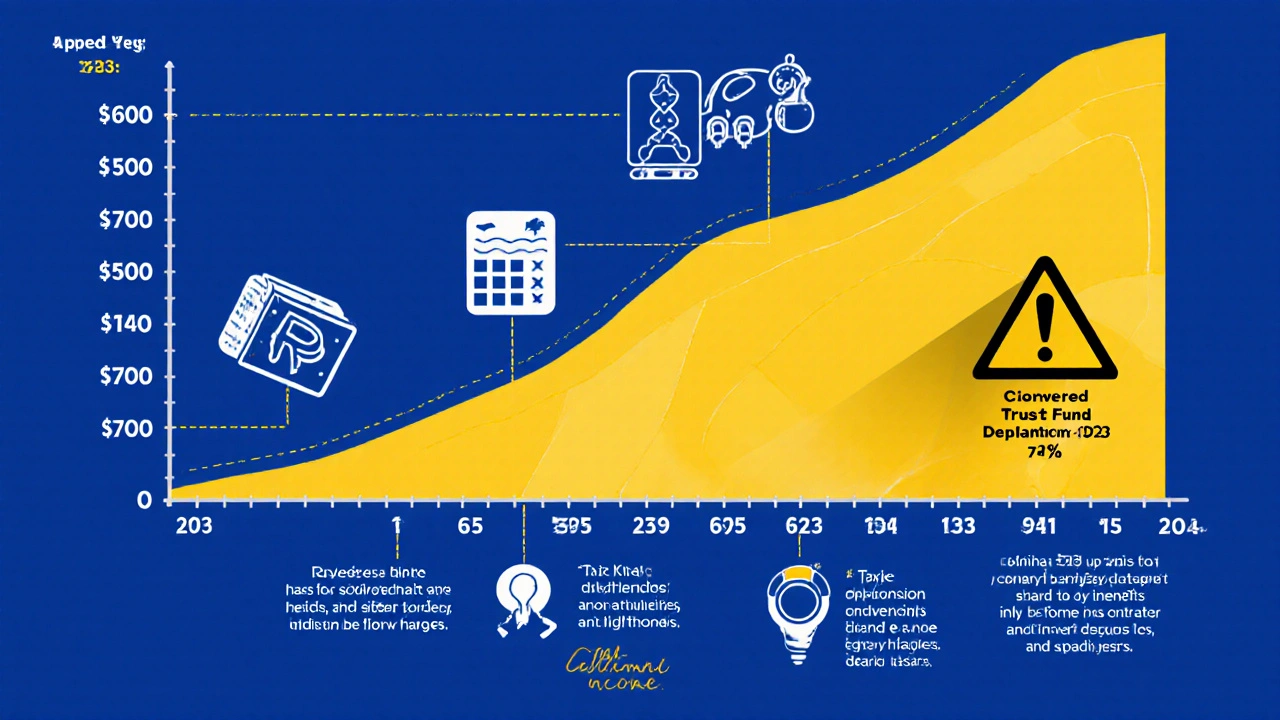

The Social Security trust fund is projected to be depleted by 2033. After that, the program can still pay out about 79% of scheduled benefits using ongoing payroll taxes. That means if you’re retiring in 2030, your check might be 21% smaller than expected. This isn’t a scare tactic. It’s math. And it changes how you plan. If you’re counting on full benefits after 2033, you’re taking a risk. That’s why delaying your claim becomes even more critical. Every extra dollar you get now means you need less from your savings later. Two possible fixes: either cut benefits by 22% across the board, or raise payroll taxes by 3.65%. Neither is popular. Neither is guaranteed. So plan like the cuts might happen. Don’t rely on them not to.What You Need to Do Right Now

You don’t need a financial advisor to get started. You need three things:- Go to ssa.gov/myaccount and create your free account. Check your earnings history. If there are gaps or errors, fix them now - it affects your benefit calculation.

- Use the Social Security Administration’s online calculator to estimate your benefit at 62, 67, and 70. Don’t guess. Get the numbers.

- Map out your retirement income: pensions, 401(k), IRA, savings, rental income. Then subtract your expected expenses. If you’re short, delaying Social Security might be your best tool to close the gap.

Common Mistakes (And How to Avoid Them)

- Mistake: Claiming at 62 because you feel you’ve “earned it.” Fix: You’ve earned it. But you’ll earn more by waiting. Think long-term, not emotional.

- Mistake: Assuming your spouse will get half your benefit automatically. Fix: They have to apply for it. Don’t assume. File the paperwork.

- Mistake: Ignoring Medicare premiums. Fix: If you’re withdrawing from taxable accounts, you’re raising your income. That increases your Medicare bill. Factor that in.

- Mistake: Thinking Social Security will be there unchanged. Fix: Plan for 79%. Build a buffer.

Who Doesn’t Need This Strategy?

If you have a pension that covers 80% of your expenses, or if you have over $1 million in retirement savings and plan to live frugally - you’re in a different position. Social Security is a nice bonus, not a necessity. But for the rest of us - the 90% - this strategy isn’t optional. It’s essential.Final Thought: It’s Not About Getting the Most - It’s About Not Running Out

The goal isn’t to maximize your monthly check. It’s to make sure your money lasts as long as you do. The average 65-year-old today will live into their mid-80s. Some will live past 95. Social Security is the only retirement income that doesn’t run out. That’s why coordinating it with your other resources isn’t a luxury. It’s your best insurance policy.What happens if I claim Social Security at 62 and later change my mind?

You can withdraw your application within 12 months of claiming, repay all benefits received, and reapply later at a higher amount. But you only get one chance to do this. After 12 months, you’re locked in.

Can I work while collecting Social Security?

Yes - but if you’re under full retirement age and earn more than $21,240 in 2025, $1 is withheld for every $2 you earn above that limit. In the year you reach FRA, $1 is withheld for every $3 earned above $56,520. Once you hit FRA, there’s no earnings limit.

Do I have to pay taxes on Social Security if I’m still working?

Yes. Your Social Security benefits can be taxed even if you’re still employed. The tax rules depend on your combined income - not your employment status. If your total income pushes you over the thresholds ($25,000 single, $32,000 married), up to 85% of your benefit is taxable.

How does delaying Social Security affect my spouse’s survivor benefit?

Delaying your benefit increases your spouse’s survivor benefit by the same percentage. If you wait until 70, your spouse will receive your full delayed benefit after you pass away. That’s why it’s often the smarter move for the higher earner to delay - it protects the surviving spouse financially.

Is it better to take Social Security early and invest it?

Only if you can consistently earn more than 7-8% per year after taxes and fees - and you’re willing to take significant market risk. Most people can’t. Social Security’s 8% annual boost for delaying is risk-free and inflation-protected. That’s hard to beat.

What if I’m divorced? Can I still claim spousal benefits?

Yes - if you were married for at least 10 years, are currently unmarried, and your ex-spouse is eligible for benefits. You can claim a spousal benefit based on their record without affecting their benefit. You can even claim it if they haven’t filed yet, as long as they’re eligible and you’ve been divorced for at least two years.

Graeme C

November 8, 2025 AT 02:16This is one of the most lucid breakdowns of Social Security strategy I’ve ever read. The 8% guaranteed return on delaying is literally better than any annuity or bond out there-no fees, no counterparty risk, inflation-adjusted for life. People treat it like a福利 instead of a financial instrument, and that’s why they get wrecked in retirement. The Roth conversion window point? Gold. Most advisors don’t even mention it until it’s too late. If you’re 55-65 and reading this, stop scrolling and open your SSA account right now. Do it before lunch.

Also, the IRMAA trap? Brutal. I watched my uncle lose $12k/year in Medicare premiums because he took a lump-sum 401(k) withdrawal ‘to be smart.’ Turns out, being smart means understanding tax brackets, not just cashing out.

And yes, if you’re married and the higher earner, delay. Always. Your spouse’s survivor benefit is your legacy. Don’t gamble it for a few extra years of cash flow.

Astha Mishra

November 9, 2025 AT 05:00While I deeply appreciate the practicality of this guide, I find myself reflecting on the philosophical weight of what we’re being asked to do-delaying gratification in a culture that glorifies instant results. Social Security, in its essence, is a social contract: we pay into a system we may never fully receive, trusting that future generations will honor it as we honor those before us. The 2033 depletion date is not merely an actuarial prediction-it is a moral question. Are we building a society where elders are cared for, or merely managed? I wonder, if we treated retirement planning not as a personal finance puzzle but as a collective responsibility, would we see fewer people clinging to 62 because they fear scarcity? Perhaps the real strategy isn’t in timing claims, but in reimagining how we value care, dignity, and intergenerational trust.

Still, thank you for the numbers. They are the scaffolding upon which we must build something kinder.

Kenny McMiller

November 10, 2025 AT 15:36Bro, the 8% delayed retirement credit is the only risk-free arbitrage left in the system. You’re getting 8% guaranteed, compounded annually, for life, indexed to inflation-no hedge fund, no crypto, no REIT can touch that. And people still claim at 62 like it’s Black Friday? LMAO.

Also, Roth conversions during the ‘tax valley’ between retirement and RMDs? That’s the secret sauce. Most people think Roth is just ‘tax-free money’-nah, it’s a tax evasion tool disguised as savings. And if you’re single and making $30k from part-time work while your IRA’s still sitting there? Convert $40k, pay 12% tax, lock in the growth. Boom. Next decade, your SS stays untaxed, your Medicare stays cheap, and you’re living like a billionaire with a pension.

Also, SSA website is garbage UI but the data’s legit. Fix your earnings record. I had $12k missing from a summer job in ‘98. Took 3 months, 3 calls, and a notarized letter-but my benefit jumped $180/mo. Worth it.

Dave McPherson

November 12, 2025 AT 13:42Wow. A financial article that doesn’t sound like it was written by a robot who graduated from a ‘Retirement Planning 101’ course on Udemy. Finally, someone who gets it.

Let’s be real-most people who claim at 62 are either broke, delusional, or both. And the ones who think they can ‘invest’ their early SS check? Bro, you’re not Warren Buffett. You’re the guy who bought Dogecoin because Elon tweeted it. The 8% guaranteed return isn’t a suggestion-it’s a divine mandate from the gods of actuarial science.

Also, IRMAA? That’s the silent tax assassin. You think you’re being clever by withdrawing from your 401(k) early? Congrats, you just paid $10k extra to Medicare because you didn’t know your ‘combined income’ includes half your SS. That’s like buying a Ferrari and then realizing you have to pay $8k/year in parking tickets.

And the ‘file and suspend’ is dead? Good. It was a loophole only financial advisors used to sell you overpriced annuities. Real strategy is patience, discipline, and not being an idiot. Simple.

RAHUL KUSHWAHA

November 14, 2025 AT 05:08Thanks for sharing this 😊 I’m 58 and just started looking into this. I didn’t realize my spouse’s survivor benefit would increase if I delay. That’s… really important. I’ll check my SSA account this weekend. I’m not good with numbers but this makes sense. One thing though-what if you’re not sure if you’ll live to 80? I’m worried about ‘wasting’ those early years. 🤔