T-Bill Emergency Fund Calculator

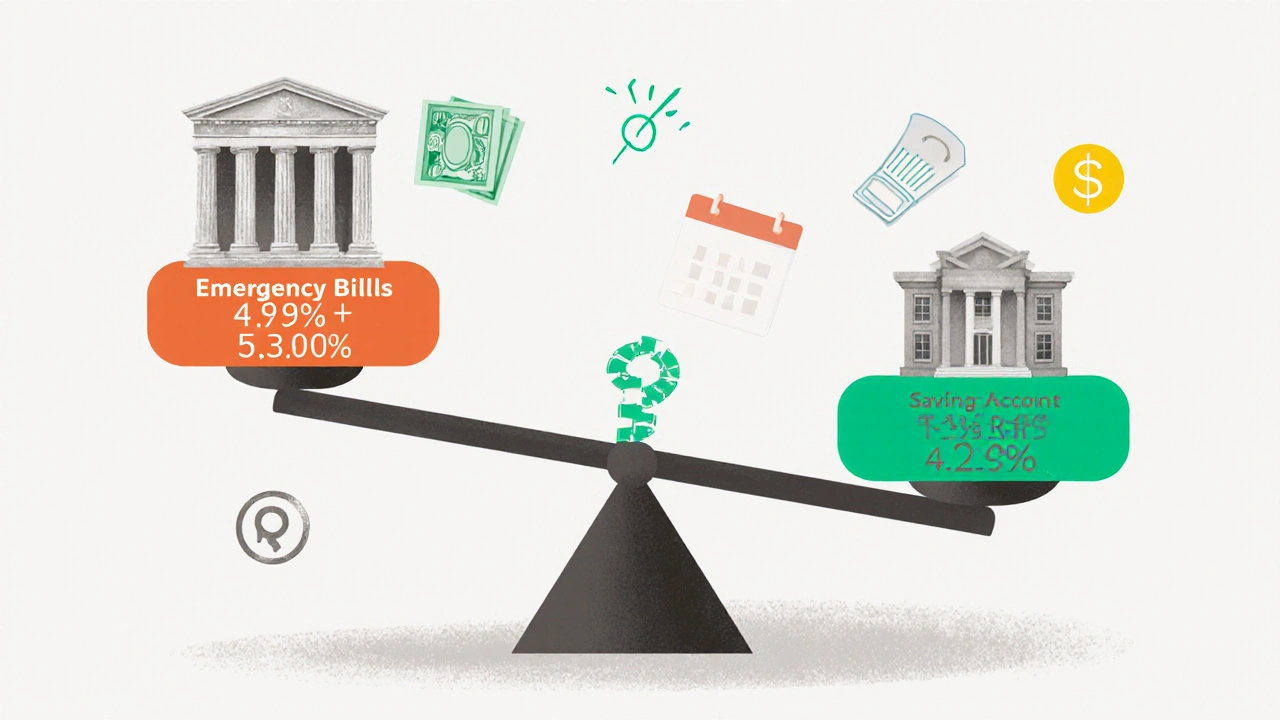

Compare Your Emergency Fund Options

Calculate how much more you could earn with Treasury bills versus traditional savings accounts.

Results will appear here after calculation

When you're building an emergency fund, you don't want to risk losing money. You also don't want to leave cash sitting in a savings account earning 0.5% while inflation eats away at its value. That's where treasury bills come in. They're not flashy, they don't promise huge returns, but for short-term safety and real yield, they're hard to beat.

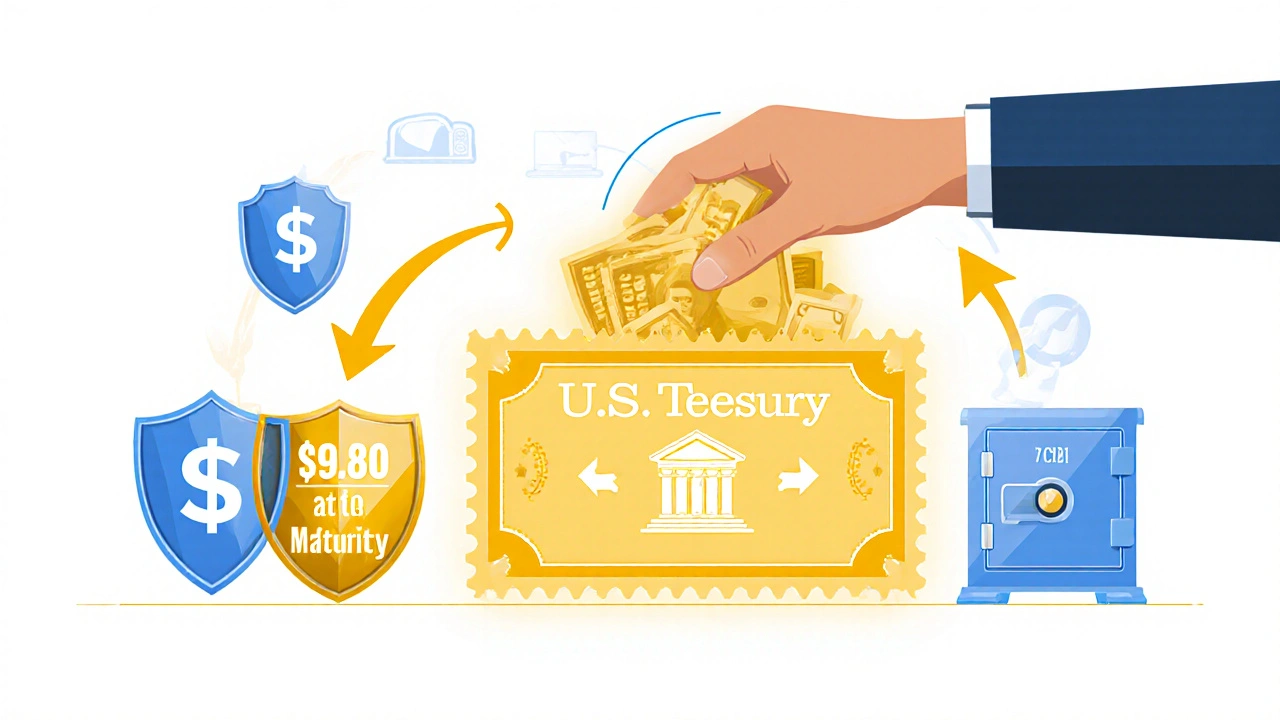

What Exactly Are Treasury Bills?

Treasury bills, or T-bills, are short-term loans you give to the U.S. government. In return, they promise to pay you back the full amount when the bill matures-usually in 4, 8, 13, 26, or 52 weeks. You don't get monthly interest payments. Instead, you buy them at a discount. For example, you might pay $980 for a $1,000 bill. When it matures, you get $1,000 back. The $20 difference is your interest.

They're backed by the full faith and credit of the U.S. government. That means unless the U.S. defaults-which hasn't happened in over 200 years-your money is as safe as it gets. No FDIC insurance needed. No bank failure risk. Just pure government IOU.

Why T-Bills Are Perfect for Emergency Funds

Emergency funds need three things: safety, quick access, and decent returns. T-bills check all three.

- Safety: The U.S. government has never missed a payment on a T-bill. Even during the 2008 crash or the 2020 pandemic, T-bill prices held steady or rose as people ran to safety.

- Access: You can sell T-bills in the secondary market before they mature. Most brokers settle trades within one business day. That’s faster than most CDs, which charge penalties for early withdrawal.

- Yield: As of November 2024, 4-week T-bills were paying 5.30%, and 52-week bills were at 4.95%. That’s 10 times more than the average savings account. Even after federal taxes, you’re still ahead of most money market funds.

Compare that to a traditional savings account earning 0.5% or a CD locking your money away for a year with a 0.75% penalty for early withdrawal. T-bills give you better returns without the strings attached.

T-Bills vs. Other Emergency Fund Options

Let’s break down how T-bills stack up against the alternatives:

| Option | Yield (Late 2024) | Access Time | Penalty for Early Withdrawal | Tax Treatment |

|---|---|---|---|---|

| Treasury Bills (T-bills) | 4.95% - 5.30% | 1 business day (secondary market) | No penalty (sell at market price) | Federal tax only; exempt from state/local |

| Savings Accounts | 0.40% - 0.70% | Immediate | None | Federal and state tax |

| Certificates of Deposit (CDs) | 4.20% - 4.80% | Up to 7 days | Yes (typically 3-6 months interest) | Federal and state tax |

| Money Market Funds | 4.60% - 4.80% | 1-2 business days | None | Federal and state tax |

| High-Yield Checking | 0.50% - 1.50% | Immediate | None (but requirements apply) | Federal and state tax |

The clear winner? T-bills. They beat CDs on liquidity and taxes. They beat money market funds on yield and safety. And they crush savings accounts on returns.

How to Buy Treasury Bills

Getting started is simple. You have two options:

- Through TreasuryDirect.gov - This is the U.S. government’s official website. You open a free account, link your bank, and bid on bills during weekly auctions. You can buy as little as $100. The interface is basic but reliable. Many users report it’s easy once you get past the first few steps.

- Through a Broker - Platforms like Fidelity, Schwab, or Vanguard let you buy T-bills just like stocks. They handle the auction for you. The benefit? You can set up automatic reinvestment. The downside? Some brokers charge small fees for trades or account maintenance.

Most people start with TreasuryDirect. It’s free, transparent, and gives you direct ownership. Once you’re comfortable, you can move to a broker for convenience.

What About Taxes?

T-bills are taxed at the federal level, but not at the state or local level. That’s a big deal. If you live in California or New York, where state income tax can hit 10% or more, this saves you hundreds of dollars a year on a $10,000 investment.

For example: A $10,000 T-bill earning 5% gives you $500 in interest. If you’re in the 24% federal tax bracket, you pay $120 in federal tax. But you pay $0 to your state. A CD with the same yield would cost you $120 plus, say, $50 in state tax. That’s $170 total. T-bills win by $50 on the same return.

Real People, Real Results

On Reddit, a user named ConservativeInvestor87 wrote: “I put 20% of my emergency fund into 6-month T-bills. I’m earning 5.1%-more than triple what my bank pays. I sleep better knowing it’s safe and accessible.”

But not everyone gets it right. Another user, RateChaser2024, learned the hard way: “I needed cash fast and sold a T-bill early. I lost $750 because the market price dropped. I should’ve kept that money in a savings account.”

That’s the key point: T-bills are safe, but their price can dip slightly if you sell before maturity. If you’re buying them for an emergency fund, buy them with the intention of holding them to maturity. Only sell if you absolutely need the cash. That’s how you avoid losses.

What’s Next for T-Bills in 2025?

Experts expect T-bill yields to slowly drop in 2025 as the Federal Reserve cuts interest rates. Some predict yields could fall to 3.8%-4.2% by late 2025. That’s still higher than most savings accounts.

The government is also increasing the supply of 4-week T-bills starting January 2025. That means more liquidity, tighter pricing, and easier access for retail investors. More competition among buyers means better deals for you.

And don’t worry about the debt ceiling. Even during past debates, T-bills kept trading normally. The U.S. has always paid its bills-even when politics got messy.

Who Should Avoid T-Bills?

T-bills aren’t for everyone. If you’re investing for retirement 20 years from now, they’re too short-term. You’ll miss out on higher returns from stocks or bonds.

They’re also not ideal if you’re trying to beat inflation over the long term. A 5% return sounds great, but if inflation hits 4%, your real return is only 1%. That’s fine for cash you need in the next year-but not for wealth building.

And if you’re not comfortable with the idea of buying at a discount and getting paid back at face value, it might feel confusing at first. But once you run a simple calculation-pay $980, get $1,000 back-it clicks.

Final Thoughts: T-Bills Are the Smart Choice for Emergency Cash

Your emergency fund isn’t meant to grow. It’s meant to be there when you need it. T-bills give you more than just safety. They give you real yield, tax advantages, and flexibility that savings accounts and CDs can’t match.

Start small. Buy a $1,000 T-bill. Watch how it works. Reinvest when it matures. In six months, you’ll have more confidence-and more money-than you did in your old savings account.

You don’t need to be a financial expert. You just need to know that putting your emergency cash in T-bills is one of the smartest, simplest moves you can make right now.

Are Treasury bills safe for emergency funds?

Yes, Treasury bills are among the safest investments available. They’re backed by the full faith and credit of the U.S. government, meaning default risk is virtually zero. They’re safer than bank savings accounts (which are FDIC-insured but pay near-zero interest) and safer than CDs (which can charge penalties for early withdrawal). T-bills are ideal for emergency funds because they preserve capital while earning meaningful interest.

Can I lose money on Treasury bills?

You won’t lose money if you hold a T-bill until maturity-you’ll always get the full face value. But if you sell it early in the secondary market, the price can fluctuate slightly based on interest rate changes. If rates rise after you buy, your T-bill’s market value may drop. That’s why it’s best to buy T-bills with the intention of holding them to maturity, especially for emergency funds.

How do I buy Treasury bills?

You can buy T-bills directly through TreasuryDirect.gov for free, or through most major brokers like Fidelity, Schwab, or Vanguard. The minimum investment is $100, and you can buy in $100 increments. TreasuryDirect requires you to set up an account and link your bank account. Brokers make it easier if you already invest there, but may charge small fees. Both options are straightforward and secure.

Are T-bills better than savings accounts for emergency funds?

Yes, for most people. As of late 2024, 4-week T-bills paid over 5.3%, while the average savings account paid under 0.7%. Even after federal taxes, T-bills deliver significantly higher returns. Plus, you can sell T-bills quickly without penalties, unlike CDs. The only advantage savings accounts have is instant access-but if you need cash within hours, you can still access T-bill proceeds within one business day.

Do I pay state taxes on Treasury bills?

No. Interest earned on Treasury bills is exempt from state and local income taxes. You only pay federal income tax on the interest. This makes T-bills especially attractive for residents of high-tax states like California, New York, or Minnesota, where state taxes can add 5-10% to your tax bill on other investments.

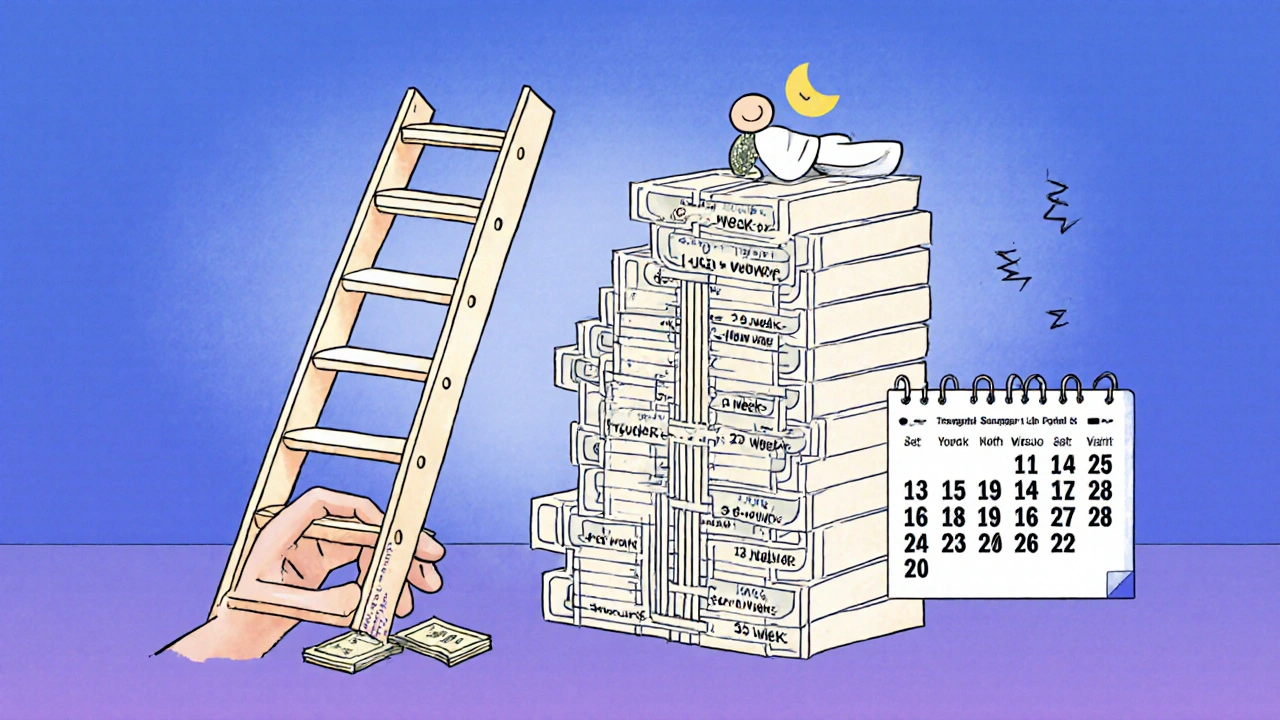

How long should I hold T-bills for an emergency fund?

Match the maturity date to your emergency timeline. If you want access within 3 months, buy 4- or 8-week T-bills. If you’re okay waiting 6 months, go for 13- or 26-week bills. For a full emergency fund, ladder your purchases-buy a mix of 4-week, 13-week, and 52-week bills. This way, one bill matures every month or two, giving you regular access to cash without locking everything up.

Can I automate buying T-bills?

Yes, if you use a broker like Fidelity or Schwab, you can set up automatic purchases of T-bills each week or month. TreasuryDirect doesn’t offer auto-renewal, but you can manually reinvest proceeds when a bill matures. Automating helps you stay consistent and take advantage of rising rates without having to remember to buy.

What’s the difference between T-bills, T-notes, and T-bonds?

T-bills mature in one year or less and are sold at a discount with no periodic interest. T-notes mature in 2 to 10 years and pay interest every six months. T-bonds mature in 20 to 30 years and also pay semiannual interest. For emergency funds, only T-bills make sense-they’re short-term, liquid, and avoid interest rate risk. Notes and bonds are better for long-term portfolios.

Dave McPherson

November 14, 2025 AT 02:35Let’s be real - T-bills aren’t some revolutionary hack, they’re just the default adult move. Everyone else is out here chasing meme stocks or locking cash into CDs like it’s 2012. Meanwhile, you’re buying a government IOU that pays 5.3% and doesn’t even require you to remember your password. The fact that people still use savings accounts is basically financial hoarding with extra steps. And don’t get me started on money market funds - those are just T-bills with a fancy coat of paint and a 0.1% fee disguised as ‘convenience.’

Also, the tax exemption? That’s not a perk - it’s a public service. If you live in CA or NY and you’re not using T-bills, you’re literally giving your state a free vacation fund. The U.S. government is basically paying you to not be a financial peasant. I’ve seen people cry over 0.2% APY on their savings account. Meanwhile, I’m compounding at 5% with zero stress. It’s not investing - it’s just not being dumb.

RAHUL KUSHWAHA

November 14, 2025 AT 04:25Really appreciate this breakdown 😊

I’m from India and didn’t know T-bills were this accessible to regular folks. Here, fixed deposits are the norm - but they’re locked for years and taxed heavily. The idea of buying $100 bills with no penalty and state-tax-free returns? Mind blown. I’ll try TreasuryDirect next week. Thanks for making it so clear!

Julia Czinna

November 16, 2025 AT 00:51One thing I’d add: while T-bills are fantastic for emergency funds, the ‘laddering’ strategy is non-negotiable if you want true liquidity. Buying a single 52-week bill might sound tempting for the higher yield, but what if you need $3,000 in month 3? You’re stuck selling at a potential loss or waiting. Instead, split your fund into four equal parts: 13-week, 26-week, 39-week, and 52-week. That way, every quarter, a chunk matures - no guesswork, no panic, no market timing. It’s the quiet, boring, genius move that actually works.

Also, the Reddit anecdote about losing $750? That’s a cautionary tale, not a flaw in T-bills. It’s a flaw in misunderstanding them. T-bills aren’t trading instruments - they’re cash equivalents with interest. Treat them like a locked drawer with a timer, not a stock ticker.

And yes, the tax exemption is a massive win. In states like mine, that’s easily $100+ per $10k annually. That’s a free dinner out every month. Why wouldn’t you?

Laura W

November 17, 2025 AT 20:50Y’all are overcomplicating this. T-bills = free money you don’t have to think about. I put $5k in 4-week bills last month. Got paid $65 in interest before my coffee even cooled. I didn’t have to sign 17 forms, I didn’t have to call my bank, I didn’t even have to remember I bought them. TreasuryDirect auto-renewed it. Boom. Next month, same thing. Meanwhile my cousin is still using Capital One’s 0.4% savings account and bragging about ‘being safe.’ Bro. You’re not safe. You’re being robbed by inflation in slow motion. T-bills are the cheat code. Start small. Do it. You’ll thank yourself in 6 months.