Retirement Savings Calculator

Your Retirement Plan

Retirement Milestones

Key benchmarks: By age 30: 1x salary, 40: 3x, 50: 6x, 60: 8x, 67: 10x

Your Retirement Projection

Monthly Savings Required

$0.00

Projected Retirement Fund

$0.00

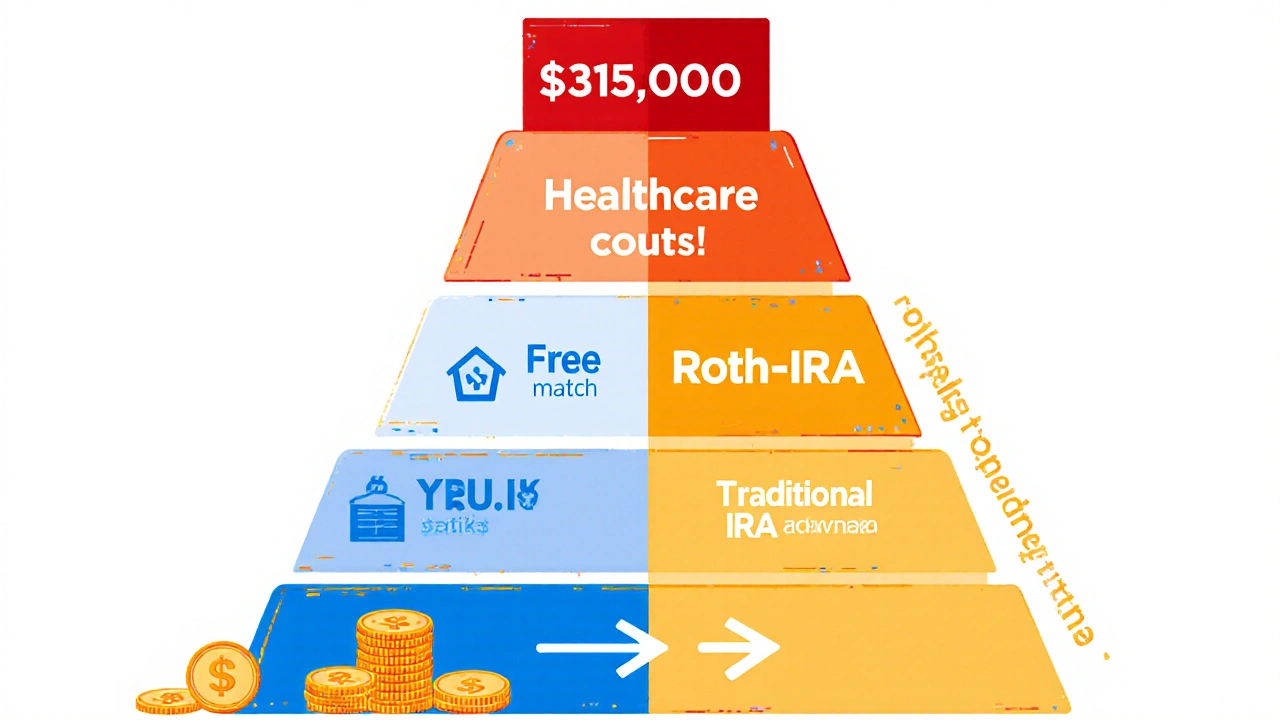

Healthcare Estimate (2024)

$315,000+

Most people think retirement is something that happens far off in the future - maybe when they’re 60 or 65. But if you’re waiting until then to start saving, you’re already behind. The truth is, retirement planning isn’t about picking a perfect investment or timing the market. It’s about starting early, saving consistently, and knowing exactly how much you need to live on when you stop working.

Why Retirement Planning Matters More Than Ever

Back in the 1980s, about 62% of big companies offered traditional pensions. By 2023, that number dropped to just 13%. Today, almost every worker is on their own. Your employer might offer a 401(k), but they’re not guaranteeing your income in retirement - you are. Add to that the fact that people are living longer. The average U.S. life expectancy is now 79.1 years. If you retire at 67, you could be living on your savings for 12 to 15 years - maybe more. And healthcare? Fidelity estimates a 65-year-old couple retiring in 2024 will need about $315,000 just for medical costs, not including long-term care. That’s not a small number. That’s a major part of your retirement budget.When Should You Start Saving?

The best time to start saving for retirement was 10 years ago. The second-best time? Right now. Fidelity’s research shows that if you start saving at age 25, you only need to put away about 15% of your income each year to replace 45% of your pre-retirement income. If you wait until 35, that jumps to 18%. At 45? You need to save 24%. Why? Because compound growth works best over time. Take two people: one starts saving $1,000 a year at 25, the other at 35. Both earn 7% annually. By 65, the person who started early has $86,154. The one who waited? Only $43,425. That’s more than $42,000 lost just because of a 10-year delay. It’s not about being perfect. It’s about being early. Even if you can only save $50 a month at 28, that’s $600 a year. At 7% returns, that grows to over $127,000 by age 40 - as one Reddit user demonstrated. Start small, but start now.How Much Should You Save Each Year?

The standard advice? Save 15% of your gross income. That includes any money your employer puts in. If your company matches 50 cents on the dollar up to 6% of your salary, and you contribute 6%, you’re already at 9% total. You only need to add 6% more from your own pocket to hit 15%. But 15% isn’t magic. It’s a baseline. If you want to retire early, live in a high-cost area, or expect higher medical bills, you might need more. Some experts, like Stanford’s Laura Carstensen, argue that with lifespans stretching past 100, you should aim for 25%. Fidelity gives clear benchmarks for where your savings should be at different ages:- By 30: 1x your annual salary

- By 40: 3x your salary

- By 50: 6x your salary

- By 60: 8x your salary

- By 67: 10x your salary

Where Should You Save?

Not all accounts are created equal. Here’s how to prioritize:- 401(k) with employer match - Always contribute enough to get the full match. It’s free money. For a $60,000 earner with a 50% match up to 6%, that’s $1,800 extra a year.

- Roth IRA - If you expect to be in a higher tax bracket in retirement, this is your best friend. Contributions are made after tax, but withdrawals are tax-free. Max out at $7,000 in 2024 ($8,000 if you’re 50+).

- Traditional IRA or 401(k) - Good if you want a tax break now. But you’ll pay taxes later.

- After-tax brokerage accounts - For those who’ve maxed out tax-advantaged accounts and still want to save more. No tax breaks, but no contribution limits either.

What Most People Get Wrong

Many think they’re saving enough because they’re putting away 10%. But 10% is outdated. The average worker contributes just 7% to their 401(k), and 56% of those with employer plans don’t even contribute enough to get the full match. That means they’re leaving an average of $1,123 a year on the table. Another big mistake? Underestimating healthcare. One Trustpilot reviewer said they followed the “save 10%” rule but didn’t account for medical costs - and ended up $180,000 short. That’s not a rare story. Then there’s lifestyle inflation. As your salary grows, so do your expenses. You get a raise? You upgrade your car, your rent, your dining out. That’s normal. But if you don’t automatically increase your savings rate, you’ll never catch up. That’s why “save more tomorrow” programs - which auto-increase your contribution by 1% each year - work so well. Fidelity found they boost savings rates by 2.1 percentage points annually.Automation Is Your Secret Weapon

The biggest predictor of retirement success? Consistency. And the best way to be consistent? Automation. Set up automatic payroll deductions the day you start your job. If your employer lets you choose your contribution percentage, pick 10% right away. Then increase it by 1% every six months. You won’t feel the pinch - you’ll never even see the money. Fidelity’s data shows that people who use auto-deductions save 83% more consistently than those who transfer money manually. You don’t need discipline. You need a system.

What About Social Security?

Social Security will replace about 40% of your pre-retirement income - if you’re an average earner. But here’s the catch: the trust fund is projected to run out in 2035. If nothing changes, benefits could drop by 23% for everyone. Don’t count on Social Security to carry you. Treat it like a bonus, not a safety net. Your retirement income should come from your savings, investments, and maybe a part-time job - not just government checks.What If You’re Behind?

37% of Americans have less than $25,000 saved for retirement. If you’re in that group, don’t panic. Catch-up is possible. Start by maxing out your 401(k) and IRA. If you’re 50 or older, you can make catch-up contributions: $30,500 in your 401(k) and $8,000 in your IRA in 2024. In 2025, those limits go even higher for people 60-63. Fidelity’s new “Catch-Up 2.0” accounts let those 50-60 contribute up to $50,000 a year through after-tax channels. It’s not tax-deductible, but it lets you build wealth fast. Also, consider working a few extra years. Even two more years of saving and delaying Social Security can add tens of thousands to your retirement income.Your Next Steps

You don’t need a financial advisor to get started. You need a plan. Here’s what to do in the next 30 days:- Check your latest 401(k) statement. How much do you have saved? How much are you contributing?

- Calculate 15% of your annual income. That’s your target.

- Make sure you’re getting your full employer match. If not, increase your contribution.

- Set up an automatic transfer to a Roth IRA if you don’t have one.

- Use the Department of Labor’s free retirement calculator to estimate how much you’ll need based on your expenses.

How much should I save each month for retirement?

Aim to save 15% of your gross income each year. For someone making $60,000, that’s $7,500 annually, or $625 per month. This includes any employer contributions. If you’re starting late, you may need to save more - up to 20% or even 25%.

Is it too late to start saving if I’m 40 or 50?

No, but you’ll need to save more. At 40, aim for 18-20% of your income. At 50, increase to 25% or more. Use catch-up contributions: you can save up to $30,500 in a 401(k) and $8,000 in an IRA in 2024. Also, consider working longer - even two extra years can make a big difference.

Should I prioritize a 401(k) or an IRA?

Always contribute to your 401(k) up to the employer match first - that’s free money. Then max out a Roth IRA if you qualify. After that, go back to your 401(k) to reach your 15% goal. If you’re a high earner, you may need taxable brokerage accounts to save more.

How much will I need in retirement?

Most experts recommend having 10 times your final salary saved by retirement. If you earn $70,000, aim for $700,000. Another method: save 12 times your annual expenses. For example, if you expect to spend $50,000 a year in retirement, save $600,000. Always include healthcare - plan for $300,000+ for a couple.

What happens if I withdraw money early?

Withdrawing from a 401(k) or IRA before 59½ triggers a 10% penalty plus income taxes. On average, this reduces your account by 25-30%. That means if you take out $10,000, you might only get $6,500 after taxes and penalties. Avoid early withdrawals unless it’s a true emergency.

Laura W

November 16, 2025 AT 15:55Okay but let’s be real - if you’re not maxing out your Roth IRA while also hitting the 401(k) match, you’re just playing retirement roulette. I started at 22 with $100/month and now I’m 31 with $87k in retirement accounts. Compound interest isn’t magic, it’s math - and math doesn’t care how tired you are. Auto-increase your contribution every six months like your life depends on it. Because it does.

Also, stop saying ‘I’ll start next year.’ That’s the exact lie your future self is screaming at you right now.

Graeme C

November 18, 2025 AT 02:0415%? That’s the bare minimum for a middle-class life in 2024. If you’re earning £50k in the UK and think you’ll retire comfortably on £30k/year with inflation at 3.5%, you’re delusional. Healthcare costs alone will devour 40% of your savings by 75. Fidelity’s $315k estimate? Too low. I’ve seen retirees on NHS waiting lists with $200k saved and zero dental coverage. You need 12x your annual expenses - not 10x. And if you’re relying on state pensions? Good luck with that. The UK system is a sinking ship. Start now. Save aggressively. Or retire at 70 working at Tesco.

Astha Mishra

November 18, 2025 AT 09:04It’s interesting how we frame retirement as a number - 10x salary, 15% savings, $700k target - as if life were a spreadsheet. But what if retirement isn’t about accumulating wealth, but about reducing dependency? I’ve met people in Kerala who retire at 60 with nothing but a small plot of land, a few chickens, and their grandchildren. They don’t have 401(k)s, but they have community. Maybe the real question isn’t ‘How much do I save?’ but ‘How much do I need to be free?’

Still… I agree with the math. Because in this world, freedom often costs money. And if you can build both - financial security and emotional resilience - you’ve already won.

Also, ‘save more tomorrow’ is a trap. Tomorrow is just today with a different clock. Start today. Even if it’s $5. Even if it’s just one less latte. The universe rewards consistency, not perfection.

Kenny McMiller

November 18, 2025 AT 12:46Bro, the real secret? Don’t even think about it. Set up auto-deposits and forget it. I didn’t check my 401(k) for 3 years. Came back and it was up 40%. Didn’t do a thing. That’s the power of automation. No discipline needed. Just set it, forget it, and let Wall Street do the heavy lifting while you binge Netflix.

Also, if you’re 50 and behind? Stop panicking. Just max out your catch-up contributions. $30.5k in a 401(k)? That’s like getting a free $15k bonus from the government. Take it. All of it. Don’t be cute. Just save.