Finance & Investing

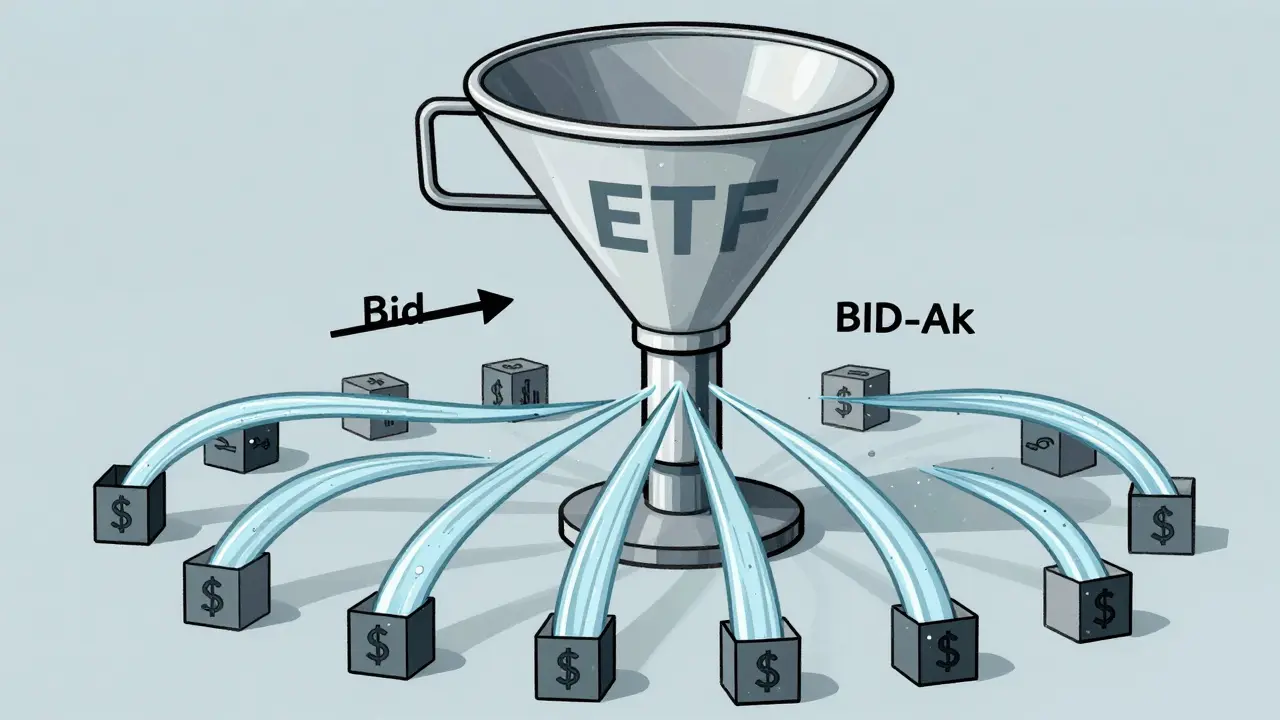

When you think about Finance & Investing, the process of managing money to grow wealth over time through smart decisions and tools. Also known as personal finance and capital allocation, it's not about guessing markets—it's about understanding how money moves and where to put it so it works for you. Most people lose money before they even buy a stock because they don’t see the hidden costs, like the bid-ask spread, the difference between what buyers are willing to pay and what sellers want. This tiny gap can eat into your profits, especially in options trading, a type of derivative contract that gives you the right to buy or sell an asset at a set price. If you're trading options with low liquidity, how easily an asset can be bought or sold without changing its price, you’re paying more in spreads than you think. Market makers set these prices, and when there aren’t enough buyers and sellers, they widen the gap to protect themselves—and that’s on your dime.

Finance & Investing isn’t just about picking winners. It’s about managing risk, knowing when to wait, and understanding the tools you’re using. The options trading costs, all the fees, spreads, and commissions that reduce your net returns add up fast. Many traders focus only on the price of the option, but the real cost is often the spread they pay when entering and exiting. And if you’re trading infrequently or on small accounts, those costs can kill your edge. Liquidity isn’t just a buzzword—it’s your lifeline. High liquidity means tighter spreads, faster fills, and less slippage. Low liquidity? You’re basically gambling on the market maker’s mood.

What you’ll find here isn’t theory. It’s what actually happens when you trade options, what the pros watch for, and how regular people can avoid the traps. You’ll learn how time, moneyness, and volume affect your trades—not just in theory, but in your account balance. No fluff. No jargon. Just real insights from people who’ve been there. Whether you’re new to options or you’ve been trading for years but keep losing money on entry and exit, this collection gives you the tools to fix it. The posts below cover the exact issues you’re facing—because if you’re wondering about bid-ask spreads, you’re not alone, and you don’t have to keep paying for it.