Bond Ladder Income Calculator

Estimate your monthly income from a bond ladder strategy. See how your investments generate predictable cash flow while reinvesting at current interest rates.

Your Bond Ladder

Imagine getting a steady paycheck from your investments-every few months, without touching your stocks-even when the market crashes. That’s not a fantasy. It’s what happens when you combine a bond ladder with an equity core. This strategy isn’t for traders or gamblers. It’s for people who want to retire without worrying about running out of money, while still letting their savings grow over time.

Why This Strategy Works

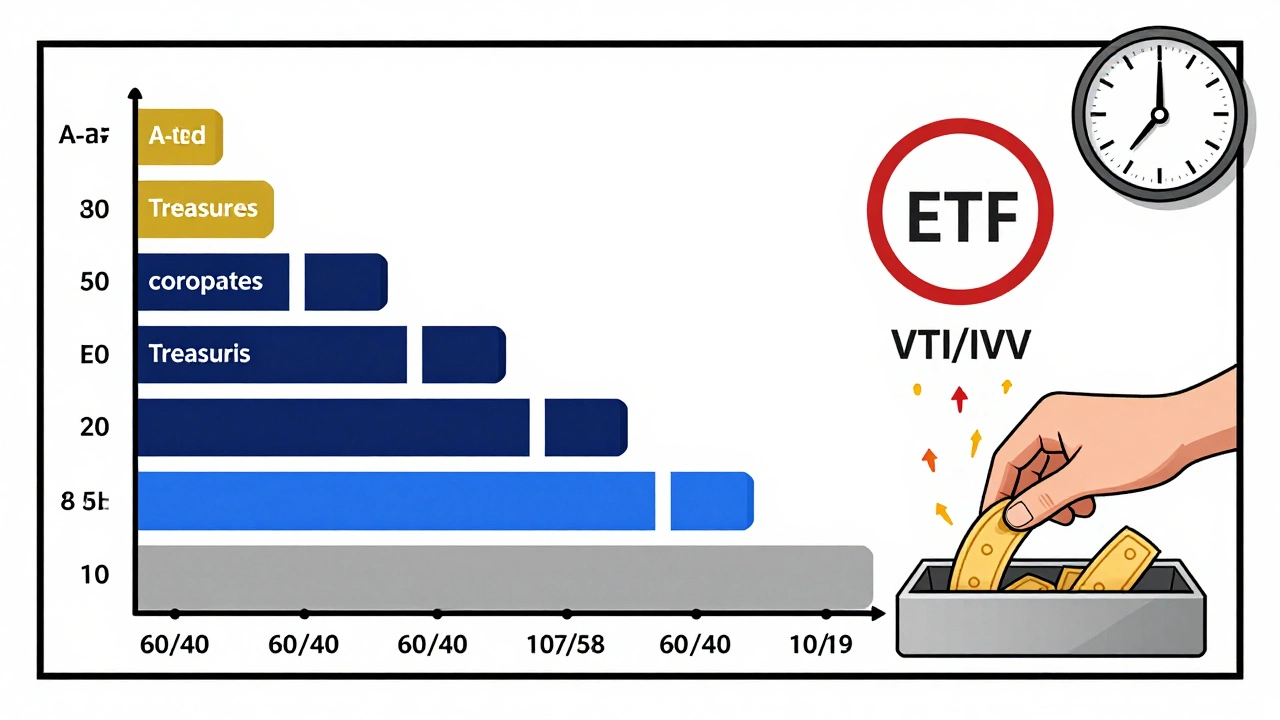

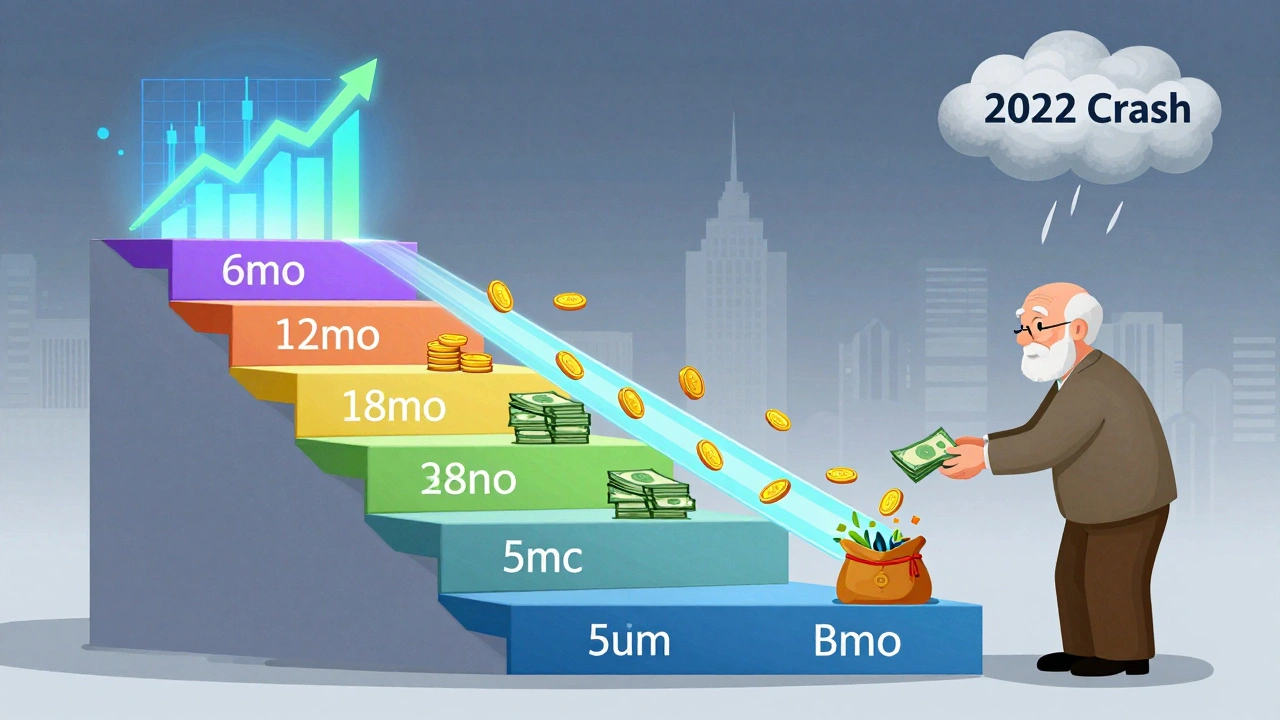

Most people think investing is either safe (bonds) or risky (stocks). But the real secret? It’s not choosing one or the other. It’s using both together in a smart way. A bond ladder gives you cash flow. The equity core gives you growth. Together, they create a portfolio that doesn’t just survive market swings-it thrives through them. Back in 2022, when the S&P 500 dropped over 19%, investors with 100% stocks panicked. Those with a bond ladder? They kept getting paid. Maturing bonds turned into cash. That cash covered living expenses. No need to sell stocks at a loss. That’s the power of this blend. According to Fidelity’s 2024 analysis, a 60% equity / 40% bond ladder portfolio returned 6.8% annually from 2010 to 2024. That’s better than bonds alone-and far less volatile than stocks alone. The volatility? 32% lower than a pure stock portfolio.How a Bond Ladder Works

A bond ladder isn’t just a bunch of bonds. It’s a planned sequence of maturities. Think of it like stairs. Each step (or “rung”) is a bond that matures at a different time. Here’s how most people build one:- Start with $50,000 or more. You need enough to spread out across multiple bonds.

- Buy 5 to 10 bonds, each worth $10,000 to $50,000.

- Space out the maturity dates-every 6 to 12 months over 3 to 10 years.

- Only use bonds rated A or higher (S&P or Moody’s). Avoid junk bonds.

- Use a mix of Treasuries, investment-grade corporates, and maybe some high-quality municipals.

What Goes Into the Equity Core

The equity core is your growth engine. It’s not about picking individual stocks. It’s about owning the whole market, cheaply and efficiently. The best options are low-cost index funds or ETFs:- Vanguard Total Stock Market ETF (VTI)

- iShares Core S&P 500 ETF (IVV)

- Fidelity ZERO Total Market Index Fund (FZROX)

How to Build Your Blend

This isn’t a set-it-and-forget-it strategy. But it’s not complicated either. Here’s how to get started:- Figure out your income needs. How much do you need each year? If you need $40,000, and your bond ladder will pay $16,000, then your equity core needs to cover the rest-or grow enough to cover future increases.

- Choose your bond quality. Stick to A-rated or higher. BBB-rated bonds look tempting because they pay more, but they act like stocks in a crash. In 2020, BBB-rated corporate bonds lost over 20% in value. Not what you want in your income stream.

- Build the ladder. Use Fidelity’s Bond Ladder Builder or TreasuryDirect.gov’s free calculator. Start with a 5-year ladder if you’re new. Expand later.

- Set up your equity core. Open a brokerage account. Buy one of the ETFs listed above. Set up automatic reinvestment of dividends.

- Rebalance quarterly. If your equity core grows too big (say, 70% instead of 60%), sell some and buy more bonds. If bonds outperform, do the opposite. Keep your 60/40 split within 5% bands.

Real People, Real Results

On Reddit’s r/personalfinance, a user named u/RetiredTeacher2023 shared how their $850,000 portfolio generated $2,800 a month during the 2022 market crash. Their bond ladder paid $1,500/month. The rest came from dividends and a small amount of equity sales. No panic. No selling low. Another user, u/FinanceVeteran87, said the real benefit wasn’t the money-it was the peace of mind. “Knowing exactly when my bonds matured kept me from selling stocks when the market dropped,” they wrote. “I didn’t have to guess. I had cash coming in.” These aren’t outliers. A 2023 survey by the Financial Planning Association found that 68% of people who used this strategy with a financial advisor said they met or exceeded their income goals. Only 49% of DIY investors did. Why? Because advisors help avoid common mistakes: bad credit selection, missed reinvestments, or mismatched maturities.What This Strategy Doesn’t Do Well

No strategy is perfect. Here’s where this one falls short:- It’s not for small accounts. Under $50,000? You can’t build a real ladder. Stick with bond funds.

- It’s not passive. You need to monitor it. Reinvest. Rebalance. Review credit ratings. That’s 5-7 hours a quarter.

- It’s not tax-efficient. Individual bonds generate taxable interest. ETFs are better for taxable accounts because of lower turnover and capital gains handling.

- It struggles in extreme rates. If interest rates go from 2% to 8% overnight, a bullet portfolio (all bonds maturing at once) might outperform. But that’s rare.

Who Should Use This?

This strategy is made for one group: people within 5 to 15 years of retirement-or already retired-who need reliable income and don’t want to risk their savings. It’s perfect if you:- Have $500,000 to $2 million in investable assets

- Need $3,000 to $7,000 per month in income

- Want to avoid selling stocks during downturns

- Are willing to spend a few hours a quarter managing your portfolio

What’s Next?

This strategy is getting smarter. Fidelity launched automated ladder rebalancing in September 2024 for accounts over $100,000. Vanguard added ladder analytics to Portfolio Watch in October 2024. Schwab plans to roll out a “Dynamic Ladder Builder” in Q2 2025 that adjusts maturities based on Fed policy signals. But the core idea won’t change: control your cash flow. Let growth work for you. Stay calm when markets freak out. The bond ladder isn’t about maximizing returns. It’s about minimizing stress. The equity core isn’t about beating the market. It’s about owning it, cheaply and consistently. Together, they’re not just an investment strategy. They’re a retirement safety net.Can I build a bond ladder with bond funds instead of individual bonds?

Technically, yes-but you lose the key benefits. Bond funds don’t mature. They keep rolling over. You don’t get predictable cash flow or principal return. You’re exposed to interest rate risk without the ladder’s structure. If you want the ladder effect, you need individual bonds with set maturity dates.

How much money do I need to start?

You need at least $50,000 to build a meaningful bond ladder. With less, you can’t properly diversify across issuers or stagger maturities without buying fractional bonds. Below $50,000, use a total bond market ETF instead-like BND or AGG.

What happens if interest rates go up?

Your existing bonds lose value on paper, but that doesn’t matter if you hold them to maturity. You still get your full principal back. And as bonds mature, you reinvest at higher rates. That’s the whole point of the ladder-it turns rising rates from a threat into an opportunity.

Should I use Treasuries or corporate bonds?

Use both. Treasuries are safest and act as your shock absorber during market stress. Corporates pay more yield but carry credit risk. A good mix is 30-50% Treasuries, the rest A-rated corporates. Never go below A-rating.

Is this strategy better than target-date funds?

For income-focused retirees, yes. Target-date funds are great for hands-off savers, but they don’t give you control over cash flow. With a bond ladder, you decide exactly when and how much cash you get. You also pay lower fees and avoid the one-size-fits-all glide path.

Can I use this in a Roth IRA?

You can-but it’s not ideal. Roth IRAs are best for growth assets that benefit from tax-free compounding. Use your Roth for your equity core. Keep your bond ladder in a taxable account so you can manage tax timing and reinvest interest as needed.

What if I can’t reinvest a maturing bond right away?

Don’t panic. Keep the cash in a high-yield savings account or short-term Treasury bill (like a 1-month T-bill) until you’re ready. Just don’t let it sit idle for more than 30 days. Every day you delay reinvestment is a day you’re missing out on compounding.

Royce Demolition

December 13, 2025 AT 06:15This bond ladder + equity core thing is LIFE-CHANGING 😍 I was panic-selling during the 2022 crash like a total idiot… then I found this method. Now I get paid every month like clockwork-no stress, no drama. My portfolio’s still growing while I sip coffee and watch Netflix. Who knew investing could feel this chill? 🙌

Sabrina de Freitas Rosa

December 15, 2025 AT 04:18Ugh. So you’re telling me I need $50K just to play nice? 😒 Most people don’t even have $5K saved. This sounds like a rich person’s fantasy. And don’t even get me started on ‘rebalancing quarterly’-like, who has time for that? You’re not helping the average Joe-you’re just making them feel bad for not being rich enough to play your game. 🤦♀️

Erika French Jade Ross

December 17, 2025 AT 03:29honestly? i love how this breaks it down without the jargon. i’m in canada and thought bond ladders were only for us americans with fancy brokerages… turns out, i can do it with just a decent cibc account 😊 i started with $30k and used t-bills as fillers between maturities-worked like a charm. my only mistake? waiting 45 days to reinvest one bond… lost like 0.8% that month 😅 but now i set reminders. peace of mind? yes please. 🌿