When you're building a stock portfolio, one of the first big decisions you’ll face is whether to chase dividend-paying stocks or growth stocks. It’s not just about picking winners-it’s about matching your strategy to your life stage, goals, and tolerance for risk. One gives you cash every quarter. The other bets big on the future. Neither is right for everyone.

What Are Dividend-Paying Stocks?

Companies that pay dividends tend to be older, more established, and profitable. They’ve passed the wild growth phase and now have steady cash flow. Examples include Coca-Cola, Johnson & Johnson, and Microsoft-which started paying dividends in the 1930s and has raised them every year since 1975.

Dividend yield tells you how much you’re earning relative to the stock price. It’s calculated by dividing the annual dividend by the current share price. Most solid dividend stocks offer between 2% and 5%. A yield above 5% can look tempting, but it often signals trouble-like a falling stock price or an unsustainable payout.

Look at the payout ratio: dividends divided by earnings. If a company pays out more than 80% of its profits as dividends, it’s risky. If it’s between 30% and 60%, that’s healthy. Starlight Capital’s 2024 analysis found dividend growth stocks typically have payout ratios under 60% and debt-to-equity ratios below 0.5-meaning they’re not over-leveraged and can keep paying even if profits dip.

What Are Growth Stocks?

Think Amazon, Nvidia, or Tesla. These companies don’t hand out cash. Instead, they use profits to build the next big thing. Investors buy them hoping the stock price will skyrocket as the company scales.

Growth stocks often have sky-high price-to-earnings (P/E) ratios-25 to 50 or even higher. That means you’re paying a lot for each dollar of profit today, because you expect it to grow massively tomorrow. A P/E of 15-25 is typical for dividend stocks. The higher the P/E, the more faith you’re placing in future growth.

When evaluating growth stocks, look at revenue growth (aim for 15%+ annually), gross margins (60%+ in tech), and total addressable market size. A company selling software to millions of businesses is more promising than one selling to a shrinking niche.

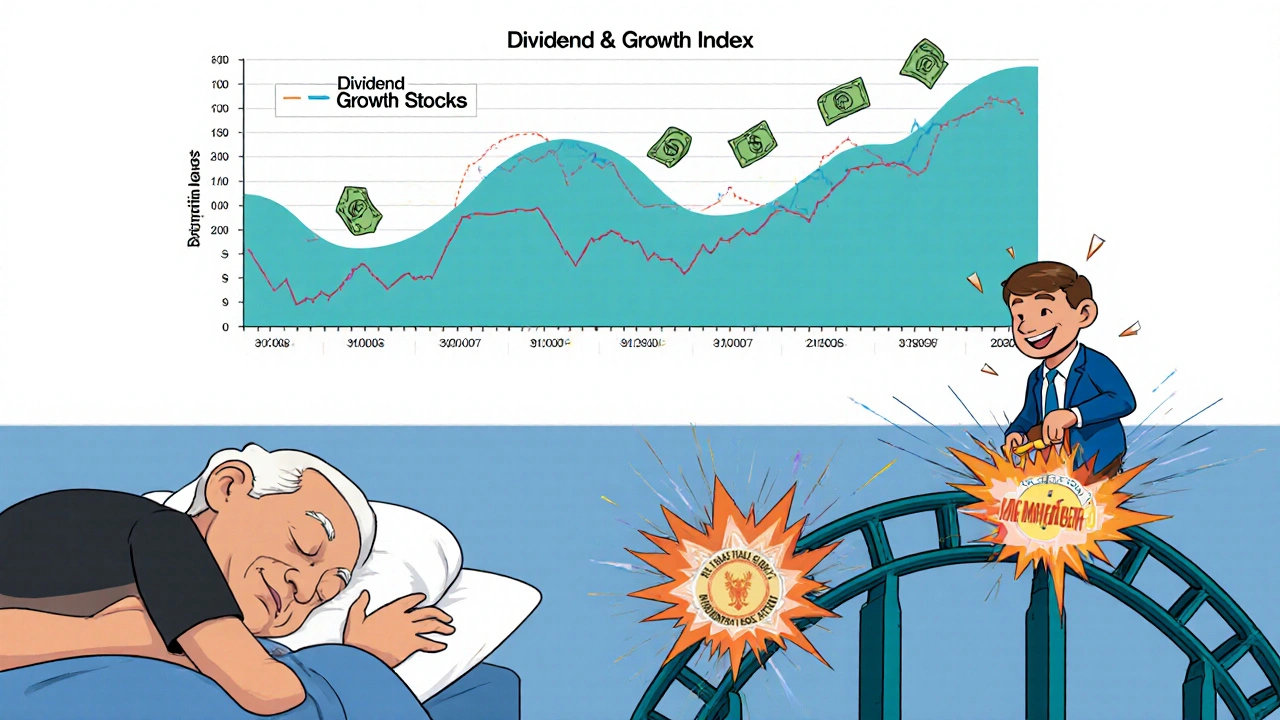

Performance: Dividends vs. Growth Over Time

From 2008 to 2024, dividend growth stocks (those consistently raising payouts) outperformed high-yield dividend stocks. Why? Because they combine income with capital appreciation. A stock that raises its dividend 5% a year while the price climbs 8%? That’s a double win.

But here’s the catch: growth stocks blew past dividend stocks during the 2010-2020 bull market. The Magnificent Seven-Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla-accounted for 71% of the S&P 500’s total return in 2023 alone. Over that decade, growth stocks returned an average of 18.3% per year. Dividend payers? Just 11.2%. That’s a huge gap.

But growth stocks came with 32% more volatility. In 2022, when markets crashed, the broader S&P 500 dropped 15.1%. The Morningstar US Dividend Growth Index? Only down 12.3%. That’s because dividend stocks tend to have lower beta-closer to 0.8-1.0-meaning they don’t swing as wildly with the market. Growth stocks often have betas of 1.2-1.5. They’re more sensitive to fear and hype.

Interest rates matter too. From 1955 to 2008, when rates were rising, dividend stocks beat growth stocks by 4.7% a year. But from 2009 to 2020, during near-zero rates, growth stocks crushed them by 6.2%. Right now, with rates still elevated, dividend stocks have a tailwind.

Who Should Choose What?

If you’re under 35, most experts say go for growth. Why? Because time is on your side. You can reinvest every dollar you make and let compounding work for decades. Financial Samurai’s analysis shows it takes just 12.7 years to build a $1 million portfolio with growth stocks, assuming historical returns. With dividend stocks? 18.3 years. That’s a six-year difference.

On Reddit’s r/personalfinance, a 32-year-old investor said switching to growth ETFs cut his retirement timeline from 23 years to 15. That’s not fantasy-it’s math.

But if you’re nearing retirement or already retired, dividends are a lifeline. In a 2024 Morningstar survey, 68% of retirees prioritized dividend stocks for steady income. One investor on r/financialindependence reported $42,381 in dividend income in 2023 from an $850,000 portfolio. That’s nearly 5% yield-and it covered 87% of his living expenses.

Dividend income doesn’t require selling shares. That’s huge. When markets drop, you don’t have to lock in losses to pay bills. You just collect the check.

What You Need to Watch Out For

Dividend investors: don’t fall for yield traps. A high yield isn’t a gift-it’s a warning. If a company’s payout ratio is above 80%, or if earnings are falling while dividends stay flat, it’s unsustainable. Check their balance sheet. Are they taking on debt to pay dividends? That’s a red flag.

Look for dividend growth. Companies that have raised dividends for 10+ years (like the ones in the Morningstar US Dividend Growth Index) are far more reliable. They’ve survived recessions, rate hikes, and competition. Microsoft, Coca-Cola, and Procter & Gamble are all on that list.

Growth investors: beware of acquisition addiction. Some companies grow by buying others-but that’s risky. Dr. David Skarbnik of TSI Network warns that many growth stocks overpay for targets and end up dragging down returns. Don’t just chase revenue growth. Ask: Is this growth profitable? Is it sustainable?

Also, avoid companies with no moat. If a growth stock’s product can be copied in six months, it’s not a long-term winner. Look for network effects, patents, or brand loyalty.

How to Build Your Strategy

You don’t have to pick one or the other. Many investors blend both. The new trend? “Dividend Growth 2.0”-companies that pay dividends AND grow earnings fast. Microsoft pays a 2.1% yield but grows earnings 15% a year. That’s rare and powerful.

For beginners, ETFs simplify this. The iShares Select Dividend ETF (DVY) holds high-yield dividend stocks. It’s been around for years, but investors complain it underperforms the S&P 500 in bull markets. The Vanguard Growth ETF (VUG) holds top growth names like Apple and Microsoft. It’s a solid core holding for younger investors.

Monitoring is different for each:

- Dividend investors: check quarterly earnings calls, watch for dividend announcements, track payout ratios. Rebalance once a year.

- Growth investors: review revenue trends, gross margins, and competitive threats every six months. Don’t panic over short-term price swings.

Taxes matter too. Qualified dividends are taxed at 0%, 15%, or 20% based on income. Capital gains from growth stocks are taxed at the same rates-but only when you sell. That gives you control over when you pay taxes. You can hold growth stocks for decades and defer taxes indefinitely. That’s a huge advantage.

The Bigger Picture

More tech companies are paying dividends now. Meta and Alphabet started in 2024. That’s a signal: even the fastest-growing firms eventually mature. Morningstar predicts 90% of the top 50 tech firms will pay dividends by 2030.

AI is changing how we analyze dividends. BlackRock’s Aladdin platform now uses machine learning to predict dividend sustainability with 27% more accuracy than old models. That’s not magic-it’s data. Companies that can keep raising dividends while growing are the new elite.

Dividend-paying stocks now make up $32.7 trillion of the global equity market. North America leads with 53% of all dividend payments. But the trend is clear: the line between growth and dividend stocks is blurring. The best companies aren’t choosing one path-they’re doing both.

Final Thoughts

Dividend stocks are income anchors. Growth stocks are rocket ships. One gives you cash today. The other gives you wealth tomorrow.

If you’re young, aggressive, and can stomach volatility, lean into growth. Reinvest everything. Let compounding do the heavy lifting.

If you’re older, need income, or hate sleepless nights during market crashes, dividend stocks offer stability. Look for consistent growers-not just high yielders.

And if you’re unsure? Start with a mix. 60% growth, 40% dividend. Adjust as your life changes. The goal isn’t to pick the ‘best’ stock. It’s to build a portfolio that fits your life.

Are dividend stocks safer than growth stocks?

Dividend stocks tend to be less volatile and often have stronger balance sheets, making them safer during market downturns. But safety isn’t guaranteed. A company with a high payout ratio or falling profits can cut its dividend, causing the stock to drop. Growth stocks are riskier because their valuations depend on future expectations-but they can also deliver higher returns over time.

Can I invest in both dividend and growth stocks?

Absolutely. Many investors use a balanced approach. For example, you might hold growth stocks in your retirement account to maximize long-term gains and dividend stocks in a taxable account for steady income. ETFs like VIG (Vanguard Dividend Growth) or VUG (Vanguard Growth) make it easy to get exposure to both.

Do I need to pay taxes on dividends even if I reinvest them?

Yes. Even if you use dividends to buy more shares through a DRIP (Dividend Reinvestment Plan), the IRS still treats them as taxable income in the year they’re paid. You’ll receive a 1099-DIV form from your broker. Growth stocks, on the other hand, only trigger taxes when you sell, giving you more control over timing.

What’s a good dividend yield to aim for?

A yield between 2% and 5% is typical for healthy, established companies. Anything above 5% should raise questions. Check the payout ratio-if it’s over 80%, the dividend may not be sustainable. Focus on companies with a history of raising dividends annually, not just high current yields.

Why are more tech companies starting to pay dividends now?

Many tech giants like Microsoft, Apple, and now Meta and Alphabet have reached a point where they generate more cash than they can profitably reinvest. Instead of hoarding cash or buying back shares (which now carry a 1% excise tax), they’re returning it to shareholders via dividends. It signals maturity and confidence in their financial health.

How often should I review my dividend or growth portfolio?

Dividend investors should monitor quarterly earnings and dividend announcements, but annual rebalancing is usually enough. Growth investors should review fundamentals-revenue, margins, competitive position-every six months. Avoid checking prices daily. Both strategies benefit from patience and discipline.

Whether you choose dividends, growth, or a mix, the key is alignment. Your portfolio should reflect your goals-not the latest market hype. Stay focused. Stay patient. Let time do the work.

Julia Czinna

November 8, 2025 AT 04:12I’ve been holding dividend stocks since 2020, mostly VIG and a few individual names like JNJ and PG. What I didn’t expect was how much psychological comfort they gave me during the 2022 crash. I didn’t sell a single share. Just kept collecting checks while everyone else was panicking. It’s not glamorous, but it’s peace of mind you can’t buy with a P/E ratio.

Laura W

November 8, 2025 AT 11:20Yo, growth stocks are the real MVPs right now. AI, quantum computing, space tech-these aren’t just buzzwords, they’re cashflow multipliers. Dividends are nice, but if you’re not riding the rocket, you’re just watching from the ground. VUG crushed DVY for a decade straight. If you’re not leveraged to innovation, you’re basically investing in nostalgia.

Graeme C

November 9, 2025 AT 19:09Let’s be brutally honest-dividend investing is the financial equivalent of a slow, steady heartbeat. Growth investing is a cocaine-fueled drum solo at a metal concert. One keeps you alive. The other makes you feel immortal. And guess what? The market rewards immortality… until it doesn’t. The 2022 correction exposed how many ‘safe’ dividend stocks were just one earnings miss away from a 40% plunge. Don’t confuse stability with safety.

Astha Mishra

November 11, 2025 AT 01:51It is interesting to contemplate the philosophical underpinnings of investment strategy-whether we seek the comfort of the known, the dividend, or the uncertain promise of tomorrow, the growth stock. In many ways, this mirrors the human condition: do we choose security in the present, or risk everything for a future we cannot yet see? I have observed that those who choose growth often do so not merely for wealth, but for meaning-believing in the potential of innovation, of progress, of human ingenuity. Yet, the dividend investor, too, seeks meaning-not in speculation, but in consistency, in dignity, in the quiet dignity of a reliable stream. Both paths are valid. Both require courage. The real question is not which is better, but which aligns with the soul of the investor.

Kenny McMiller

November 11, 2025 AT 13:03Just bought my first VIG ETF last month. Honestly? I’m not here to win the lottery-I’m here to not lose my shirt. If Microsoft pays me $200 a quarter just for owning it, and the price ticks up 5% a year? That’s a win. No need to chase 100x returns. I’ll take 8% with sleep.