How would you feel if your $50,000 investment dropped to $40,000 overnight? Would you panic and sell? Stay calm and wait it out? Or even buy more because prices are low? Your answer tells you more about your investing future than you might think.

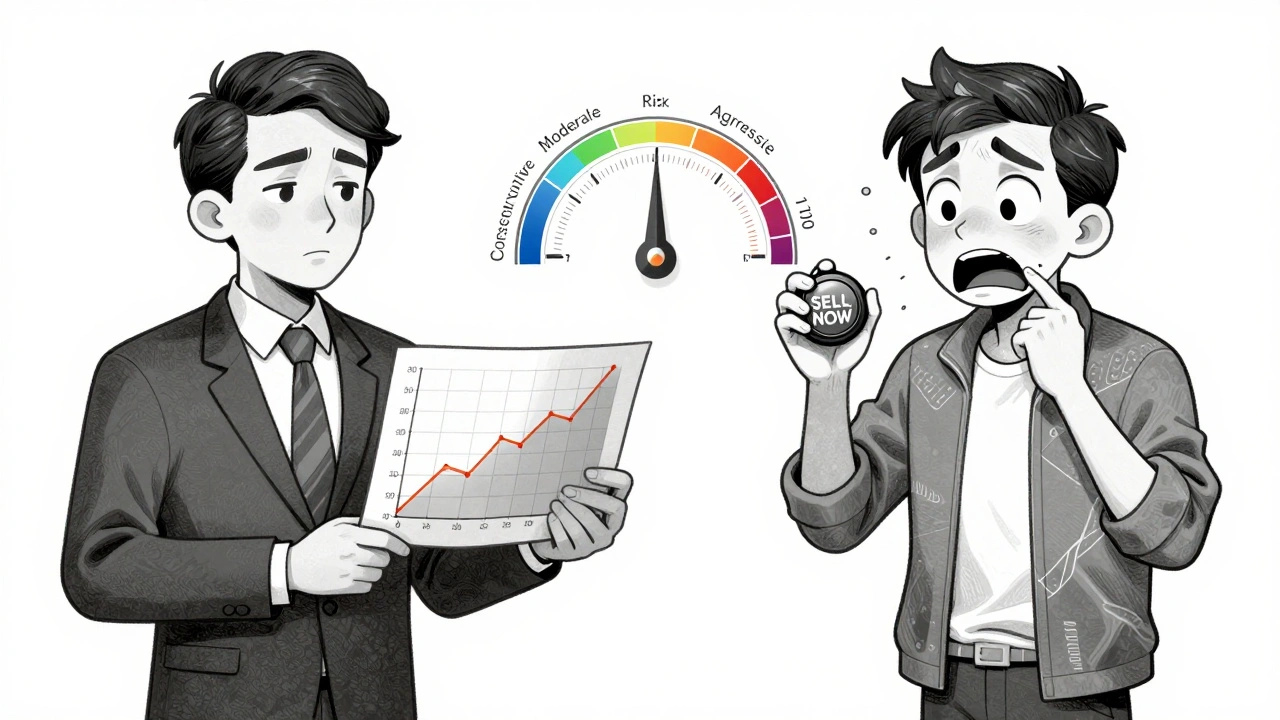

Most people think they know how much risk they can handle-until the market actually drops. Then, the gap between what they said they’d do and what they actually do becomes painfully clear. That’s why a real risk assessment quiz isn’t just a form you fill out-it’s a mirror that shows you who you really are when money is on the line.

Why Your Risk Tolerance Matters More Than You Think

Your risk tolerance isn’t about being bold or cautious. It’s about matching your emotional wiring to your portfolio. If you’re forced into an investment strategy that scares you, you’ll likely make decisions based on fear, not logic. And that’s how good plans turn into costly mistakes.

Studies show that 68% of investors act more conservatively during real market crashes than they claimed they would in a quiz. That’s not weakness-it’s human nature. The problem isn’t your reaction. It’s that no one ever asked you to face the truth before.

Financial advisors use risk assessments to avoid mismatches. Imagine putting someone who freezes at the sight of volatility into 90% stocks. When the market drops 20%, they sell everything. That’s not a market loss-it’s a behavioral loss. And it’s preventable.

The Science Behind the Quiz: Grable-Lytton Risk Tolerance Instrument

The most trusted risk assessment tool in finance wasn’t made by a bank. It was developed by two academics: Dr. John Grable at the University of Georgia and Dr. Ruth Lytton at Virginia Tech. Back in 1999, they created a 13-question quiz based on behavioral finance principles. Since then, it’s been used to assess over 200,000 investors.

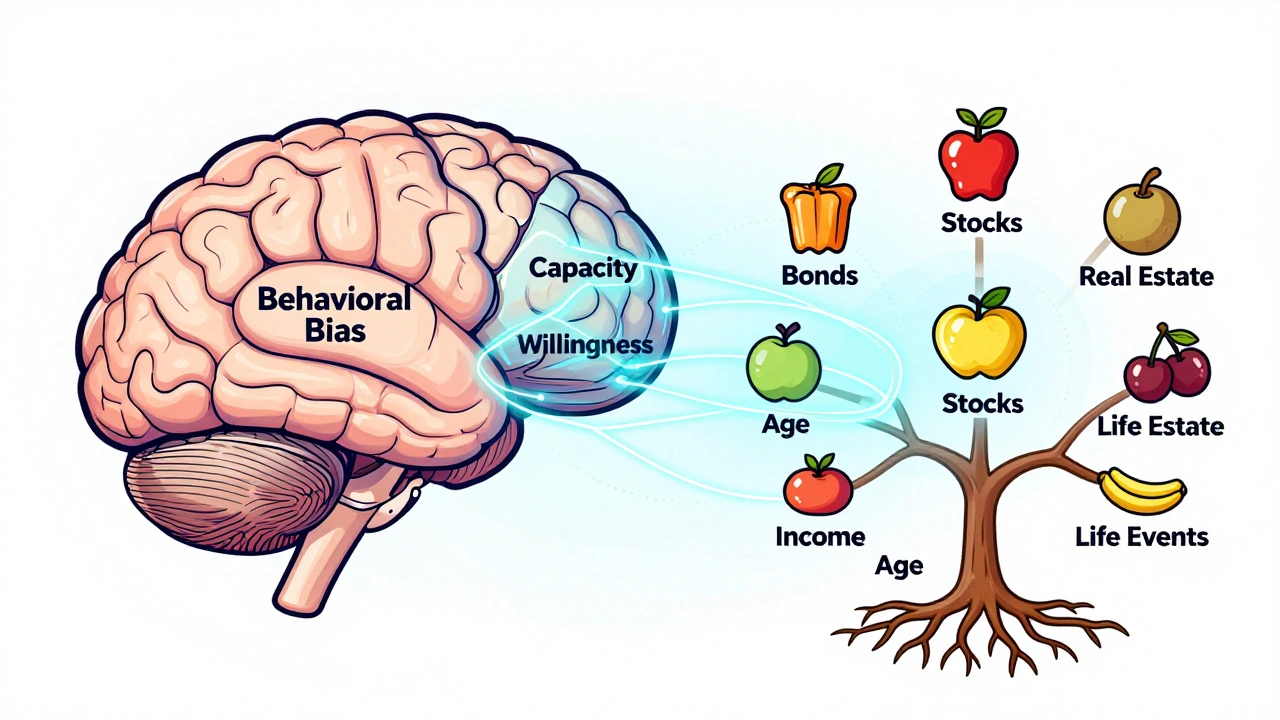

This isn’t a personality test. It’s a psychometric instrument. Each question is designed to measure two things: your capacity to handle risk (based on age, income, goals) and your willingness to take it (how you feel about losses). The quiz gives you a score from 0 to 100.

Here’s how the scores break down:

- 0-35: Conservative. You prefer safety over growth. Losing even 5% makes you uncomfortable.

- 36-65: Moderate. You’re okay with some ups and downs, as long as you see growth over time.

- 66-100: Aggressive. You expect volatility. You’re willing to lose 30% or more if it means higher long-term returns.

Major firms like Transamerica, Ameriprise, and Merrill Edge use variations of this quiz. They don’t just ask, “How risky are you?” They show you real scenarios: “Your account drops 20% in six months. What do you do?” That’s the difference between guessing and knowing.

What the Quiz Actually Asks (And Why It Works)

A good quiz doesn’t ask, “Do you like risk?” That’s too vague. Instead, it uses concrete choices that trigger real emotional responses.

For example:

- “You have $10,000 to invest. Option A: Guaranteed $500 gain. Option B: 50% chance to gain $1,500, 50% chance to gain nothing. Which do you pick?”

- “Your portfolio loses $15,000 in a year. You still have 10 years until retirement. Do you change your strategy?”

- “You’re offered a 10% return with a 15% chance of losing half your money. Do you take it?”

These aren’t hypotheticals. They’re behavioral traps. People who say they’re aggressive often pick the safe option. That’s loss aversion-your brain hates losing more than it loves winning. The quiz exposes that.

One investor on Reddit scored “moderate” on his Ameriprise quiz. When the market fell 20% last year, he moved everything to bonds. He didn’t change his goals. He just panicked. His quiz didn’t lie-he did.

Why Most People Get It Wrong (And How to Avoid It)

Here’s the hard truth: 42% of people overstate their risk tolerance when they’re not facing real losses. Why? Because it feels good to say you’re bold. It’s social desirability bias-you want to look like a savvy investor.

That’s why the best quizzes include loss scenarios. If a question says, “You could lose $20,000,” your body reacts differently than if it says, “You might earn more.”

Another trap? Thinking your risk tolerance is fixed. It’s not. Your tolerance changes with age, income, life events, and even the size of your portfolio. A $10,000 loss hurts more when you have $50,000 than when you have $500,000. That’s why the CFA Institute says risk tolerance must be reassessed every 1-2 years.

And don’t fall for the “one-size-fits-all” labels. “Conservative,” “moderate,” “aggressive” are broad buckets. Two people can both be “moderate” but have completely different portfolios-one might hold 50% bonds, another 30%. The quiz should lead to a conversation, not a label.

How to Use Your Results (And What to Do Next)

Taking the quiz is step one. What you do after is what matters.

If you scored conservative:

- Your portfolio should be heavy on bonds, cash, and low-volatility assets.

- Don’t chase high returns. You’ll end up selling at the wrong time.

- Focus on preserving capital and steady growth.

If you scored moderate:

- A mix of stocks and bonds works best-maybe 50/50 or 60/40.

- Expect some swings. You’ll see down years, but you should recover over time.

- Rebalance annually. Don’t let one asset class dominate.

If you scored aggressive:

- 80%+ in equities is normal. You can handle 30-40% drops.

- Don’t get lazy. Even aggressive investors need diversification-global stocks, small caps, real estate.

- Set automatic buy-ins during dips. That’s how you turn fear into strategy.

And here’s the secret: your quiz score should match your investment plan-not the other way around. If your advisor recommends a portfolio that doesn’t fit your score, walk away.

The Bigger Picture: Risk Tolerance Isn’t Just About Money

Financial risk tolerance reflects how you handle uncertainty in life. Do you plan for every possibility? Or do you roll the dice? Your investing behavior is a mirror.

That’s why the most valuable part of the quiz isn’t the score-it’s the conversation it starts. With yourself. With your partner. With your advisor.

FINRA found that 72% of investors felt more confident after taking a risk quiz. Why? Because they stopped guessing. They had data. They had a plan.

And that’s the goal. Not to be the most aggressive investor. Not to chase the highest returns. But to sleep well at night knowing your portfolio matches your soul.

What to Do If You’re Still Unsure

Don’t rely on free online quizzes from banks or apps. Many are oversimplified. They ask three questions. They don’t measure loss aversion. They don’t use validated scales.

Look for tools that:

- Have 10+ questions

- Include real loss scenarios

- Give you a numerical score (0-100)

- Are based on the Grable-Lytton method

Transamerica, Ameriprise, and PreciseFP offer versions you can access. Many financial advisors give them out for free. Ask for one.

And if you’re doing this alone, don’t stop at the score. Write down:

- What’s your time horizon?

- What’s your emergency fund?

- What’s the worst market drop you’ve lived through?

- How did you feel during that time?

That’s your real risk profile-not the quiz.

Final Thought: Your Risk Tolerance Is a Starting Point, Not a Finish Line

There’s no perfect score. No right answer. Just the one that fits you.

Markets will keep swinging. You’ll have good years and bad ones. The goal isn’t to avoid losses. It’s to stay in the game. And that only happens when your portfolio doesn’t scare you.

Take the quiz. Be honest. Talk to someone. Then build your plan around what you learned-not what you wish you were.

What is a risk tolerance quiz?

A risk tolerance quiz is a standardized tool used in financial planning to measure how comfortable you are with investment losses and market volatility. It typically includes 10-15 questions that assess both your ability to handle risk (based on your finances) and your emotional comfort with it. The results help match your portfolio to your true behavior, not just your hopes.

How accurate are risk tolerance quizzes?

Validated quizzes like the Grable-Lytton instrument are scientifically proven to predict behavior better than self-assessment alone. But no quiz can perfectly predict how you’ll react during a real market crash. Studies show people often act more conservatively than they say they will. The quiz’s value is in starting an honest conversation-not giving you a final answer.

Can my risk tolerance change over time?

Yes, and it should. Your risk tolerance changes with age, income, family situation, and even your portfolio size. A $10,000 loss means something very different when you have $50,000 saved versus $500,000. Most experts recommend reassessing your risk tolerance every 1-2 years or after major life events like marriage, job loss, or retirement.

What’s the difference between risk capacity and risk willingness?

Risk capacity is your financial ability to handle losses-based on your income, savings, time horizon, and goals. Risk willingness is your emotional comfort with volatility. A young person with a high income may have high capacity but low willingness. Someone near retirement may have low capacity but high willingness. A good quiz measures both.

Do I need a financial advisor to take a risk quiz?

No, you can take many risk quizzes on your own. But the real value comes from discussing your results with a professional. Many people misinterpret their scores or don’t know how to translate them into a portfolio. Advisors use the quiz as a starting point for planning-not the whole plan. Fidelity’s survey found that 83% of clients felt more confident after talking through their quiz results with an advisor.

Graeme C

December 4, 2025 AT 22:22Finally, someone broke down risk tolerance without using corporate fluff. I scored 82 on the Grable-Lytton, and yeah-I bought more during the 2022 crash. People say ‘stay the course’ like it’s a mantra, but the real test is whether your hands shake when the ticker turns red. I don’t care what my advisor says-I know my nervous system. If you’re not puking a little when markets dip, you’re either lying or underinvested.

Astha Mishra

December 6, 2025 AT 11:43It's fascinating, really, how we project our emotional resilience onto financial instruments as if money were a mirror of the soul. I've seen friends who, despite having ample capacity, retreat into cash during downturns-not out of fear, but out of a deep-seated belief that stability is moral. Is it not true that our relationship with risk reflects our relationship with uncertainty in life? We fear loss not because of the dollar amount, but because it threatens our narrative of control. The quiz doesn't tell us how to invest-it tells us how to be human.

Laura W

December 7, 2025 AT 23:10OMG YES. I took the Ameriprise quiz last year and scored ‘moderate’-then watched my portfolio drop 18% and immediately moved half to T-bills. I thought I was being smart. Turns out I was just being a panic-buying idiot. Now I’ve got automatic rebalancing set up and I’m actually sleeping again. If you’re not doing this, you’re just gambling with your future. Get the real quiz. Not the 3-question BS from Robinhood.

Kenny McMiller

December 9, 2025 AT 03:35Loss aversion is a cognitive bias rooted in prospect theory-Kahneman and Tversky nailed it in ‘99. The asymmetry between pain of loss vs. pleasure of gain is roughly 2:1. That’s why ‘moderate’ investors sell at the bottom. They’re not irrational-they’re neurologically wired to overvalue preservation. The real flaw in most quizzes? They don’t account for portfolio size scaling. Losing $20K hurts more when you have $100K than $1M. That’s not behavioral-it’s arithmetic. Advisors ignore this and slap on labels like ‘aggressive’ like it’s a personality type.

Dave McPherson

December 10, 2025 AT 07:55Ugh. Another ‘risk quiz’ post. Let me guess-you’re the guy who thinks a 13-question survey from 1999 is the holy grail of investing? Newsflash: markets don’t care about your ‘score.’ If you need a quiz to tell you not to sell during a crash, you shouldn’t be investing at all. Just put it all in index funds and shut up. Or better yet-get a job. Real money isn’t made by psychometric tools. It’s made by people who don’t need validation from a bank’s online form.