MACD Indicator Calculator

How This Tool Works

Enter historical closing prices to calculate the MACD indicator. The tool will show you the MACD line, signal line, histogram, and identify potential trading signals based on crossovers and divergences.

The MACD indicator isn’t magic. It doesn’t predict the future. But if you understand how it works, it can tell you when momentum is shifting - and that’s worth more than most guesswork in trading.

Back in the late 1970s, Gerald Appel built this tool to help traders see what the market was really doing beneath the noise. Today, it’s on every major platform: TradingView, MetaTrader, Thinkorswim. And it’s still one of the most used indicators, with nearly 80% of professional traders relying on it, according to a 2022 survey. Why? Because it does two things at once: tracks trends and measures momentum. Most indicators do one or the other. MACD does both.

What Makes Up the MACD Indicator?

At its core, the MACD is simple. It’s made of three parts:

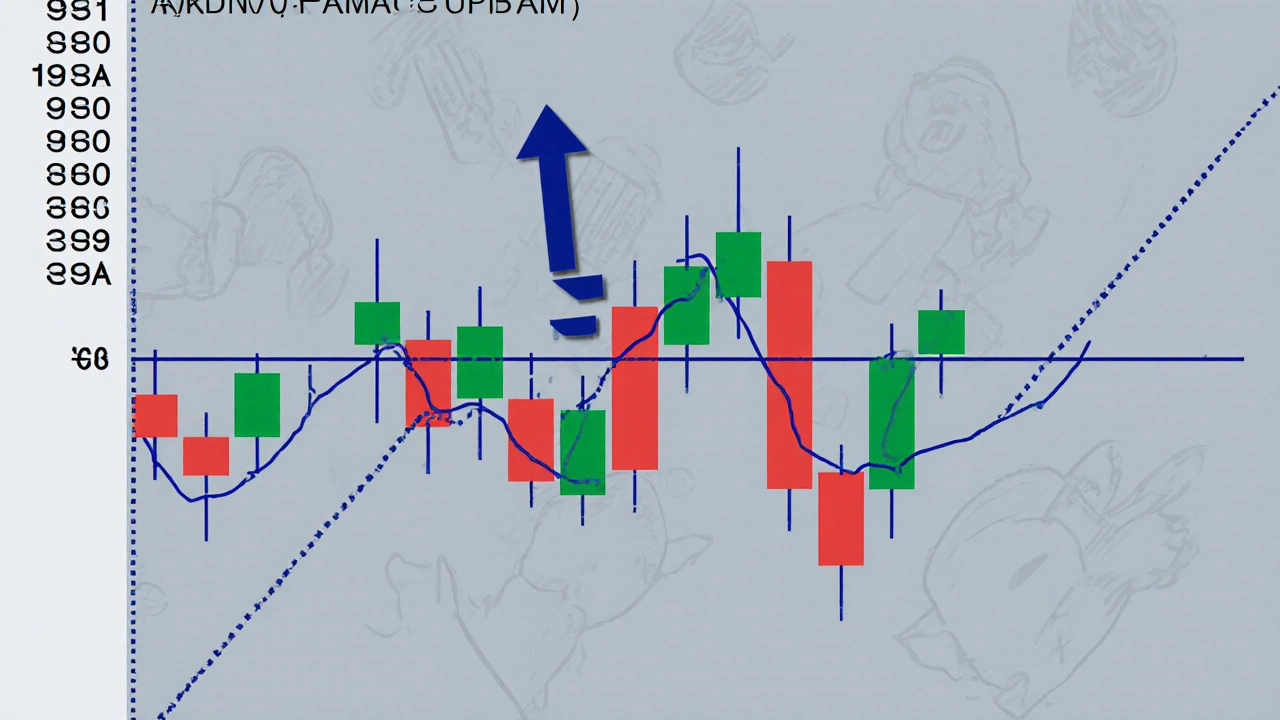

- MACD Line: The difference between the 12-day and 26-day exponential moving averages (EMAs). This shows short-term momentum compared to longer-term trends.

- Signal Line: A 9-day EMA of the MACD line. Think of it as the smoothed version of the MACD line - it’s what the MACD line chases.

- Histogram: The visual bar chart that shows the gap between the MACD line and the signal line. When the bars grow taller, momentum is strengthening. When they shrink, it’s fading.

These numbers - 12, 26, 9 - are the default settings. They’re not sacred. Some traders tweak them, especially for faster timeframes like 5-minute charts. But if you’re just starting out, stick with the defaults. They’ve been tested across decades of market cycles.

Three Ways MACD Gives You Trading Signals

There are three main ways the MACD tells you what’s happening in the market. Each one gives you a different kind of insight.

1. Signal Line Crossovers

This is the most common signal. When the MACD line crosses above the signal line, it’s a buy signal. When it crosses below, it’s a sell signal. Simple, right?

But here’s the catch: in sideways markets, you’ll get false signals every few hours. I’ve seen traders lose money chasing these crossovers on EUR/USD during low-volatility periods. The market wasn’t trending - it was just bouncing. The MACD kept crossing back and forth, and so did their trades.

That’s why you need context. A crossover near a strong support level? That’s more reliable. A crossover in the middle of a range? Probably noise.

2. Centerline Crossovers

When the MACD line crosses above zero, it means the 12-day EMA is now above the 26-day EMA. That’s a sign the short-term trend has turned bullish. When it drops below zero, the opposite is true - bearish momentum is taking over.

This isn’t about entry points. It’s about trend direction. If you’re a swing trader holding positions for days or weeks, this tells you whether you should be looking for long setups or avoiding them altogether. A trader I know only takes long trades when the MACD is above zero. It cuts his losing trades in half.

3. Divergences

This is where MACD becomes powerful - and where most traders miss the real opportunity.

A bullish divergence happens when price makes a lower low, but the MACD makes a higher low. That means even though price is falling, momentum is weakening. It’s a warning: the downtrend might be running out of steam.

A bearish divergence is the reverse: price makes a higher high, but MACD makes a lower high. Momentum is fading even as price climbs. That’s often a sign of exhaustion.

Linda Raschke, a veteran trader, says watching the histogram for these divergences is more important than the crossovers. She waits for the bars to stop shrinking and start expanding in the direction of the emerging trend. That’s the moment momentum is actually shifting - not when the lines cross.

Why MACD Fails (And How to Fix It)

MACD is not a standalone tool. If you trade it alone, you’ll get burned.

Here’s the truth: MACD is a lagging indicator. It reacts to price changes, not predicts them. In choppy markets - think summer months or post-news volatility - it gives false signals constantly. A Reddit user named QuantTrader87 said he had a 68% win rate using MACD… but only when he filtered trades with the 200-day moving average. Without it, his win rate dropped to 42%.

And here’s another problem: MACD doesn’t tell you if something is overbought or oversold. Unlike RSI, which bounces between 0 and 100, MACD has no upper or lower bounds. It can stay positive for weeks in a strong uptrend. That doesn’t mean it’s time to sell. It just means the trend is strong.

So how do you fix this?

- Combine with price action: Look for candlestick patterns at support/resistance levels. If MACD gives a buy signal and price bounces off a key support zone with a bullish engulfing candle? That’s a high-probability trade.

- Add volume: High volume on a MACD crossover confirms market participation. Low volume? Probably a fakeout.

- Use RSI for confirmation: If MACD gives a buy signal and RSI is below 30, you’re getting a double confirmation of momentum shift and oversold conditions.

A real example: In March 2023, GBP/USD hit a strong support level near 1.2400. The MACD was forming a bullish divergence. RSI was at 28. Volume spiked on the bounce. Traders who entered there made 127 pips before the next resistance level. But those who just followed the MACD crossover without checking price or volume? They got stopped out when the next candle engulfed the entry.

How Traders Actually Use MACD in 2025

Professional traders don’t stare at MACD like a crystal ball. They use it as part of a system.

Day traders on 15-minute charts use MACD crossovers only when the 50-period EMA is sloping upward. That filters out counter-trend noise.

Swing traders wait for centerline crossovers and then look for divergences on daily charts. They’ll hold positions for days, letting the momentum play out.

Algorithmic traders still use MACD - but they’ve tweaked the parameters. A 2023 study found 62.8% of retail algo strategies include MACD, but rarely with the default 12,26,9. Most use 8,17,6 or 5,35,5 to reduce lag and false signals.

Even the best traders admit: if your price action skills are strong, you might not need MACD at all. Dr. Alexander Elder, a respected trading psychologist, says MACD can become a crutch. If you can read candlestick patterns, volume, and structure, you can spot momentum shifts without an indicator.

But for most people? MACD is a helpful tool. It’s not the answer - it’s the question.

How to Set Up MACD on Your Platform

Every major trading platform has MACD built-in. No extra cost. No plugin needed.

On TradingView: Click “Indicators,” search “MACD,” and click add. Default settings are pre-loaded. You can change the EMAs if you want to test alternatives.

On MetaTrader 4/5: Go to Insert > Indicators > Oscillators > MACD. Same defaults. Right-click the indicator to adjust colors or line thickness.

On Thinkorswim: Click “Studies,” search “MACD,” and apply. You can add alerts for crossovers or divergences.

Pro tip: Set the histogram to green for positive values and red for negative. It makes momentum shifts easier to spot at a glance.

What to Do If MACD Keeps Giving False Signals

If you’re losing money because MACD keeps flashing buy/sell signals that go nowhere, here’s your fix:

- Stop trading on timeframes below 15 minutes. MACD is too noisy on 1-minute or 5-minute charts unless you’re scalping with strict rules.

- Only trade in the direction of the 200-day moving average. If price is below the 200-day EMA, ignore buy signals. Only look for sell signals.

- Wait for confirmation. Don’t enter on the first crossover. Wait for the next candle to close beyond the high/low of the signal candle.

- Use volume. If volume is declining on a crossover, it’s weak. If volume spikes, it’s real.

- Backtest. Take 10 past trades where MACD gave a signal. Did they work? If less than 50% worked, your strategy needs work - not a new indicator.

MACD doesn’t fail. Traders fail by using it alone.

Final Thought: MACD Is a Filter, Not a Crystal Ball

The best traders don’t chase signals. They wait for confluence. MACD is one piece of the puzzle - not the whole picture.

It’s great for spotting momentum shifts. It’s okay for confirming trends. But it’s useless without context.

Combine it with price structure, volume, and major support/resistance levels. Filter trades with the 200-day moving average. Wait for confirmation. And never risk more than 1% of your account on a single trade.

That’s how you turn a simple indicator into a reliable edge - not by finding the perfect setting, but by building the right habits.

Graeme C

November 17, 2025 AT 01:24MACD ain't magic, but it's the closest thing we got without going full quant. I used to chase every crossover until I started filtering with the 200-day EMA - game changer. Now I only take longs when price is above it and the histogram starts expanding after a shrink. No more whipsaws in sideways markets. Also, pairing it with volume spikes? That’s how you tell if it’s institutional money moving or just retail noise.

Astha Mishra

November 18, 2025 AT 22:31It is fascinating, isn't it, how such a simple mathematical construct - the difference between two exponential moving averages - can reflect the collective psychology of thousands of traders across continents? The MACD, in its elegance, mirrors the human tendency to seek patterns even in chaos. I have often wondered if its persistence isn't due to its accuracy, but rather its comforting narrative: that markets, however turbulent, are governed by rhythm. And perhaps that rhythm, though imperfect, is enough to give us a foothold in the uncertainty. I find myself returning to it not because it predicts, but because it reminds me to wait - to observe, not react.

Kenny McMiller

November 19, 2025 AT 12:32Look, MACD is just a lagging indicator wrapped in a pretty histogram. Real traders use price action + volume profile. But hey, if you need a crutch to feel like you're not gambling, go ahead. Just don't blame the indicator when your account gets vaporized. Pro tip: if you're using default 12,26,9 on a 5m chart, you're not trading - you're playing slot machines with charts. I tweak mine to 8,17,6 on 15m for less lag. Also, divergences > crossovers. Always. The histogram tells the truth before the lines do.

Dave McPherson

November 20, 2025 AT 18:59Oh sweet mother of technical analysis, here we go again with the MACD fanboyery. Let me guess - you also think RSI is a crystal ball and Bollinger Bands are divine scripture? Newsflash: every retail trader on Reddit thinks they’ve cracked the code because they saw a divergence on BTC in 2021. MACD is a 1970s analog tool repackaged for digital degenerates. The only thing more outdated than this indicator is the idea that ‘professional traders’ still use it without a dozen other filters. I’ve seen algos that use 17 different indicators in a Bayesian ensemble - MACD is the *last* one they check, if at all. If you’re not coding your own custom momentum oscillator, you’re just a spectator in a casino with charts.