Agent Banking Model Calculator

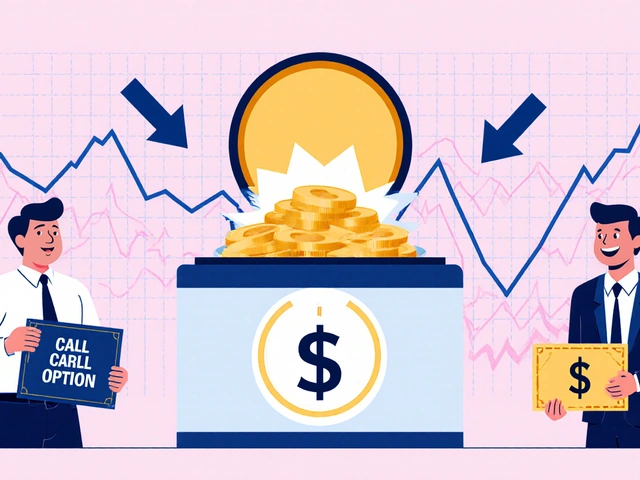

Direct Model

Cost: $1,200-$1,500 per agent annually

Satisfaction: 4.3/5

Used by major banks like Equity Bank in Kenya with 12,500+ agents

Full bank control over agents and services

Higher operational costs but consistent customer experience

Aggregated Model

Cost: $700-$900 per agent annually

Satisfaction: 3.8/5

Used by Post Office in South Africa serving 7 banks

Lower costs but varying service quality

Faster national coverage (e.g. 85% population reach in Senegal)

Agent Network Configuration

Results

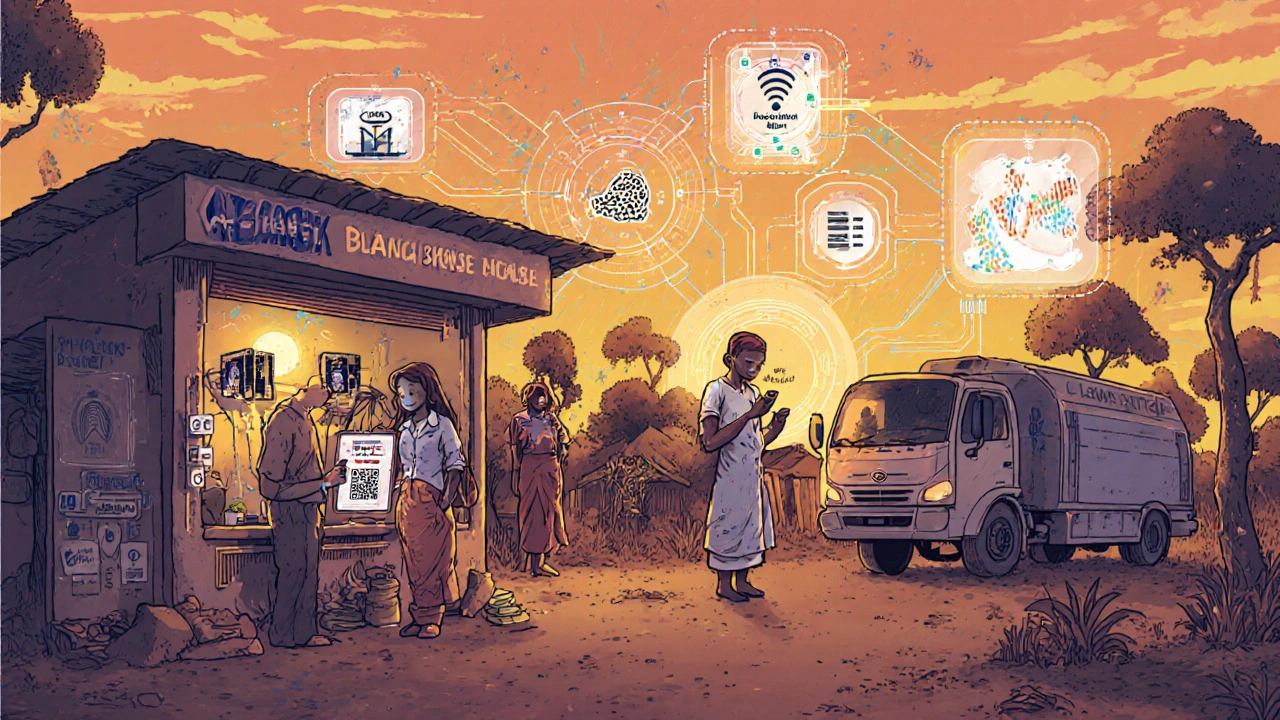

What Is Agent Banking, and Why Does It Matter?

Imagine walking into your local grocery store and being able to deposit cash, withdraw money, or pay a bill-without ever stepping into a bank. That’s agent banking in action. It’s not science fiction. It’s happening right now in villages, towns, and cities where traditional banks don’t go. Agent banking lets regular businesses-like shops, pharmacies, or post offices-act as mini-banks, using simple tech to connect customers to real financial services. This isn’t just convenient. For over 1.4 billion people worldwide who don’t have bank accounts, it’s life-changing.

Before agent banking, getting basic financial services meant traveling hours, paying high fees, or just giving up. In rural Kenya, Senegal, or Nigeria, people used to carry cash everywhere because there was no safe or easy way to save or send money. Now, with a smartphone or even just a basic USSD code, they can do it all through the corner shop. Banks benefit too. Running a physical branch costs about 70-80% more per transaction than using an agent. That’s why financial institutions are shifting fast.

The Two Main Models: Direct vs. Aggregated

Not all agent banking works the same way. There are two clear models, each with strengths and trade-offs.

The Direct Model is when a single bank hires and manages its own agents. Think of Equity Bank in Kenya. They’ve built a network of over 12,500 agents, all trained, branded, and monitored by the bank itself. This gives them full control. Customers know exactly what to expect. Service is consistent. But it’s expensive. Each agent costs the bank $1,200-$1,500 a year in training, tech, and oversight.

The Aggregated Model flips the script. Instead of one bank running its own agents, a third party-like a post office or telecom company-hosts agents who serve multiple banks at once. In South Africa, the Post Office handles transactions for seven different banks through just 1,300 locations. Banks save money-costs drop to $700-$900 per agent annually. But there’s a catch: service quality can vary. One agent might be great with Absa, but slow or confused with FNB. Customer satisfaction scores are lower, around 3.8/5 compared to 4.3/5 for direct models.

Which one wins? It depends. Big banks with deep pockets and brand loyalty go direct. Smaller institutions, fintechs, or those targeting rapid expansion lean on aggregators. Senegal’s rollout of agent banking reached 85% of the population in three years using the aggregated model-five years faster than direct approaches.

How the Tech Actually Works

You don’t need a fancy app or high-speed internet for agent banking to work. Most transactions happen through USSD codes-those simple text-based menus you dial on any phone. In Senegal, 65% of agent transactions use USSD. Only 35% use apps. That’s because most users have basic phones. The agent uses a smartphone or a small POS device, connects to the bank’s system, and processes the request in under a minute.

Security is built in. For small transactions, a PIN or signature is enough. For anything over $130 in Nigeria, you need biometric verification-fingerprint or face scan. The system logs everything. If an agent tries to withdraw more than their daily limit, the system blocks it. Transaction success rates are high: 99.2% in well-connected areas. But in remote villages with spotty signals, that drops to 92%. Processing time jumps from 45 seconds to two minutes.

What’s new? AI is starting to help. In Kenya, pilot systems now predict when an agent will run out of cash. They use historical data-harvest season spikes, payday patterns, holidays-to send cash deliveries before the agent runs dry. That’s cut cash-out incidents by 45%. Biometrics are now used in 75% of transactions in Senegal, slashing fraud by 62%.

Who Are the Agents? Real People, Real Impact

Agents aren’t bank employees. They’re shop owners, tailors, phone repair guys, or post office clerks who added banking to their business. In Kenya, 78% of agents say their main business got busier after becoming an agent. Foot traffic increased by 22% on average. A grocery store owner in rural Uganda now sells more rice and sugar because people come in to withdraw cash.

But here’s the problem: not all agents make money. MobiFin’s survey of 500 agents in Kenya found that 65% said transaction volume wasn’t enough to cover costs. The top 20% of agents handle 65% of all transactions. That’s a long tail of struggling agents. Why? Commission rates. If you earn less than 0.5% of each transaction, it’s not worth it. Top performers earn 1.5%, plus bonuses. That’s $150-$300 extra per month. Enough to keep them in the game.

Agent turnover is high-up to 35% a year in some markets. The fix? Better pay. Better training. And trust. People need to believe the agent won’t steal their money. That’s why community leaders are being brought in to vouch for agents. In Senegal, village chiefs helped launch agent networks. Trust jumped.

Real Problems Real People Face

Agent banking isn’t perfect. Users report the same complaints over and over.

- Cash runs out. In Nigeria, 63% of negative reviews mention agents running out of cash, especially during harvest season when farmers need to withdraw large sums. One agent in Kano told a reporter, “I had 20 people waiting. I had $500. I had to send them away.”

- Network failures. In rural areas, poor signal means transactions fail. 47% of complaints in Nigeria cite this. No internet? No transaction.

- Confusion and mistrust. Some users don’t understand how it works. They think the agent is the bank. When something goes wrong, they blame the shop owner. That’s why education matters. Banks now run radio ads, SMS reminders, and even drama skits in local markets to explain how it works.

And then there’s fraud. 12% of fraud cases in Nigeria come from compromised agent devices. That’s why the Central Bank now requires biometric verification for transactions over $130. It’s not foolproof, but it’s a big step.

How to Build a Successful Agent Network

Getting this right takes more than tech. It takes planning.

First, regulatory approval takes 2 months. Every country has different rules. Nigeria simplified its agent registration in 2022-and saw a 37% jump in registered agents within six months.

Second, training is non-negotiable. The World Bank found that successful programs spend 40% of their budget on training. Failed ones spend 20-25%. Agents need basic math, customer service, and how to use the tech. Those with secondary education complete transactions 30% faster and make 25% fewer mistakes.

Third, liquidity management is critical. If agents run out of cash, the whole system breaks. Top networks use real-time dashboards to monitor cash levels and auto-schedule replenishment. In Kenya, AI now predicts cash needs with 89% accuracy.

Fourth, commission structure must be fair. Flat rates don’t work. Kenya’s Equity Bank uses tiered commissions: 0.7% base, plus bonuses for hitting volume targets. That keeps agents motivated.

Finally, community trust takes time. You can’t force it. You build it with local leaders, consistent service, and transparency. In Senegal, it took 8 months before customers stopped being nervous about leaving cash with a shop owner.

The Future: More Than Just Cash

Agent banking is evolving. The next phase isn’t just deposits and withdrawals. It’s becoming a community financial hub.

In Kenya, 32% of agents now sell micro-insurance, savings plans, or even mobile airtime bundles. That’s increased their income by 40%. Banks are starting to bundle products. A farmer withdraws cash, then gets a text offering a low-interest loan to buy seeds. It’s seamless.

Integration with digital wallets is next. 68% of banks plan to link agent networks with mobile wallets by 2027. Imagine paying for groceries with your phone, then using the same agent to send money to your sister in another town. No cash needed.

The numbers back this up. The agent banking market in Sub-Saharan Africa will grow from $28 billion in 2021 to $75 billion by 2026. By 2027, it could be the main way people access banking in 30+ African countries. Over 50 billion transactions a year are expected.

But sustainability is still in question. 43% of agents operate below profitability. If commission rates don’t rise, many will quit. The solution? More value-added services. More partnerships. More innovation.

Why This Matters for Financial Inclusion

Financial inclusion isn’t just about numbers. It’s about dignity. It’s about being able to save for your child’s school fees without hiding cash under a mattress. It’s about sending money home without paying a 20% fee. It’s about having a record of your income so you can get a loan.

Agent banking has already moved the needle. In Kenya, the unbanked rate dropped from 41% in 2006 to 26% in 2014. In Senegal, savings account ownership jumped from 22% to 38% in just five years. That’s not luck. That’s design.

This model works because it’s simple, cheap, and local. You don’t need a fancy app. You don’t need a bank branch. You need a trusted person in your neighborhood with a phone and a little training. That’s the power of agent banking.

Astha Mishra

October 31, 2025 AT 07:16It's fascinating how agent banking quietly redefines dignity-not through grand policy speeches, but through a shopkeeper in rural Kenya who now handles withdrawals like a bank teller, and a grandmother who finally saves for her grandchild’s school fees without hiding cash under her mattress. There’s a quiet poetry in this: financial inclusion doesn’t require a smartphone, a credit score, or even a formal education-it just needs trust, a phone with USSD, and someone who’s been in the village long enough to be known by name. The real innovation isn’t the tech; it’s the normalization of financial agency in places where it was once unthinkable. And yet, we still treat this as a ‘development project’ rather than a fundamental human right. Maybe that’s the deeper shift we need: not just expanding access, but reimagining who gets to be considered ‘bankable’ in the first place.

Kenny McMiller

November 1, 2025 AT 02:55Let’s be real-agent banking is just fintech’s version of ‘low-hanging fruit’ for emerging markets. The aggregated model? Pure cost arbitrage. Banks offload operational overhead to unregulated micro-entrepreneurs while still extracting value via transaction fees. And don’t get me started on the ‘AI cash prediction’ hype. It’s just regression on historical spikes-no ML, no deep learning, just Excel with a buzzword label. The real bottleneck isn’t tech-it’s governance. Without standardized KYC, interoperability, and regulatory sandboxes, we’re just patching a leaky boat with duct tape. And biometrics? Sure, it cuts fraud… but what happens when the village agent’s device gets stolen and the fingerprint data leaks? No one’s auditing that.

Dave McPherson

November 1, 2025 AT 16:54Ugh. Another feel-good op-ed dressed up as a white paper. ‘Dignity’? Please. This is just capitalism with a village aesthetic. You think a shop owner in Senegal giving out cash advances is doing it out of altruism? Nah. He’s got 15% commission and a 20% churn rate. The ‘trust’ you’re romanticizing? That’s just people too scared to complain because they’ve got no alternatives. And don’t even get me started on the ‘micro-insurance’ upsells-those are predatory as hell. Banks are turning corner shops into debt collection fronts with a smile. The real story? 43% of agents are broke. The system’s designed to extract, not empower. It’s Uber with more paperwork.

RAHUL KUSHWAHA

November 3, 2025 AT 11:35It's amazing how something so simple can change so much. :)

Thank you for sharing this.