Dividend Stock Valuation Calculator

How Interest Rates Impact Your Dividend Stocks

Based on your inputs, this calculator shows how different interest rate environments affect the present value of dividend stocks. Remember: high-yield stocks (front-loaded cash flows) are less sensitive to rate changes than growth stocks (future cash flows).

When interest rates move, dividend stocks don’t just react-they reprice. It’s not as simple as ‘rates go up, stocks go down.’ That old rule doesn’t hold up when you look at the real data. Some dividend stocks surge when rates rise. Others crash. Why? It all comes down to when and how a company pays out cash, and what’s driving the rate change in the first place.

Why Discount Rates Matter More Than You Think

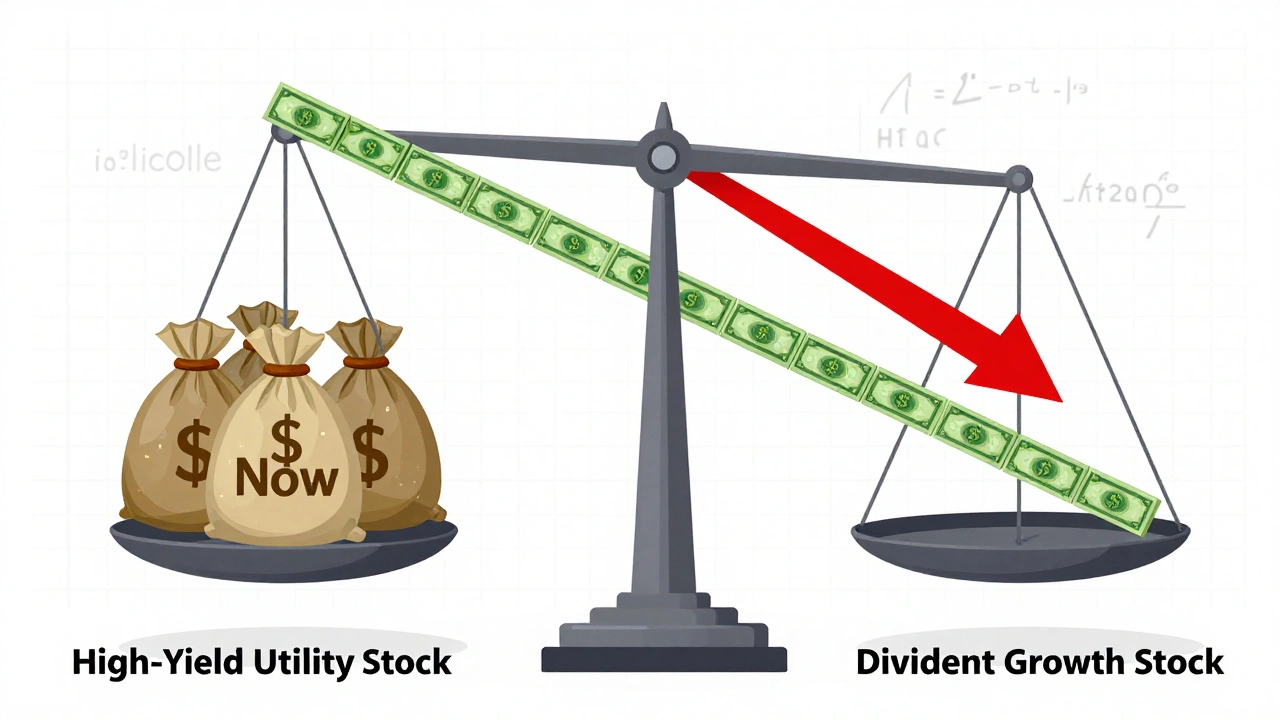

Every dividend stock has a value based on the money it’s expected to pay out over time. That’s called a discounted cash flow model. You take future dividends, shrink them back to today’s dollars using a discount rate, and add them up. That’s the stock’s fair value. The discount rate? It’s mostly tied to interest rates. When the 10-year Treasury yield jumps from 1% to 3%, the discount rate investors use goes up too. That means future cash flows are worth less today. A dividend you’ll get in 2030? Its value today drops sharply. But here’s the twist: not all dividend stocks are the same. A company that pays out most of its cash in the next 5 years? It barely feels the bump. A company that’s betting big on growth 10, 15, even 20 years out? That one gets hammered. Lyn Alden’s analysis showed that when the discount rate falls from 12% to 8%, a growth-oriented dividend stock sees its value jump by 61.8%. A mature, high-yield stock with front-loaded payouts? Only 44.7%. Why? Because the growth stock’s cash flows are farther out. More of them get squeezed by the higher discount rate. That’s duration-how long you’re waiting for your money.Rising Rates Don’t Always Mean Falling Stock Prices

The myth says rising interest rates = bad for stocks. But Wilmington Trust looked at 50 years of data and found something surprising: when the 10-year Treasury yield rose, the S&P 500’s price-to-earnings ratio often went up too. Why? Because rates don’t rise in a vacuum. They usually climb because the economy is growing. Companies make more money. Earnings rise faster than the discount rate. So even though future cash flows are discounted more, they’re also bigger. Net result? Stock prices go up. The only time this breaks? Stagflation. When rates climb because inflation is soaring and growth is slowing, that’s when earnings stall and discount rates spike. That’s the real danger zone. In fact, a 2025 study by Gormsen and Lazarus found that only 35% of rate changes come from ‘pure discounting’-the kind that directly hurts valuations. The rest come from changes in growth expectations or risk. And those? They can actually lift stock prices.Dividend Growth vs. High Yield: Two Different Animals

Not all dividend stocks are created equal. There are two main types:- High-yield dividend stocks: Think utilities, banks, telecoms. They pay out 4%, 5%, even 6% now. But their growth is slow. Their cash flows are front-loaded.

- Dividend growth stocks: Think Coca-Cola, Johnson & Johnson, Mastercard. They pay 2% now, but raise it every year. Their real value is in the future payouts.

The 2015-2018 Rate Hike Cycle: A Real-World Test

The Federal Reserve raised rates from 0.25% to 2.5% between December 2015 and December 2018. Most people expected dividend stocks to get crushed. They didn’t. The S&P 500 Dividend Aristocrats Index-companies with 25+ straight years of dividend increases-returned 46.3%. The broader S&P 500? Only 35.7%. Why? Because these companies had proven they could grow earnings through cycles. They didn’t just pay dividends-they increased them. Investors didn’t flee. They doubled down. Lord Abbett’s ‘yield-on-cost’ analysis shows why this matters. Imagine you bought $10,000 worth of the S&P 500 in 2000. By 2020, your annual dividend income had grown to $420. Same $10,000 in bonds? You got $310. The difference? Earnings growth. The dividend kept rising. The bond coupon didn’t.What Drives the Rate Change? That’s the Real Question

A rate hike from a strong economy? Good for stocks. A rate hike from runaway inflation? Bad. A rate cut from a recession? Bad. A rate cut from booming productivity? Good. Gormsen and Lazarus’s research proves it: the same direction of rate movement can have opposite effects depending on why it happened. Investors who just look at the Fed’s rate decision are missing the story. In early 2021, the 10-year yield jumped from 0.93% to 1.74% in just three months. Panic set in. But here’s what actually happened: 124 S&P 500 companies raised dividends. Only 3 cut them. That’s 30% raising vs. 1% cutting. The market didn’t collapse. It adapted.

What Should You Do as a Dividend Investor?

Forget chasing the highest yield. That’s a trap. Look for companies that:- Have raised dividends for 10+ years straight

- Have low payout ratios (under 60%)

- Operate in industries with pricing power (consumer staples, healthcare, tech)

- Generate strong free cash flow

The Bigger Picture: Duration Is Your Friend or Foe

Think of dividend stocks like bonds, but with growth. High-duration dividend stocks-those with long-term growth potential-are most sensitive to rate changes. Low-duration stocks-those paying out now-are more stable. If you’re worried about rising rates, tilt your portfolio toward lower-duration dividend payers. That doesn’t mean giving up on growth. It means choosing companies that grow fast enough to justify their current price, even if rates climb. The best dividend investors don’t fight interest rates. They understand them. They build portfolios that work in all environments-not just the ones they like.Do rising interest rates always hurt dividend stocks?

No. Rising rates often signal a growing economy, which boosts corporate earnings. Companies that can raise dividends faster than rates climb actually outperform. The problem is when rates rise due to inflation without growth-that’s when dividend stocks struggle.

Are high-yield dividend stocks safer than dividend growth stocks?

Not necessarily. High-yield stocks often come from slow-growing industries with limited pricing power. If earnings don’t grow, the dividend becomes unsustainable. Dividend growth stocks, even with lower yields, tend to be more resilient because their payouts keep rising, protecting investors from inflation and rate hikes.

What’s the best dividend strategy in a rising rate environment?

Focus on companies with a long history of raising dividends, low payout ratios, and strong cash flow. Avoid companies with yields above 5% that haven’t increased payouts in years. The S&P 500 Dividend Aristocrats Index has consistently outperformed during rate hikes.

How do I know if a company can keep raising its dividend?

Check the payout ratio-dividends divided by earnings. If it’s under 60%, the company has room to grow. Also look at free cash flow. If dividends are covered by cash flow, not just accounting earnings, it’s more sustainable. Look for 10+ years of consistent increases.

Should I sell my dividend stocks if the Fed raises rates?

Don’t react to Fed moves alone. Ask why rates are rising. If it’s because the economy is strong and companies are earning more, hold or even buy. If it’s because inflation is spiraling and growth is fading, reassess your holdings. Most dividend growers will still outperform over time.

Geoffrey Trent

December 9, 2025 AT 03:52Look, I’ve seen this exact post five times this month. Everyone’s obsessed with ‘dividend aristocrats’ like they’re magic beans. The truth? Most of these companies are just slow-moving utilities with 5% yields because they can’t grow anymore. If you’re not thinking about inflation-adjusted returns, you’re just chasing yield like a drunk at a bar.

And don’t get me started on ‘payout ratios under 60%’-that’s a kindergarten metric. What about capital allocation? What about debt? What about whether the company’s actually reinvesting or just buying back stock to inflate EPS? You think J&J’s dividend is safe? Try telling that to someone who owned it in 2022 when they got hit with $10B in litigation.

Stop treating dividend stocks like bonds with a bonus. They’re still equities. And equities don’t care about your emotional attachment to ‘consistent’ payouts.

Also, Gormsen and Lazarus? Bro, that paper’s from 2025. You’re citing future research like it’s gospel. Chill.

John Weninger

December 10, 2025 AT 00:00I really appreciate how you broke this down-it’s easy to panic when rates rise, but you’re right that context matters so much.

I’ve got a friend who sold all his dividend stocks last year when the 10-year hit 4.5%, and now he’s kicking himself because the ones he dumped are up 20% and paying more than ever. He was scared of the numbers, not the story.

For anyone new to this, I’d say: look at the dividend history like a resume. If a company’s raised it every year for 15+ years, they’ve probably earned it. And if their earnings are growing faster than inflation? That’s not a yield trap-that’s wealth building.

Don’t chase the highest yield. Chase the most consistent grower. Even if it starts at 2.5%, that 2.5% turning into 5% in 10 years? That’s how you outsmart the market without trying to time it.

And yeah, the Fed’s moves are loud, but the real signal is in the earnings calls. Listen to what management says about pricing power and labor costs. That’s where the truth lives.

Omar Lopez

December 10, 2025 AT 03:37The article contains several structural and terminological inaccuracies that undermine its credibility. First, the term ‘discount rate’ is improperly conflated with the 10-year Treasury yield; while correlated, they are not synonymous. The discount rate is an investor-specific construct, often derived from CAPM or WACC, not a direct proxy for government bond yields.

Second, the claim that ‘a 61.8% valuation increase’ occurred due to a 400-basis-point discount rate decline is mathematically implausible without specifying the duration, growth rate, or terminal value assumptions. Such a figure is only possible under unrealistic perpetuity assumptions with zero growth after year 20.

Furthermore, the assertion that ‘only 35% of rate changes come from pure discounting’ is a misinterpretation of Gormsen and Lazarus (2025). Their paper actually distinguishes between monetary policy shocks and macroeconomic regime shifts-not ‘pure discounting’ as a standalone category.

Lastly, the S&P 500 Dividend Aristocrats index outperformed not because of dividend growth per se, but because of its heavy weighting in consumer staples and healthcare-sectors with defensive characteristics and pricing power, irrespective of rate environment.

Recommendation: cease using financial models as rhetorical devices. Understand the assumptions before citing them.

Jonathan Turner

December 11, 2025 AT 06:35Meanwhile, China’s pumping out 500% yield bonds in their special economic zones and you’re over here calculating payout ratios like it’s 2008?

Dividend investing is for grandpas who still use Yahoo Finance. If you’re not buying crypto, AI chips, or private equity, you’re already losing. Just sayin’.