Call Option Profit Calculator

Call Option Profit Calculator

Results

Key Notes

Your maximum loss is limited to your premium paid ($). If the stock price is below the strike price at expiration, the option expires worthless. If the stock price is above the strike price, you can exercise your option and buy the shares at the strike price, then sell at the market price.

Buying a call option isn’t about owning stock. It’s about buying a bet - a legal contract that gives you the right, but not the obligation, to buy a stock at a set price before a specific date. You’re not buying shares. You’re buying the chance to buy them later, at a price you lock in today.

Let’s say you believe Tesla stock will jump from $200 to $250 in the next 45 days. Instead of spending $20,000 to buy 100 shares, you pay $300 for a call option with a $205 strike price. If Tesla hits $250, you can exercise your option and buy the shares at $205 - then sell them at $250. Your profit? $4,700. But if Tesla stays flat or drops? You lose only your $300. That’s the power of limited risk with unlimited upside.

What Exactly Is a Call Option?

A call option is a standardized contract traded on exchanges like the CBOE and NYSE. Each contract covers 100 shares of the underlying stock. You pay a premium - the price of the option - upfront. In return, you get the right to buy those 100 shares at a fixed price (the strike price) anytime before the expiration date.

For example: You buy one ABC 110 call option for $3 per share. That costs $300 total ($3 × 100 shares). If ABC rises to $120 before expiration, you can exercise your option, buy 100 shares at $110 each, and immediately sell them for $120. Your gross profit is $1,000. Subtract your $300 premium, and your net gain is $700. If ABC never hits $110, the option expires worthless. You lose the $300. That’s it.

This structure is why options are called derivative instruments - their value comes from something else: the stock price. And unlike owning stock, you don’t get dividends. You don’t vote. You just have a time-limited right to buy.

How Call Options Are Priced

Two things drive the price of a call option: intrinsic value and time value.

Intrinsic value is the difference between the stock’s current price and the strike price - but only if the stock is above the strike. If the stock is at $115 and your strike is $110, your option has $5 of intrinsic value. If the stock is at $105? No intrinsic value. The option is out of the money.

Time value is everything else. It’s the extra you pay for the chance the stock might rise before expiration. The more time left, the higher the time value. A call option with 6 months to expire costs more than one with 10 days - even if the strike and stock price are identical.

That’s why options lose value as they get closer to expiration. This is called theta decay. About one-third of the time value disappears in the last 30 days. So holding an option too close to expiration without a big price move is a losing game.

There’s also vega - sensitivity to volatility. If the market expects big swings in the stock, option prices rise. If everyone thinks the stock will stay quiet, prices fall. High volatility = higher premiums. Low volatility = cheaper options.

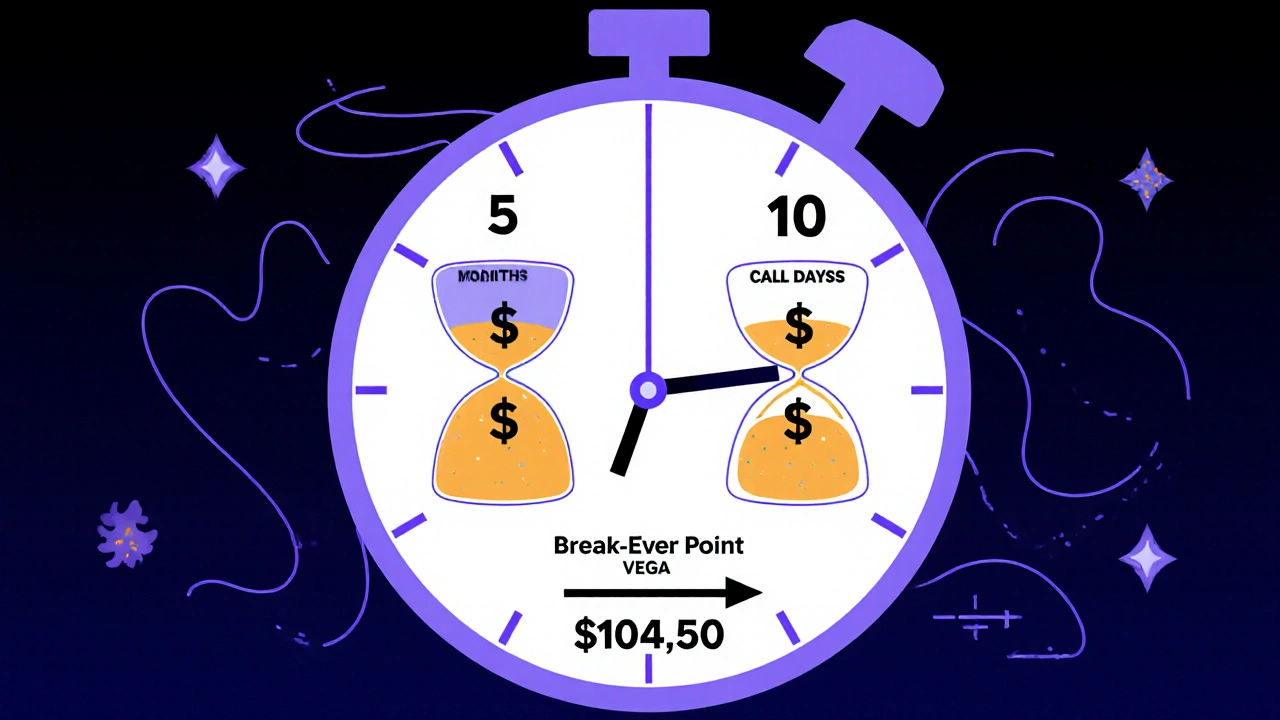

Break-Even Point: The Real Target

Most beginners think, “I just need the stock to go up.” That’s not enough. You need it to go up enough to cover your cost.

The break-even point is simple: strike price + premium paid.

Let’s say you buy a $100 strike call for $4.50. Your break-even is $104.50. The stock has to hit that price - not just $101 - for you to start making money. If it hits $103, you’re still down $1.50 per share. That’s why many options traders lose: they think a small move is enough. It’s not.

CME Group puts it plainly: “If you paid 4.50 points for a 100 call option, the breakeven is 104.50.” That’s not a suggestion. It’s math.

Why Use Call Options Instead of Buying Stock?

Three reasons: leverage, capital efficiency, and defined risk.

Take Apple at $188 per share. To own 100 shares, you need $18,800. But a $200 call option might cost $2.69 per share - or $269 total. That’s less than 1.5% of the stock cost. If Apple jumps to $210 in two weeks, your option might be worth $1,000. That’s a 270% return. The stock only went up 6%. You outperformed it by 45x.

That’s leverage. And it works both ways. If Apple drops to $180, your stock loses $800. Your option? Worthless. You lose $269. Same loss, less money at risk. That’s capital efficiency.

And defined risk? You can’t lose more than the premium. No margin calls. No forced selling. You walk away with zero if it doesn’t work. With stocks, losses can be much larger.

When Call Options Fail

Options aren’t magic. They fail often - and for predictable reasons.

Time decay kills slow movers. If you buy a call because you think a stock will rise in 6 months, but it only moves 5% in that time, you’ll lose money. The option’s time value evaporates. The stock didn’t fall - but you still lost.

Volatility crushes premiums. If a stock is expected to jump after earnings, options get expensive. If the earnings come and nothing happens? Volatility collapses. The option price crashes - even if the stock is unchanged.

Wrong strike price. Buying a $50 strike when the stock is at $45 seems cheap. But if the stock only hits $48, you’re still underwater. You need a bigger move to cover your cost.

Vanguard puts it bluntly: “If the stock price doesn’t rise as expected - and it doesn’t make sense to exercise the option - you lose the premium you paid.” That’s the reality. Most retail traders don’t realize how often this happens.

Who Should Trade Call Options?

Not everyone. Options trading requires discipline, knowledge, and emotional control.

Good candidates:

- Investors who already understand stock fundamentals and can identify strong bullish trends.

- People with a defined time horizon - not “I’ll wait forever.”

- Those who can limit their exposure - never risk more than 5-10% of your portfolio on options.

- Traders who use paper trading first. At least 60 days of simulated trades before risking real money.

Bad candidates:

- People chasing quick riches because they saw a TikTok video.

- Those who don’t understand breakeven points or time decay.

- Anyone who thinks options are “just like stocks, but cheaper.” They’re not.

FINRA found that only 28.7% of retail investors who trade options make consistent profits over three years. The rest lose money. Not because the market is rigged - but because they don’t understand the rules.

How to Start Trading Call Options

Step 1: Get approved. Most brokers (Charles Schwab, Fidelity, TD Ameritrade) require you to pass a knowledge quiz and sign a risk disclosure before allowing options trading.

Step 2: Start small. Buy one contract. Not five. Not ten. One. Learn how it behaves in real time.

Step 3: Use protective stops. Set a stop-loss at 20-30% below your entry price. If the option drops that much, get out. Don’t hope.

Step 4: Avoid 0DTE options. Zero days to expiration - those expire the same day you buy them - are gambling, not investing. They make up over 35% of daily volume, but 90% of buyers lose money.

Step 5: Learn the Greeks. Delta tells you how much the option moves when the stock moves. Gamma shows how delta changes. Theta is time decay. Vega is volatility. You don’t need to be a math expert - but you need to understand what each one means.

TD Bank says it best: “A call option is a contract that entitles the owner the right, but not the obligation, to buy a stock, bond, commodity or other asset at set price before a set date.” That’s the core. Everything else is detail.

What Comes Next?

Once you understand call options, you’ll see how they fit into bigger strategies: covered calls for income, spreads to reduce cost, or hedging your stock portfolio. But start simple. Master buying calls first.

The market has changed. Retail traders now make up over half of all options volume. But the rules haven’t. The math is the same. The risks are the same. The rewards are still there - if you play smart.

Don’t chase hype. Don’t bet your rent money. Don’t assume the stock will go up - just because you want it to.

Buy a call option when you have a clear reason, a defined timeline, and the discipline to walk away if it doesn’t work.

What happens if I don’t sell or exercise my call option before expiration?

If your call option is out of the money (stock price below strike price), it expires worthless and you lose the premium you paid. If it’s in the money, most brokers will automatically exercise it for you - meaning you’ll buy the stock at the strike price. But you must have enough cash in your account to cover the purchase. Always check your broker’s policy on automatic exercise.

Can I lose more than my premium when buying a call option?

No. When you buy a call option, your maximum loss is limited to the premium you paid. Even if the stock drops to zero, you can’t owe more than what you spent to buy the option. This is one of the key advantages of buying options over selling them or trading stocks on margin.

How much money do I need to start trading call options?

You can start with as little as $100-$300 to buy one contract, depending on the premium. But brokers often require a minimum account balance of $2,000 for options trading. If you plan to trade frequently, you’ll need $25,000 to avoid Pattern Day Trader restrictions. The key is not just having money - it’s having enough to absorb losses without emotional trading.

Are call options better than buying stocks directly?

It depends on your goal. If you want long-term ownership, dividends, and no time pressure, buying stock is better. If you want to bet on a short-term price move with limited risk and high leverage, call options are more efficient. They’re not better - they’re different tools for different situations.

What’s the difference between a call option and a put option?

A call option gives you the right to buy a stock at a set price. A put option gives you the right to sell a stock at a set price. Calls are for bullish bets. Puts are for bearish bets or protection. They’re mirror images - one profits when prices rise, the other when they fall.