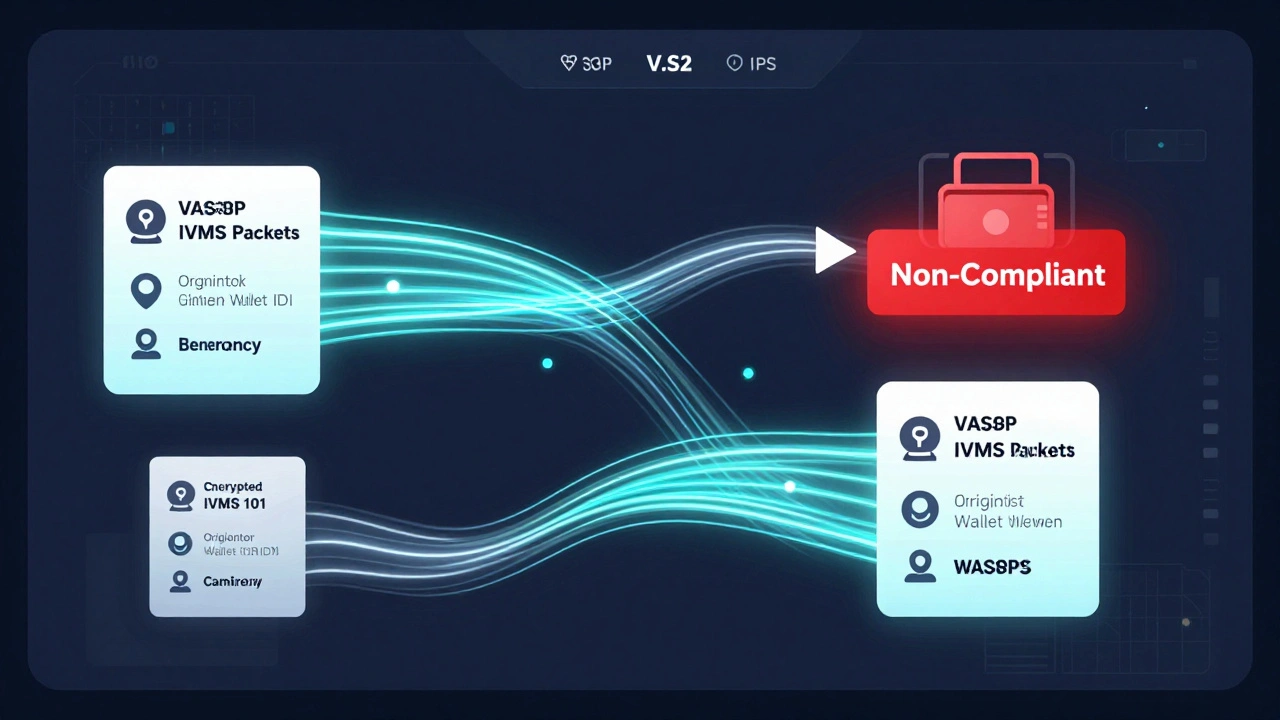

Travel Rule Solutions: How Crypto Exchanges Stay Compliant with Global AML Rules

Travel Rule solutions help crypto exchanges comply with global AML rules by automatically sharing user data on transfers over $1,000. Learn how IVMS 101, FATF, and providers like Notabene and Sumsub make crypto transfers traceable and legal.

View More