Transferring cryptocurrency used to be simple: send funds from one wallet to another, and that’s it. No forms, no questions, no paper trail. But since 2021, that’s changed - dramatically. If you’re running a crypto exchange, wallet service, or any kind of Virtual Asset Service Provider (VASP), you’re now legally required to share detailed personal information with the other side of every transaction over $1,000. This isn’t optional. It’s the Travel Rule, and failing to follow it can cost you millions in fines, or worse - your license to operate.

What the Travel Rule Actually Requires

The Travel Rule comes from FATF Recommendation 16, a global standard originally designed for banks transferring wire funds. In 2019, the Financial Action Task Force expanded it to cover cryptocurrency. By June 2021, countries were expected to enforce it. Today, it’s active in over 76% of FATF member nations. For any crypto transfer above the threshold - $1,000 in most places, $3,000 in the U.S. - you must collect and send seven pieces of data:- Originator’s full name

- Originator’s account number or wallet address

- Originator’s physical address

- Originator’s date of birth (if individual)

- Beneficiary’s full name

- Beneficiary’s account number or wallet address

- Beneficiary’s physical address

How Compliance Solutions Actually Work

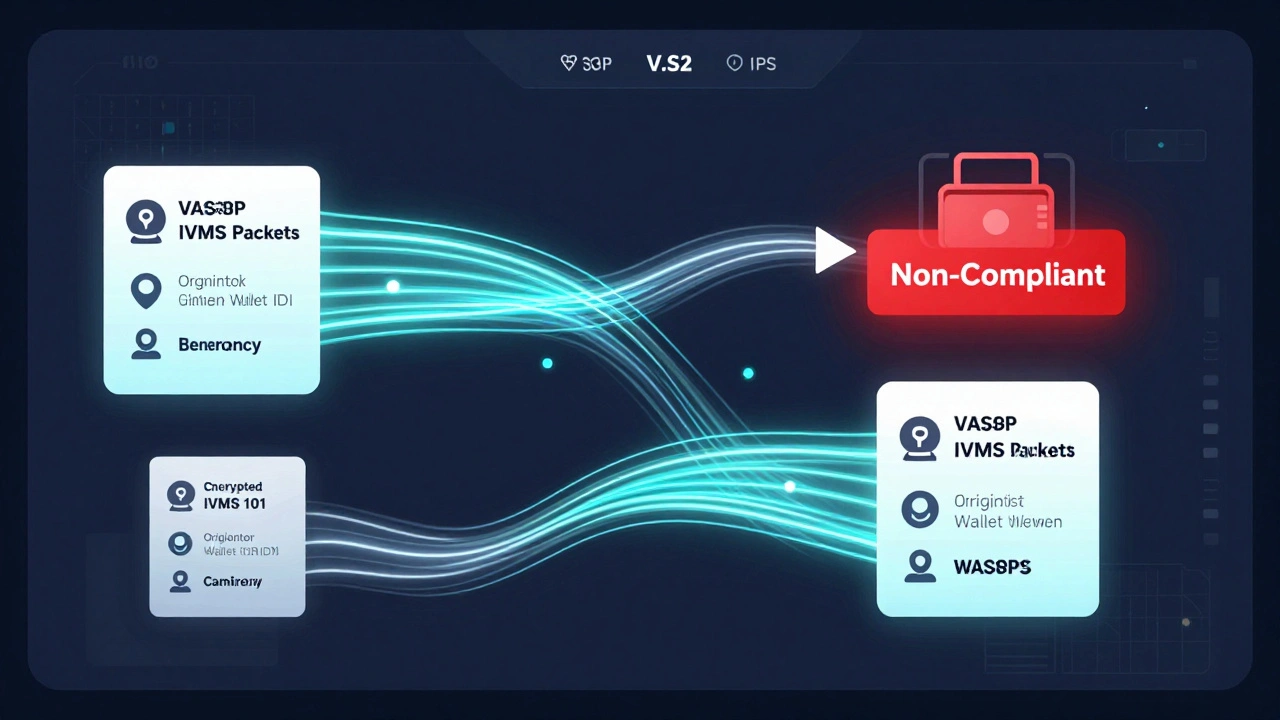

You can’t manually send this data for every transaction. That’s impossible at scale. So VASPs use specialized software - Travel Rule solutions - that automate the process. These tools connect your platform to others using standardized protocols. The most common protocol is IVMS 101, an open standard developed by the FATF. It’s used by 73% of new implementations in 2024, up from just 41% in 2022. Solutions like Notabene, Sumsub, and Proof all support IVMS 101. They work like this:- When a user initiates a transfer over $1,000, your system pulls the required info from your KYC database.

- The solution encrypts and packages the data into an IVMS 101-compliant message.

- It sends the message to the recipient VASP’s compliance system via secure API.

- The recipient verifies the data, matches it to their own records, and approves the transfer.

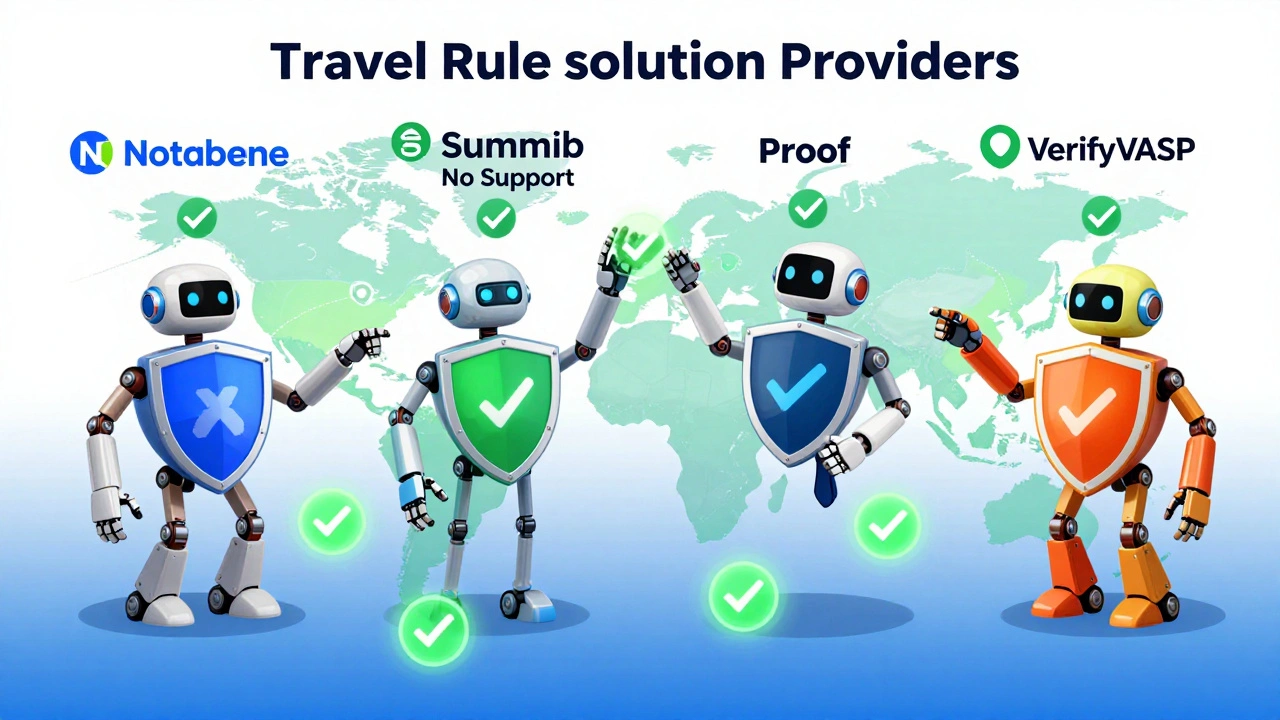

Major Players and Their Differences

Not all Travel Rule solutions are built the same. Here’s how the top four stack up:| Provider | Protocol Support | Monthly Transactions | Starting Price | Key Strength | Key Weakness |

|---|---|---|---|---|---|

| Notabene | IVMS 101, TRISA | 4.2M+ | $15,000/year | Works with 15 of top 20 exchanges | Complex setup; 8-week integration |

| Sumsub | IVMS 101 only | 4.7M | $5,000/year (Lite tier) | 30% cheaper than industry average | No TRISA support - limits connections |

| Proof | IVMS 101 | 2.1M | $12,000/year | Best real-time dashboard | Poor documentation; 63% negative feedback on errors |

| VerifyVASP | IVMS 101, proprietary | 1.8M | $18,000/year | Strong EU MiCA compliance | Limited global VASP network |

Where Compliance Breaks Down

Even the best systems have blind spots. The biggest problems come from three areas:- Unhosted wallets: These are personal wallets not controlled by a VASP - like MetaMask or Ledger. If someone sends crypto from their MetaMask to your exchange, you can’t verify their identity. Chainalysis found that 22% of these transactions fail compliance checks.

- DeFi transactions: When you swap tokens on Uniswap or stake on Aave, there’s no central entity collecting KYC data. JMLSG says these require 3.7x more manual review. FATF now says DeFi protocols acting like custodians must comply by Q2 2026.

- Non-compliant jurisdictions: If you’re sending crypto to a VASP in a country that hasn’t adopted the Travel Rule, your system can’t send the data. World Bank data shows 47% of cross-border transfers to non-compliant regions fail automatically.

Real Costs and Hidden Challenges

Many think compliance is just a one-time setup cost. It’s not. The average VASP spends $23,500 per year per connected counterparty. That’s not just software - it’s staff, training, audits, and system maintenance. A small exchange processing $5 million a month might need three full-time people just to manage Travel Rule compliance. Integration takes 12 to 16 weeks. If you don’t have existing KYC systems, staff need 227 hours of training. Even after launch, problems arise:- One European exchange paid €2.1 million in fines after missing DeFi transaction compliance.

- A U.S. platform had 17 hours of downtime during MiCA testing because their protocol didn’t match their partner’s.

- Users report unexpected costs when they exceed monthly transaction limits - a hidden trap in many pricing models.

What’s Next: The Road to Global Harmony

The market is moving fast. The EU’s MiCA regulation, fully enforced since June 2024, made Travel Rule compliance mandatory for all transfers involving EU-registered VASPs - regardless of amount. That triggered a 217% spike in adoption across Europe. The FATF is pushing for global standardization. Their October 2024 guidance now includes NFTs used as payments over $1,000. The IMF recommends lowering the U.S. threshold from $3,000 to $1,000 to close regulatory arbitrage loopholes. A new global registry - being built by FATF and IOSCO - is set to launch in late 2025. It will assign unique IDs to every compliant VASP, cutting connection failures from 29% to under 10%. In the long term, zero-knowledge proofs could change everything. Imagine proving you’re a verified user without revealing your name or address. That’s the holy grail - compliance without sacrificing privacy. Some startups are already testing it.

How to Choose and Implement a Solution

If you’re a VASP, here’s what actually works:- Test with your top 10 counterparties first. Don’t pick a vendor until you know which protocols they use. Ask them: “Do you use IVMS 101? TRISA? Proprietary?”

- Start with high-volume transfers. Roll out compliance to your biggest trading partners first. That’s where the risk and volume are.

- Plan for 12-16 weeks. Don’t rush. Integration isn’t plug-and-play. Budget for technical and compliance staff.

- Read the fine print on pricing. Watch for volume caps. Some providers charge extra if you exceed $10,000 in monthly transfers.

- Train your team on error codes. Most support issues come from misinterpreted system alerts. If your team doesn’t understand what “IVMS 101 Field 7 Missing” means, you’re setting yourself up for failure.

Is This Really Making Crypto Safer?

Critics say it’s theater. Dr. Garrick Hileman’s research says compliance costs are pushing small exchanges out of the market. Professor Angela Walch argues the rule misunderstands blockchain - you can’t trace a public ledger the same way you trace a bank account. But the data tells another story. Since 2021, illicit crypto transactions over $10,000 have dropped 62%. Europol reports a 34% decline in crypto-based money laundering. The IMF says the U.S. $3,000 threshold is being exploited in 19% of cross-border crimes. The Travel Rule isn’t perfect. But it’s the only global framework we have. And for now, it’s the law.What happens if I don’t comply with the Travel Rule?

Fines can range from $500,000 to over $10 million, depending on the jurisdiction and scale of violations. Regulators can suspend or revoke your license. In the EU, MiCA allows authorities to shut down non-compliant VASPs immediately. In the U.S., FinCEN can impose civil penalties and refer cases to the Department of Justice for criminal prosecution.

Does the Travel Rule apply to peer-to-peer (P2P) trades?

Only if a VASP is involved. If you’re trading directly with another person using a P2P platform like LocalBitcoins, and neither side is a regulated VASP, the rule doesn’t apply. But if you’re using a platform that acts as an intermediary - even if it’s not a traditional exchange - and the transfer exceeds the threshold, you’re required to comply.

Can I use the same solution for both crypto and fiat transfers?

Most Travel Rule solutions are built specifically for crypto. Traditional wire transfers follow different rules (like the Bank Secrecy Act in the U.S.) and use different systems. Some enterprise platforms offer bundled AML suites that handle both, but they’re not the same protocol. Don’t assume your banking compliance tool works for crypto - it likely doesn’t.

Do I need to collect data for transfers under $1,000?

Not under FATF’s standard rule. But some jurisdictions have stricter rules. The EU’s MiCA requires full compliance for all transfers involving EU-registered VASPs, regardless of amount. If you serve EU customers, you must collect data even for $100 transfers. Always check local regulations.

How do I know if my solution is truly compliant?

Look for certification from recognized bodies: the EU Blockchain Observatory, German Federal Office for Information Security (BSI), or FATF’s own implementation reports. Ask your vendor for audit logs showing successful IVMS 101 exchanges with other VASPs. If they can’t provide this, they’re not truly compliant - they’re just claiming to be.

Jonathan Turner

December 15, 2025 AT 09:29Oh wow, another ‘compliance is great’ propaganda piece. Let me guess-you’re the guy who thinks giving the government your entire digital life is ‘the price of freedom.’ The Travel Rule doesn’t make crypto safer-it just turns every wallet into a bank account with a side of surveillance. And don’t get me started on how this punishes small players while Big Crypto just buys their way out with fancy software. 99.98% uptime? Cool. But what about the 0.02% when your $5000 transfer gets stuck because some EU exchange’s API hiccuped? You’re not securing the system-you’re just making it slower, pricier, and more centralized. And yeah, I know you’re gonna say ‘but illicit activity dropped!’-so did cash smuggling after ATMs got cameras. That doesn’t mean it’s not a giant, expensive overreach.

Mark Vale

December 15, 2025 AT 14:24you know what’s funny? they say this is to stop crime… but i bet 90% of the data collected ends up in some private surveillance network or sold to data brokers. remember when the feds said ‘we only use this for terrorism’? yeah. now they’re tracking your crypto buys for ‘tax compliance.’ and dont even get me started on how the eu’s mirca rule forces you to collect dob and address for $100 transfers… like, why? so they can build a global crypto user profile? i’m not paranoid-i’ve read the leaks. this isn’t compliance. it’s social credit for crypto users. and the ‘solutions’? just corporate gatekeepers with fancy acronyms. ivms 101? sounds like a sci-fi protocol from a dystopian novel. lol.

Royce Demolition

December 16, 2025 AT 01:13YESSSS this is the future we’ve been waiting for! 🚀 Compliance isn’t a buzzkill-it’s the golden ticket to real institutional adoption! 💰 Banks are finally taking crypto seriously because we’re playing by the rules. Yeah, the setup’s a pain, yeah, the costs are high-but think of the payoff: hedge funds, pension funds, Wall Street all onboarding because they know they’re not dealing with a Wild West. And guess what? The tech works! 2.3 seconds? That’s faster than your coffee brews ☕️. Stop whining and get your team trained. This isn’t about control-it’s about credibility. If you’re not on IVMS 101 by Q3, you’re not in the game. Time to level up, legends! 💪🔥