2025/11 Financial Insights: Dividends, Tech, and Investing Tools

When you’re trying to grow your money wisely, dividend investing, the strategy of buying stocks that pay regular cash payouts to shareholders. Also known as income investing, it’s not just about getting checks—it’s about spotting companies that can keep paying them long-term. In November 2025, we dug into what really predicts a dividend cut: payout ratios, cash flow trends, and those sneaky safety scores most investors ignore. One post showed how a company with a 90% payout ratio and falling free cash flow is a ticking time bomb—even if its dividend yield looks tempting. You don’t need to be a Wall Street analyst to see these red flags. Just know the numbers.

Behind the scenes, fintech, the use of technology to improve and automate financial services. Also known as financial technology, it’s no longer just apps for budgeting—it’s reshaping how small businesses get paid, how insurance is priced, and how AI helps banks avoid fraud. Embedded lending for invoices lets a shop owner turn unpaid bills into cash in under a day, right inside QuickBooks. Insurtech uses your driving habits to set your premium, not your age. And RAG-powered AI in finance doesn’t guess—it answers using real documents, so compliance teams sleep better. These aren’t future ideas. They’re live tools changing how money moves today.

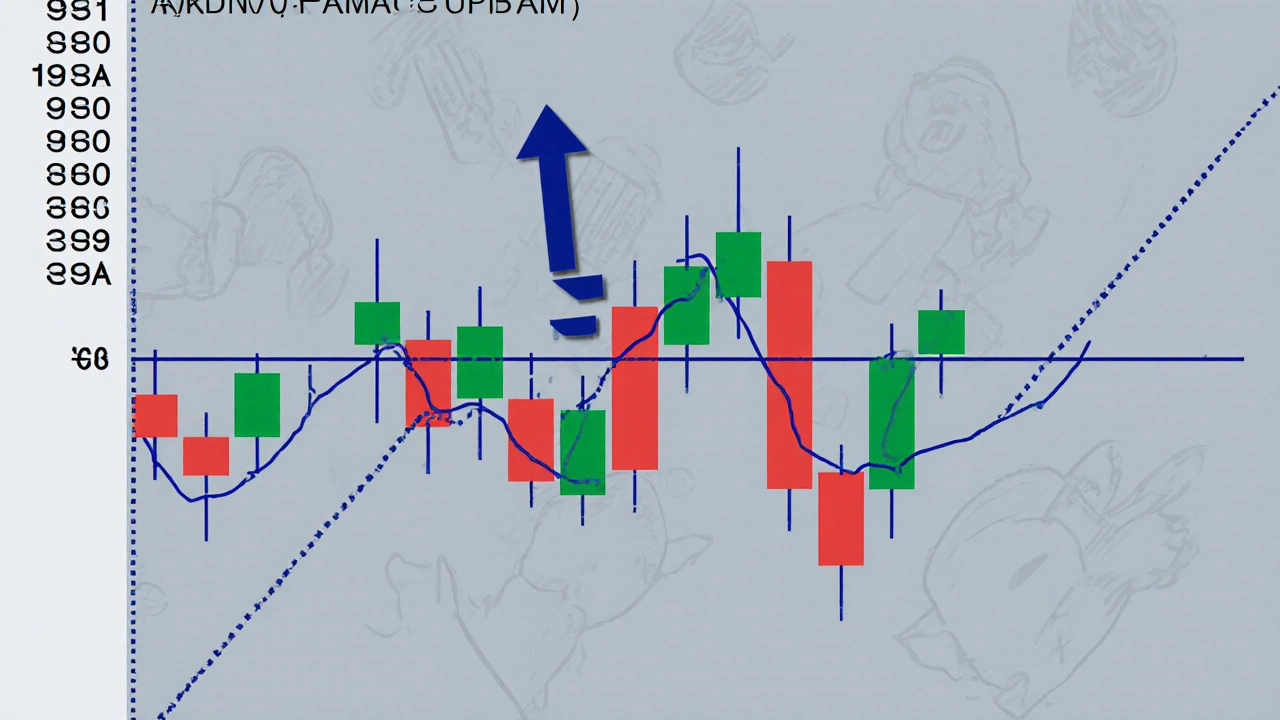

And if you’re just starting out, you don’t need fancy charts or insider tips. You need clear tools. We covered how to use stock valuation, the process of determining a company’s true worth based on earnings, growth, and market conditions. Also known as equity valuation, it’s the difference between buying a stock because it’s popular and buying it because the math makes sense. P/E ratios alone lie. PEG ratios tell you if growth is real. Forward P/E? Watch out—analysts love to overpromise. MACD signals? Use them with price action, not alone. And don’t forget the basics: market cap tells you company size, T-bills are still the safest emergency fund, and ex-dividend dates changed with T+1 settlement. Miss that, and you lose cash.

What you’ll find below isn’t a random list. It’s a toolkit. From call options and UCC filings to budgeting apps and super apps, every article answers a real question someone had this month. No fluff. No jargon. Just what works—for beginners, small business owners, and anyone trying to build wealth without betting their life savings on a hunch.