Retirement Planning: How to Build Lasting Income and Avoid Common Mistakes

When you think about retirement planning, the process of organizing your finances to support yourself after you stop working. Also known as financial independence planning, it's not just about how much you save—it's how you structure what you have so it keeps working for you, even when you're not. Most people focus on hitting a number—$1 million, $2 million—but that number means nothing if your money isn’t positioned right. You could have a huge balance and still run out of cash if you’re pulling from the wrong accounts, missing tax breaks, or holding too much in volatile assets with no income stream.

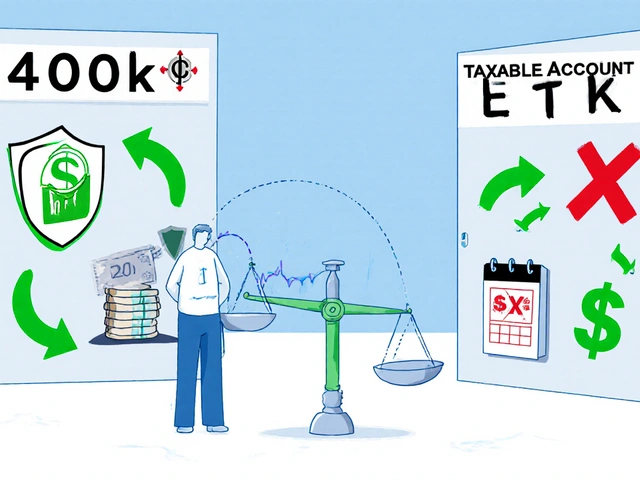

Dividend investing, a strategy that generates regular income from stocks that pay out profits to shareholders is one of the most reliable ways to build steady retirement cash flow. Companies that consistently pay dividends often have stronger balance sheets and lower volatility than growth stocks. But not all dividends are safe—some are traps. That’s why you need to check payout ratios and cash flow before you buy. And when you do invest, where you hold those stocks matters. Putting dividend payers in a taxable brokerage account, an investment account where you pay taxes on gains and dividends each year might make sense if you’ve already maxed out your IRA or 401(k). It gives you control over when you sell and how much you withdraw. Pair that with tax coordination, the smart placement of assets across taxable, tax-deferred, and tax-free accounts to boost after-tax returns, and you can add nearly 1% extra to your annual retirement income without taking more risk.

But income isn’t the only thing you need. What happens if your car breaks down, your roof leaks, or you face a medical bill before Medicare kicks in? That’s where your emergency fund, a cash reserve set aside for unexpected expenses comes in. Too many retirees keep this in a regular savings account earning almost nothing. Better options exist—like Treasury bills, short-term government securities that offer safety and competitive yields with no state taxes. They’re liquid, low-risk, and perfect for holding 6–12 months of living expenses. And don’t forget: your emergency fund should be separate from your retirement accounts. Tapping your IRA early means penalties and taxes you can’t afford.

Retirement planning isn’t a one-time setup. It’s a series of smart moves that compound over time: knowing when to sell a stock, how to time dividend payments around tax seasons, which bonds to avoid if rates are rising, and when to use a taxable account instead of a Roth. The posts below cover exactly these moves—how to spot dividend cuts before they happen, how APIs make tracking your portfolio easier, how to avoid tax mistakes on 1099 forms, and why your emergency fund needs to be more than just a savings account. You won’t find fluff here. Just clear, practical steps that real people use to make their money last longer, work smarter, and stay secure no matter what happens next.