Market Maker Spreads: What They Are and How They Impact Your Trades

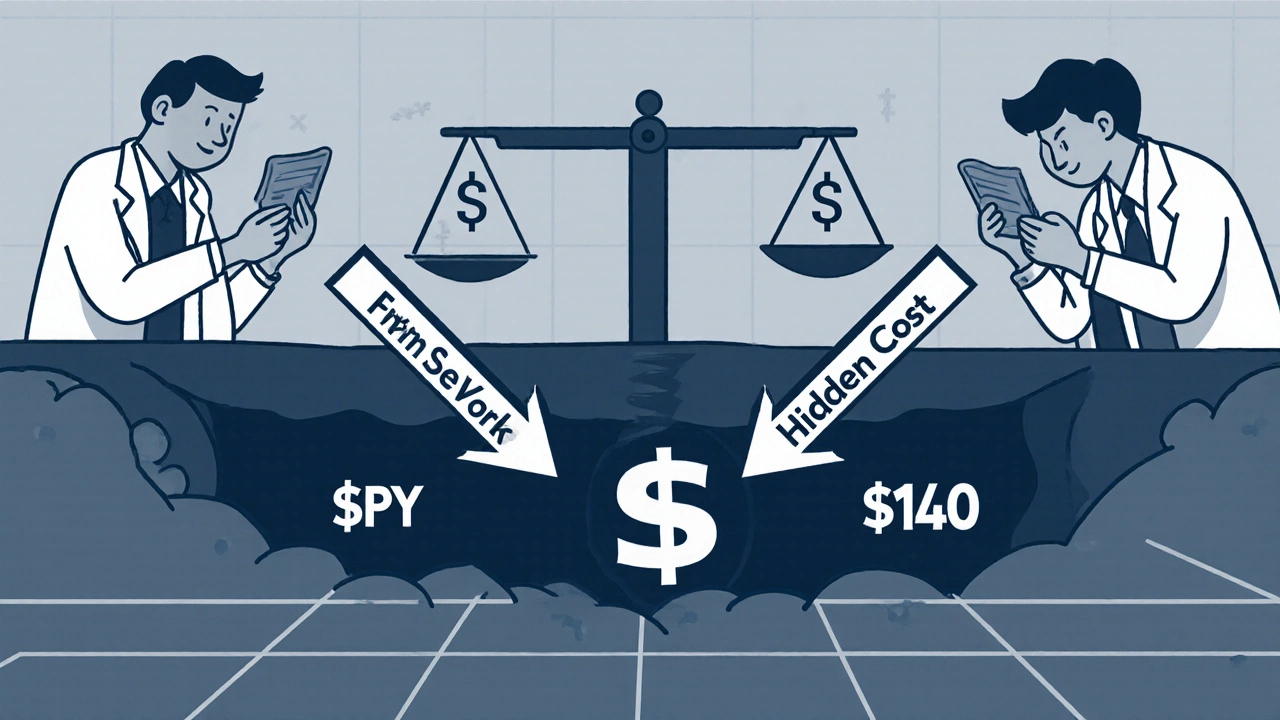

When you buy or sell a stock, the price you see isn’t the whole story. Behind the scenes, market maker spreads, the difference between what buyers are willing to pay and what sellers are willing to accept. Also known as bid-ask spread, it’s the hidden cost built into every trade. If a stock trades at $50.00 bid and $50.05 ask, that five-cent gap is the spread—and it’s taken by the market maker, not your broker. This isn’t a fee you see on a statement. It’s built into the price.

Market makers keep markets moving. They’re the ones ready to buy when you want to sell and sell when you want to buy. In return, they earn the spread. But not all spreads are the same. On big, popular stocks like Apple or Tesla, spreads can be as tight as a penny. On small or illiquid stocks, they can jump to dollars. That’s why liquidity, how easily an asset can be bought or sold without changing its price matters so much. High liquidity means tighter spreads. Low liquidity means wider spreads—and more money lost before your trade even turns a profit.

These spreads directly affect your returns. If you buy a stock at $50.05 and it jumps to $50.10 the next day, you’re only up five cents. But if the spread was ten cents, you’re already halfway to breaking even. That’s why smart traders watch spreads like a hawk. They avoid trading during low-volume hours. They skip thinly traded stocks. They use limit orders instead of market orders to control the price they pay. And they know that even a tiny spread adds up over time—especially if you trade often.

Market maker spreads also tie into how trading costs, all expenses that eat into your investment returns, including commissions, slippage, and spreads are measured. Many people think commissions are the main cost. But for most retail traders, the spread is the bigger drag. That’s why platforms advertising $0 commissions still profit—through the spread. You’re not paying a fee, but you’re paying more than the real value of the asset.

Understanding this isn’t just theory. It’s practical. If you’re using an online broker like those compared in our 2025 guide, you’re seeing market maker spreads every time you click buy. If you’re rebalancing your taxable account or using tax-aware strategies, spreads eat into your gains before taxes even come into play. Even robo-advisors don’t eliminate them—they just hide them in the pricing.

There’s no way to fully avoid market maker spreads. But you can minimize them. Trade during high-volume hours. Stick to liquid assets. Avoid penny stocks. Use limit orders. And remember: the best trade is the one you don’t make if the spread is too wide.

Below, you’ll find real examples from posts that dig into how spreads connect to brokerage tools, tax strategies, and trading behavior—so you can spot them, measure them, and trade smarter.