401(k) Tax Efficiency: How to Keep More of Your Retirement Savings

When you contribute to a 401(k), a tax-deferred retirement account offered through employers. Also known as a defined contribution plan, it lets you lower your taxable income today while your money grows without annual taxes. That’s the core of 401(k) tax efficiency—you delay paying taxes until withdrawal, often in retirement when your income—and tax rate—may be lower.

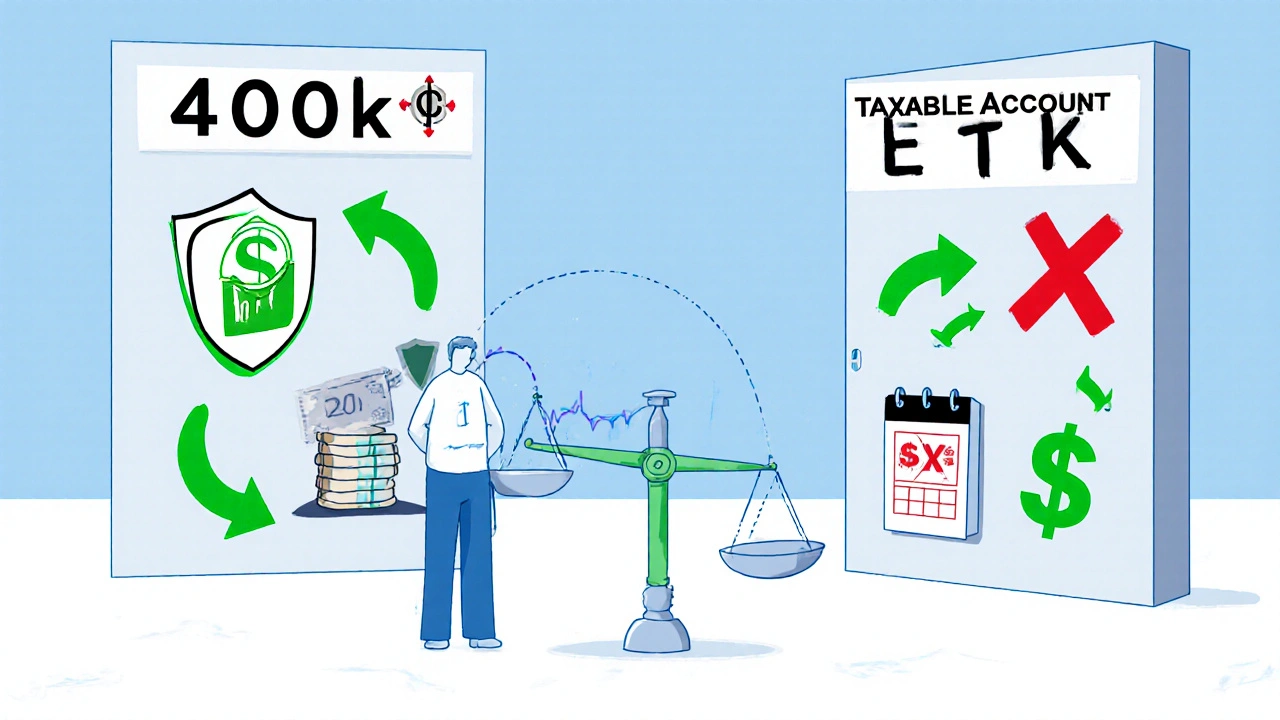

But here’s what most people miss: 401(k)s don’t work alone. Their real power shows up when you combine them with other account types. A taxable brokerage account, an investment account where you pay taxes on gains and dividends each year is great for short-term goals like a down payment, while a Roth IRA, a retirement account funded with after-tax dollars that grows tax-free gives you tax-free withdrawals later. Together, these accounts form a system called tax coordination, the strategic placement of assets across different account types to maximize after-tax returns. For example, holding bonds in your 401(k) (where interest income is sheltered) and stocks in your Roth IRA (where long-term gains grow tax-free) can boost your net returns by up to 0.75% a year—without taking more risk.

It’s not about picking the "best" account. It’s about using the right one for the right asset at the right time. Your 401(k) is your tax-deferred engine, but without understanding how it interacts with taxable accounts, Roth IRAs, or even HSAs, you’re leaving money on the table. The posts below show real examples of how people are stacking these accounts, avoiding common tax traps, and turning retirement savings into long-term wealth—not just a number on a statement.