2025/10 Archive: Tax Strategies, Fintech Regulation, and Investment Accounts

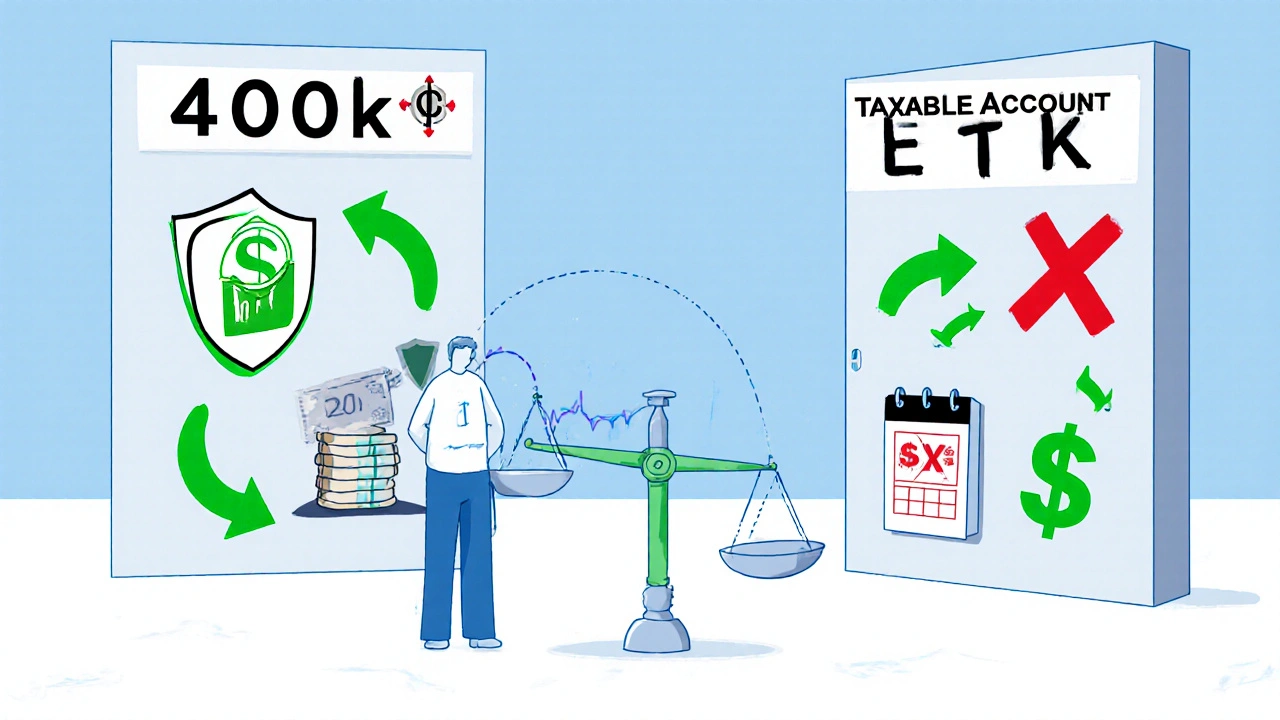

When you’re trying to grow wealth without getting crushed by taxes or tangled in regulation, the taxable brokerage account, an investment account where you pay taxes on gains and dividends but have no contribution limits or withdrawal penalties. Also known as a non-retirement investment account, it’s one of the most flexible tools in your financial toolkit—especially when you’ve maxed out your 401(k) or Roth IRA. But knowing how to use it right matters more than just having one. In October 2025, we dug into how to pair it with tax-deferred and tax-exempt accounts using tax coordination, a strategy that places different types of assets in different accounts to maximize after-tax returns. This isn’t just theory—it’s a method that can boost your annual returns by up to 0.75% by reducing what you pay in capital gains and dividend taxes.

Behind the scenes, the financial tools you rely on are changing fast. Fintech licensing, the legal permits required for companies to offer digital financial services like payments, lending, or wage access. Also known as payment licenses or money transmitter licenses, these are no longer optional if you want to operate legally across states or countries. In 2025, startups faced more complex rules than ever, with costs climbing and approval times stretching. Meanwhile, loan underwriting automation, the use of AI and real-time data to approve small business loans in minutes instead of weeks. Also known as digital underwriting, it’s replacing old-school paperwork with algorithms that look at cash flow, not just credit scores. And in Europe, PSD2 regulation, a law forcing banks to let third-party apps access your financial data with your permission. Also known as open banking, it’s making it easier to track spending, automate savings, and compare loan offers—all while requiring stronger security like two-factor authentication.

What You’ll Find in This Archive

This collection isn’t just a list of articles—it’s a snapshot of what real investors and fintech users were dealing with in October 2025. You’ll see how to handle conflicting market signals between hard data and consumer surveys, why withdrawal limits in earned wage access programs exist, and how agent banking is bringing financial services to rural communities in Africa. We covered how to design expense categories that actually save time, how bid-ask spreads in options can silently eat your profits, and how robo-advisors now offer real human support—not just chatbots. You’ll also find practical advice on organizing your emergency fund, a cash reserve for unexpected expenses, kept separate from other savings to avoid temptation. Also known as high-yield savings account, it’s not just about how much you save, but how you structure it. Whether you’re a beginner trying to understand taxable accounts or an experienced investor rebalancing across 401(k)s and brokerage accounts, this archive gives you the tools to act, not just guess.

What follows isn’t theory—it’s what worked, what didn’t, and what you need to know next. No fluff. No jargon. Just clear, actionable insights from real financial decisions made in 2025.