Wage Verification Calculator

Verify Your Earned Wages

Enter your work hours to calculate your total hours and verify if you're being paid correctly.

Result

Verify your pay by comparing your calculated hours to your paycheck.

Every paycheck should reflect every hour worked. But too often, it doesn’t. In the U.S., wage theft affects 2.4 million workers each year - that’s billions of dollars left on the table, often because of simple errors or outright manipulation. The fix isn’t just about trust. It’s about data. Specifically, time and attendance data that’s accurate, transparent, and verified in real time.

Why Your Paycheck Might Be Wrong

Let’s say you clocked in at 7:05 a.m. and clocked out at 4:15 p.m. with a 30-minute lunch. You worked 8 hours and 40 minutes. But your paycheck shows 8 hours. Where did the extra 40 minutes go? Maybe the system didn’t capture the late clock-in. Maybe your manager manually edited the timesheet. Or maybe your job was misclassified as salaried when it should’ve been hourly. These aren’t hypotheticals. The U.S. Department of Labor identifies three major forms of wage theft:- Time manipulation - Clocking in early or out late without pay

- Underreporting hours - Not counting all time worked, especially off-the-clock tasks

- Misclassification - Denying overtime by labeling workers as exempt when they’re not

How Time and Attendance Systems Work

Modern systems don’t just track time - they verify it. Here’s how they do it:- Biometric verification - Fingerprint or facial recognition ensures only the employee can clock in. TimeForge’s 2023 case studies show these systems reduce “buddy punching” (when one employee clocks in for another) by 92%.

- Geofencing - Your phone or device must be within 50 meters of your assigned worksite to clock in. This prevents remote clock-ins for warehouse workers, delivery drivers, or construction crews.

- Automated overtime triggers - When you hit 40 hours in a workweek, the system automatically flags overtime. No guesswork. No manual calculations. No missed pay.

- Real-time payroll sync - Data flows directly from time tracking to payroll software via API. Accuracy? 99.998%. That’s nearly flawless.

Key Platforms Compared

Not all systems are built the same. Here’s how the top players stack up:| System | Accuracy | Verification Speed | Cost per Employee/Month | Best For |

|---|---|---|---|---|

| TimeForge | 99.7% biometric accuracy | 5-10 minutes | $1.25-$2.50 | Wage theft prevention, retail, manufacturing |

| VerifyToday | 99.9% API sync | 98% of requests in <90 seconds | $1.25-$2.50 | Real-time wage access, gig workers |

| ADP SmartCompliance | 100% integration with ADP payroll | 10-15 minutes | $0.75-$1.80 | Large enterprises, payroll-heavy businesses |

| TimeTrex | 99.8% data sync | 5-10 minutes | $1.50-$3.00 | Predictive scheduling, overtime reduction |

| Factorial HR | 99.5% mobile accuracy | 2 minutes | $1.00-$2.00 | Small businesses, mobile-first teams |

TimeForge leads in stopping wage theft. VerifyToday is fastest for real-time wage access. ADP wins if you’re already using their payroll system. TimeTrex helps cut overtime costs. Factorial HR is simple but struggles with complex union rules.

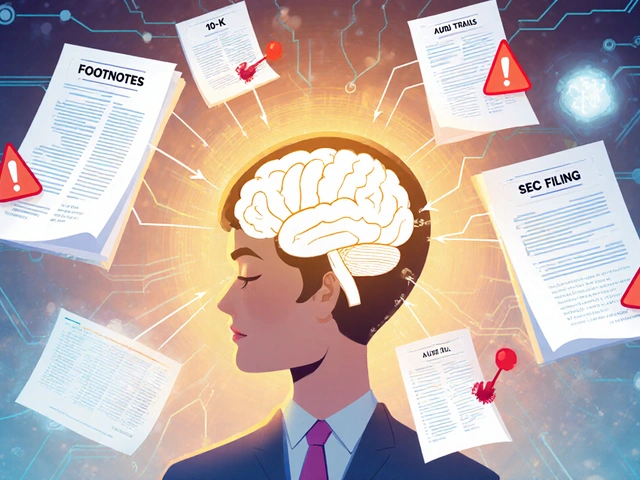

What Happens When It Goes Wrong

A 2025 HR Dive report tells a cautionary tale: a manufacturing company with 450 employees failed to configure their system properly. Overtime wasn’t being captured. Workers weren’t notified of discrepancies. When the Department of Labor audited them, they owed $287,000 in back wages. That’s not rare. A 2024 survey from Capterra found that 33% of mid-sized companies had integration issues with legacy payroll systems. Another 57% faced employee pushback against biometrics. The problem isn’t the tech. It’s the rollout. If employees can’t see their own time records, the system becomes a tool for hiding underpayment - not preventing it. The Economic Policy Institute warns: without transparency, these systems can enable wage theft.How to Do It Right

Successful implementations follow three rules:- Give employees access - They need to view, review, and dispute their hours. This isn’t optional. California’s AB 51 and New York’s 2023 law require it.

- Train managers and staff - HR staff need 28 hours on average to become proficient. Workers need 10 minutes to learn how to clock in and check their records.

- Review logs weekly - Don’t wait until payday. Look for patterns: late clock-ins, missed breaks, sudden drops in hours. These are red flags.

Legal and Privacy Risks

Geofencing and facial recognition aren’t just technical tools - they’re legal minefields. Labor attorney Mark Rodriguez pointed out in a 2024 Harvard Law Review article that geofencing apps that track location 24/7 may violate California’s AB 51, which bans mandatory monitoring. Companies using these features without clear consent face a 22% higher risk of privacy lawsuits. And then there’s data. Pew Research’s 2025 survey found 43% of workers are uncomfortable with constant tracking. That’s why new laws like the proposed Digital Employee Rights Act of 2026 are gaining traction - they’ll require companies to get explicit consent before collecting location or biometric data.

Who’s Using This and Why

Adoption varies by industry:- Manufacturing: 85% use automated systems - high risk of overtime violations

- Healthcare: 79% - shift work makes manual tracking chaotic

- Retail: 72% - hourly workers, high turnover, frequent schedule changes

- Professional services: 58% - fewer hourly workers, slower adoption

The Future: AI and Predictive Verification

The next wave isn’t just about tracking. It’s about predicting. MIT Sloan’s 2025 study found early adopters using AI to flag anomalies - like an employee who clocks in at 6:58 a.m. every day but never works past 4:02 p.m. - caught wage discrepancies 43% faster than traditional systems. UKG’s 2025 EmpInfo 3.0 update includes automated FLSA compliance scoring. VerifyToday now uses blockchain to create unchangeable time records. ADP integrated with IRS systems to verify wage garnishments in real time. Gartner predicts that by 2027, 65% of systems will proactively flag wage issues before payroll runs. That’s not science fiction. It’s the next step in fairness.What You Should Do

If you’re an employee:- Check your time records every week

- Dispute anything that doesn’t match your memory

- Know your rights - you’re entitled to see your hours

- Switch from paper to digital - manual systems are a liability

- Choose a system that gives employees access to their own data

- Train your team - tech doesn’t fix itself

- Review logs weekly, don’t wait for payroll

Can I see my own time and attendance records?

Yes - and the law often requires it. Under California’s AB 51 and New York’s 2023 wage laws, employees must have easy access to their own time records. Most modern systems let workers view, download, and dispute hours through a mobile app or web portal. If your employer won’t let you see your records, that’s a red flag - and potentially illegal.

Is biometric clock-in legal?

It’s legal if you give consent. Employers can’t force you to use fingerprint or facial recognition without a clear, written policy and a way to opt out - usually with a PIN or card alternative. Several states, including Illinois and Texas, have specific biometric privacy laws. If your employer doesn’t explain how your data is stored or used, ask for the policy. If they refuse, contact your state labor department.

What if my overtime isn’t being paid?

First, check your time records. If you worked over 40 hours in a week and weren’t paid overtime, document your hours. Then, file a complaint with your state’s labor board - or the U.S. Department of Labor. Employers who fail to pay overtime can be fined up to $1,100 per violation. In 2024, the DOL recovered $367 million in back wages for workers.

Do small businesses need time and attendance systems?

Yes - even if you have 10 employees. Manual timesheets are error-prone and leave you vulnerable to wage theft claims. Systems like Factorial HR or VerifyToday cost as little as $1 per employee per month. For a 10-person team, that’s $120 a year. The cost of one FLSA violation? Often over $50,000.

How long does it take to set up a time tracking system?

It varies. For small teams (under 50 people), setup can take 1-2 weeks. Larger companies with legacy payroll systems may need 4-6 weeks. The biggest delay? Training. Employees need to know how to clock in. Managers need to know how to review logs. HR needs to know how to handle disputes. Don’t rush this step - it’s where most failures happen.

Royce Demolition

February 9, 2026 AT 02:07Sabrina de Freitas Rosa

February 10, 2026 AT 05:34Erika French Jade Ross

February 11, 2026 AT 13:05