Financial Document Chunking Calculator

Financial Document Chunking Calculator

Optimize your RAG system by calculating the ideal chunk size for financial documents. Proper chunking preserves context around tables, footnotes, and financial statements—critical for accurate fraud detection and compliance.

Imagine you're reviewing a 500-page SEC filing for a company you're considering investing in. You need to find every mention of executive compensation, compare it to industry benchmarks, check for hidden liabilities in footnotes, and verify if recent regulatory changes affect their reporting. Doing this manually takes hours. Now imagine an AI that does it in seconds-and shows you exactly which page and paragraph it pulled each answer from. That’s not science fiction. It’s RAG for financial knowledge bases.

Why Financial AI Can’t Just Guess

Large language models (LLMs) like GPT or Claude are great at sounding smart. But in finance, guessing is dangerous. If an AI says a company’s debt-to-equity ratio is 1.5 when it’s actually 3.2, someone could lose millions. Or worse-miss a fraud scheme hiding in plain sight. That’s why standalone AI doesn’t work in finance. These models were trained on general text. They don’t know the difference between GAAP and IFRS. They hallucinate numbers. They cite fake reports. In 2024, internal tests at a major bank showed that ungrounded AI gave incorrect answers in 41% of complex fraud detection cases. Enter Retrieval-Augmented Generation, or RAG. It doesn’t rely on memory. It doesn’t guess. It looks up the answer-every time-from your own documents: annual reports, audit trails, compliance manuals, regulatory filings. Then it uses an LLM to explain it clearly. The result? Answers that are accurate, traceable, and auditable.How RAG Works in Finance (The Three-Layer System)

Financial RAG isn’t one tool. It’s a pipeline with three layers that work together like a financial detective team. Layer 1: Query Planning - When you ask, “What’s the trend in operating cash flow for Company X over the last five years?” the system doesn’t just search for those words. It understands intent. It knows you’re looking for trends, not a single number. It rewrites your question to match how financial documents are written: “Show annual operating cash flow from Form 10-K filings for fiscal years 2020-2024.” It also checks if you need to compare against peers or adjust for accounting changes. Layer 2: Retrieval Execution - Now it goes digging. It pulls data from multiple sources: vector databases for semantic similarity, graph databases to trace connections, and keyword indexes (like BM25) for exact matches. It doesn’t just grab one document. It finds 20 relevant chunks-balance sheet lines, footnote disclosures, board meeting minutes. Precision scores for top results often exceed 0.85 in financial contexts. Layer 3: Results Processing - This is where the magic happens. Raw data is messy. The system links a cash flow figure to its footnote. It cross-references a revenue recognition policy across three different filings. It spots that the “other income” line jumped 300% in 2023-right after a new accounting rule took effect. It even identifies relationships: “Company A owns 60% of Company B, which holds the asset mentioned in Document C.” That’s multi-hop reasoning. And it’s what makes RAG powerful.GraphRAG: The Game-Changer for Complex Finance

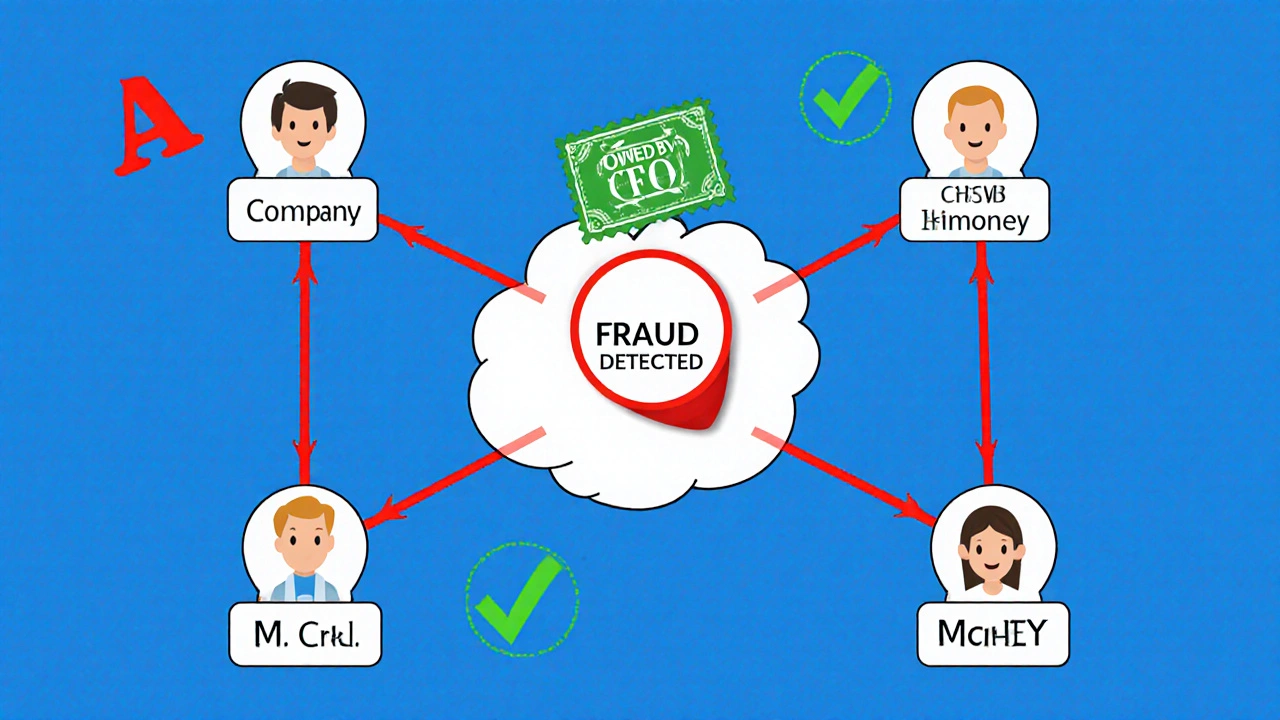

Standard RAG treats documents like isolated pages. GraphRAG treats them like a web. In July 2025, AWS launched GraphRAG inside Amazon Bedrock Knowledge Bases. It uses Amazon Neptune Analytics to map relationships between thousands of financial entities-companies, accounts, people, transactions. Think of it as building a financial family tree. Here’s how it catches fraud that traditional systems miss:- Company A transfers $2M to Company B. Company B pays $1.8M to Company C. Company C is owned by the CFO of Company A.

- 78% faster regulatory compliance checks

- 65% reduction in manual review time for SEC filings

- One top 10 global bank cut AML investigation time from 45 minutes to 17 minutes per case

What Goes Wrong (And How to Fix It)

RAG isn’t magic. Poor implementation leads to failure. The biggest mistake? Bad document chunking. Financial statements aren’t paragraphs. They’re structured tables, footnotes, and cross-references. If you split a balance sheet in half, RAG loses context. Tellen.ai’s analysis of 22 failed RAG deployments found that 58% of failures came from improper chunking. Other common pitfalls:- Using generic embeddings trained on Wikipedia, not financial reports

- Not tagging documents with metadata: reporting period, GAAP/IFRS standard, instrument type

- Updating the knowledge base once a year-when SEC rules change monthly

- Train embeddings on 50,000+ financial documents (10-Ks, prospectuses, audit letters)

- Tag every document with 15+ financial attributes

- Refresh the knowledge base within 24 hours of regulatory updates

- Always include human review for high-stakes decisions

Real-World Impact: Compliance, Fraud, and Customer Service

RAG isn’t just for back-office teams. It’s reshaping finance across the board. Regulatory Compliance - The SEC now requires material events to be disclosed within 72 hours. RAG systems monitor filings in real time, flagging changes to revenue recognition, related-party transactions, or debt covenants. Deloitte’s 2024 study found RAG achieves 94% effectiveness in tracking these updates. Fraud Detection - Financial fraud costs the global economy over $40 billion a year. RAG systems spot anomalies: unusual payment patterns, duplicate invoices, shell companies linked to insiders. GraphRAG’s ability to trace multi-institutional chains makes it especially powerful against money laundering. Customer Service - Banks using RAG in chatbots can answer complex questions like, “Why did my loan rate change after the Fed’s July hike?” by pulling from internal policy docs and rate tables-not guessing. Users on Reddit’s r/FinTech say it’s “instantly locating relevant sections in 500-page filings.” But they also warn: “It still struggles with non-standard instruments like derivatives.”

Adoption Trends and What’s Next

Adoption is accelerating. In 2023, only 12% of Fortune 500 financial firms used RAG. By 2024, that jumped to 38%. Gartner predicts the market will grow from $1.2 billion in 2024 to $4.7 billion by 2027. Most deployments focus on:- Fraud detection (67%)

- Regulatory compliance (58%)

- Customer service (42%)

- Agentic AI - RAG will team up with autonomous agents that can investigate anomalies without human prompts. Expected by 2026.

- Standardized Financial Graphs - Institutions will start sharing common knowledge graph schemas. Target: 2027.

- Regulatory Acceptance - Regulators may soon accept RAG-generated analysis as valid audit evidence. Anticipated by 2028.

Final Thought: AI as a Force Multiplier

RAG doesn’t replace analysts. It frees them. Instead of spending days digging through documents, finance professionals now spend hours interpreting insights. They focus on strategy, judgment, and relationships-things AI can’t do. As the CFA Institute put it: RAG is a “force multiplier.” It turns hours of grunt work into minutes of insight. And in finance, where accuracy is everything and time is money, that’s not just useful-it’s essential.What is RAG in finance?

RAG stands for Retrieval-Augmented Generation. In finance, it’s an AI system that answers questions by pulling information from your own financial documents-like SEC filings, audit reports, and internal policies-and then explaining it in plain language. Unlike regular AI, it doesn’t guess. It shows its sources.

How is GraphRAG different from regular RAG?

Regular RAG looks at documents one at a time. GraphRAG connects them. It builds a map of relationships between companies, people, accounts, and transactions. This lets it detect fraud that spans multiple entities-like money flowing from Company A to B to C, where C is secretly owned by A’s CEO. Regular RAG misses this. GraphRAG spots it.

Can RAG replace auditors or compliance officers?

No. RAG is a tool, not a replacement. It finds and verifies facts quickly, but it can’t judge intent, interpret gray areas, or make ethical decisions. Human oversight is critical. Without it, you risk “compliance theater”-thinking you’re safe because AI says so, when you’re not.

Why do RAG systems sometimes fail in finance?

Most failures come from poor document preparation. If financial statements are split into small chunks that break tables or footnotes, the AI loses context. Other causes: using generic AI models trained on web text instead of financial documents, not tagging data with key metadata like reporting period or accounting standard, and updating the knowledge base too infrequently.

What’s the best way to start implementing RAG in finance?

Start with one high-impact use case: regulatory compliance or fraud detection. Gather your core documents-10-Ks, audit reports, internal policies. Clean and chunk them properly, preserving financial context. Use domain-specific embeddings trained on financial texts. Tag everything with metadata. Connect to a cloud-based RAG platform like AWS Bedrock. Test with real questions. Add human review. Scale from there.

Is RAG secure for sensitive financial data?

Yes-if you control the data. Cloud-based RAG systems like AWS Bedrock allow you to upload your own documents without sending them to public AI models. Your data stays in your private knowledge base. Always verify the provider’s data handling policies. Never feed live customer data or unreleased earnings into public APIs.

How long does it take to implement RAG?

A basic RAG system can be set up in 1-2 months. GraphRAG, which connects complex relationships, takes 3-6 months. The biggest time sink isn’t tech-it’s preparing your documents. Cleaning, chunking, tagging, and validating financial data takes longer than building the AI pipeline.

What’s the cost of RAG for financial institutions?

Costs vary. Cloud-based RAG services (like AWS) charge per query and storage. Implementation costs include data preparation, domain expertise, and engineering. GraphRAG can cost 30-40% more than standard RAG due to complexity. But ROI is clear: one bank saved $2.3 million annually by cutting AML investigation time in half.