Bridge Account Calculator for Early Retirement

Bridge Account Calculator

Calculate how much you need to cover 10-15 years of expenses before accessing retirement accounts

Roth Conversion Ladder

Calculate your annual conversion amount using 2026 tax brackets

Your Bridge Account Requirements

Retiring in your 30s or 40s sounds like a dream-until you realize your portfolio might not last 50 years. The FIRE movement (Financial Independence, Retire Early) promises freedom, but it also exposes you to a silent killer: sequence risk. This isn’t just about market crashes. It’s about when they hit. And if you retire early, the timing could destroy your financial plan before you even notice.

Why Sequence Risk Is a Bigger Threat for Early Retirees

Most people think retirement planning is about how much money you have. But for FIRE folks, it’s about when you start taking money out. Sequence risk means bad returns in the first few years of retirement can permanently shrink your portfolio-even if the market recovers later. Take the 4% rule: withdraw 4% of your savings each year, and your money should last 30 years. Sounds simple. But that rule was built for someone retiring at 65. If you retire at 40, you’re betting your money will last 50+ years. That’s a whole different game. In 2008, someone retiring at 65 saw their portfolio drop 30%. They adjusted, waited, and eventually recovered. Someone retiring at 38? Same drop. But now they’re pulling money out for the next 50 years. That 30% loss isn’t a bump-it’s a hole. Studies show early retirees who faced 2008-level crashes had a 60% higher chance of running out of money. Nobel laureate William Sharpe called the 4% rule "dangerous" for early retirees. Why? Because it ignores how long you’re actually living off your savings. A 10% market drop in year one doesn’t just hurt-it cuts your long-term withdrawal rate from 4% down to 2.75% or lower. That’s not a tweak. That’s a lifestyle change.Bridge Accounts: Your Financial Lifeline

Here’s the problem: you can’t touch your 401(k) or IRA without a 10% penalty before age 59.5. Social Security? Not available until 66 or 67. So what do you live on for 15-25 years between early retirement and access to your retirement accounts? That’s where bridge accounts come in. These aren’t fancy investments. They’re your safety net-cash and low-risk assets you use to cover expenses while your retirement accounts sit untouched. Successful FIRE retirees don’t just have a big portfolio. They have a structured bridge account system. Most use three tiers:- Tier 1: 1-3 years of expenses in high-yield savings. As of February 2026, rates are hitting 4.5% APY. This is your emergency fund on steroids.

- Tier 2: 3-7 years of expenses in short-term Treasury bonds and CDs. These mature yearly, so you’re never stuck with low rates. You ladder them so one bond matures each year, giving you cash without selling investments.

- Tier 3: 7-15 years of expenses funded through Roth IRA conversions. This is the secret weapon.

The Roth Conversion Ladder: How It Actually Works

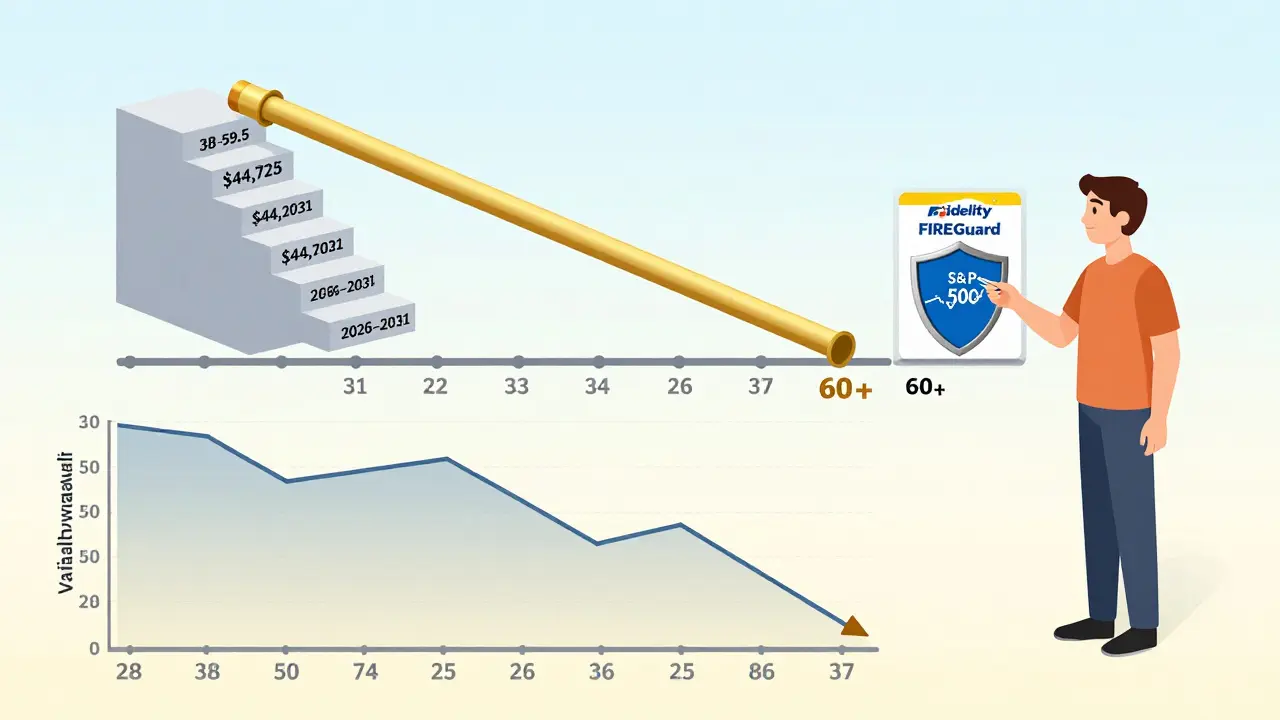

The Roth conversion ladder isn’t magic. It’s math. You convert a chunk of your traditional IRA to a Roth IRA every year-paying taxes now, so you can withdraw it tax-free later. Here’s the trick: you have to wait five years after each conversion before you can touch the converted amount without penalty. So if you convert $45,000 in 2026, you can withdraw it in 2031. Do it again in 2027? That money’s available in 2032. And so on. Why does this matter? Because you’re building a stream of penalty-free cash that starts flowing just as you need it. Most FIRE retirees target converting 80% of the 22% federal tax bracket limit-$44,725 for singles in 2026. That keeps taxes low while building a reliable income pipeline. One user on Reddit, u/EarlyRetireeJen, retired at 38 with a $1.2M portfolio. She converted $42,000 yearly from 2020 to 2025. By 2026, she had $210,000 in Roth funds available. That covered her expenses during the 2022 market crash-no need to sell stocks at a loss.

How Much Do You Really Need in Bridge Accounts?

If you spend $50,000 a year, you need $500,000 to $750,000 in bridge accounts. Why so much? Because you’re covering 10-15 years of living costs before your retirement accounts unlock. Most people underestimate this. They think: "I have $2M. I can live off 4% = $80,000/year. Easy." But they forget: they can’t touch $1.5M of that until 59.5. That leaves only $500,000 in taxable accounts. If they spend $80,000/year, they burn through it in 6 years. Then what? They’re forced to sell retirement accounts early-with penalties. The fix? Build your bridge account before you retire. Experts recommend setting aside 15-20% of your pre-retirement income specifically for this. That means if you’re saving 60% of your income to retire early, you’re actually saving 75-80% to include the bridge. It adds 1.5-2 years to your savings timeline. But it’s worth it.What Happens When You Don’t Plan for Sequence Risk?

User u/CoastFIREChris had $1.5M saved and retired at 39. He stuck with 4.5% withdrawals-$67,500/year. He didn’t use a bridge account. He just pulled from his taxable portfolio. In 2022, the market dropped 18%. He didn’t cut spending. In 2023, it dropped another 12%. By 2024, at age 52, his portfolio hit zero. He didn’t run out of money because he spent too much. He ran out because he had no buffer. When stocks fell, he had to sell more shares to keep his lifestyle. That’s sequence risk in action. Meanwhile, 76% of failed FIRE cases cited insufficient bridge funding. And 89% didn’t account for healthcare costs. Early retirees think Medicare will cover them. But Medicare doesn’t start at 65 if you retire at 40. You need private insurance for 20+ years. That’s $10,000-$15,000/year-easily $200,000 in extra savings.

Modern Solutions: What’s New in 2026

The FIRE community is adapting. The old 4% rule is dead. New strategies are rising:- Variable Percentage Withdrawal: Instead of taking 4% of your original portfolio, you take 5% of your current balance each year. If your portfolio drops 20%, your withdrawal drops 20%. A 2025 study showed 94% survival rates over 50 years.

- FIREGuard: Fidelity launched this product in January 2026. It’s a structured note that gives you 70% exposure to the S&P 500 but guarantees 90% of your principal after 10 years. Returns are capped at 8%, but it stops you from losing big in crashes.

- Deferred Annuities: More FIRE retirees are buying income annuities that start paying at 85. They cover essentials like housing and food in old age, so you don’t outlive your money.

Real Talk: Is FIRE Still Possible?

Yes-but not the way it was sold. You can’t just save 60% of your income, invest in index funds, and call it done. You need a plan for the long haul. You need:- A bridge account with 10-15 years of expenses

- A Roth conversion ladder started 5+ years before retirement

- A flexible withdrawal strategy (like variable percentage)

- Healthcare costs baked into your budget

- A backup plan (part-time work, side income) for market crashes

What’s the biggest mistake early retirees make with sequence risk?

The biggest mistake is assuming the 4% rule works the same for a 50-year retirement as it does for a 30-year one. Early retirees often ignore the timing of market downturns. A 30% drop in year one can slash your safe withdrawal rate from 4% to under 3%, forcing drastic cuts later. Many don’t realize they need a buffer-cash or low-risk assets-to avoid selling investments at a loss during crashes.

Can I use my Roth IRA as a bridge account?

Yes-but only the contributions, not the earnings. You can withdraw your Roth IRA contributions anytime without penalty or tax. But if you withdraw earnings before 59.5, you’ll pay taxes and a 10% penalty. The Roth conversion ladder solves this: you convert traditional IRA funds to Roth over time, then withdraw the converted amounts after the 5-year holding period. This lets you access tax-free money before 59.5 without penalties.

How much should I save for bridge accounts?

Save enough to cover 10-15 years of your annual expenses. If you plan to spend $50,000/year, aim for $500,000-$750,000 in bridge accounts. This includes high-yield savings, short-term bonds, CDs, and Roth conversions. Most FIRE planners recommend allocating 15-20% of your pre-retirement income toward this goal-adding 1.5 to 2 years to your savings timeline.

Is the Roth conversion ladder complicated to set up?

It’s simple if you plan ahead. Each year, convert up to $44,725 (2026 single filer limit for 22% tax bracket) from your traditional IRA to Roth. Pay taxes on the conversion that year. Wait five years. Then withdraw the converted amount tax- and penalty-free. Do this annually, starting 5-7 years before retirement. Many use automatic transfers through their brokerage. The key is consistency-not perfection.

Do I need a financial advisor for FIRE planning?

Not necessarily, but it helps. As of 2025, 68% of certified financial planners offer FIRE-specific services. They can help you model sequence risk scenarios, optimize Roth conversions, and structure your bridge accounts. Fees range from $3,500-$5,000 for a full plan. If you’re comfortable with spreadsheets and IRS rules, you can do it yourself. But if you’re unsure, a one-time plan is worth the cost.

What if I retire before 59.5 and don’t have a bridge account?

You’ll be forced to rely on taxable accounts or take penalty-heavy withdrawals. Selling investments during a downturn can wipe out years of growth. Using Rule 72(t) for substantially equal payments is risky-miscalculations trigger retroactive penalties plus interest. Without a bridge, you’re gambling your retirement on market timing. Most experts say it’s not worth the risk. Build the bridge before you retire.

Royce Demolition

February 9, 2026 AT 12:27Mark Vale

February 10, 2026 AT 16:49Sabrina de Freitas Rosa

February 11, 2026 AT 03:00Erika French Jade Ross

February 13, 2026 AT 02:43Geoffrey Trent

February 14, 2026 AT 06:14