Trend Following: How to Ride Market Moves and Profit from Momentum

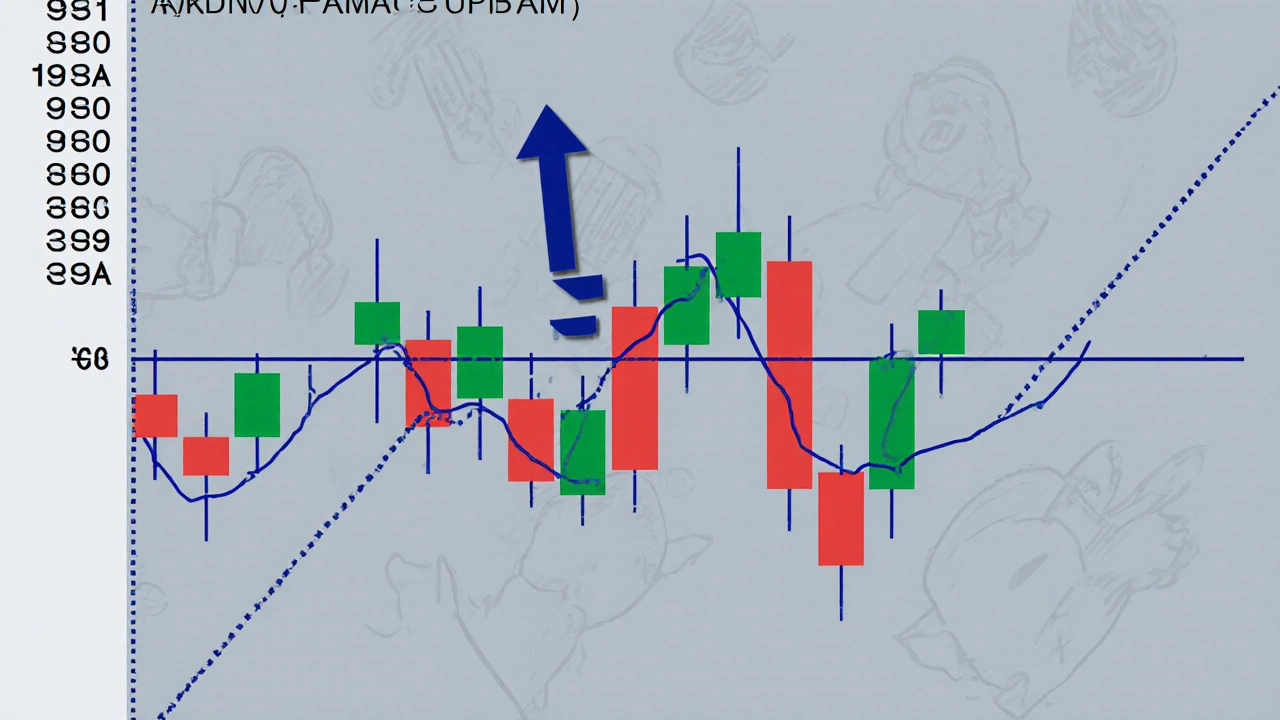

When you hear trend following, a trading strategy that buys when prices are rising and sells when they’re falling, without trying to predict when the trend will reverse. Also known as momentum trading, it’s one of the few methods that works across stocks, commodities, currencies, and even crypto—no matter the market or era. Unlike guessing when a stock will bounce back, trend following says: if it’s going up, get in. If it’s going down, get out. No opinions. No hope. Just rules.

This approach doesn’t rely on earnings reports, news headlines, or analyst forecasts. It trusts price action. And it’s not magic—it’s math. Systems use moving averages, breakouts, or volatility filters to spot when a trend starts and when it ends. You don’t need to know why a stock moved, just that it did. That’s why hedge funds, institutional traders, and even solo investors use it. It’s not about being right every time. It’s about letting winners run and cutting losers fast. The goal isn’t to catch the bottom or top—it’s to ride the middle part, where most of the profit lives.

Related tools like technical analysis, the study of historical price patterns and volume to forecast future movement often feed into trend following, but they’re not the same thing. Technical analysis is a broad toolkit—trend following is one specific way to use it. You’ll also see market trends, the general direction prices move over time—up, down, or sideways in nearly every post below. Some show how to spot them early. Others explain how to avoid fake breakouts that trap beginners. A few even break down how to combine trend following with dividend investing or emergency cash strategies to reduce risk.

What you won’t find here are predictions. No one knows if the S&P will hit 5,000 next month. But you can learn how to react when it does—whether it’s climbing, crashing, or coasting. The posts below give you real examples: how to set stop-losses that don’t get shaken out by noise, how to filter out false signals in choppy markets, and how to stick with the system when emotions scream to quit. Some use simple moving averages. Others use volatility-based exits. All of them follow the same core idea: let the market tell you what to do, not your fear or hope.

You’ll also see how trend following connects to other topics here—like understanding market cap to spot large-cap trends, or using dividend safety scores to avoid falling into a value trap during a downtrend. Even embedded lending and fintech automation can be analyzed through the lens of momentum: if a company’s cash flow is rising, its ability to offer invoice financing grows. It’s all connected.

There’s no perfect system. But trend following is one of the few that’s been tested across decades, bull markets, crashes, and sideways grind. If you’ve ever bought a stock because it "felt right" and lost money, or held too long hoping for a rebound, this is your reset. The posts below give you the practical steps—not theory, not hype. Just what works, when it works, and how to keep it simple.