Technical Analysis: How to Read Price Charts and Spot Market Trends

When you look at a stock chart and see a pattern rising like a staircase, that’s not just noise—it’s technical analysis, a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. Also known as chart analysis, it’s how traders decide when to buy or sell based on what the market has already done, not what someone says it might do next. Unlike guessing based on news or rumors, technical analysis works with hard data: price movements over time, trading volume, and patterns that repeat because human behavior doesn’t change much.

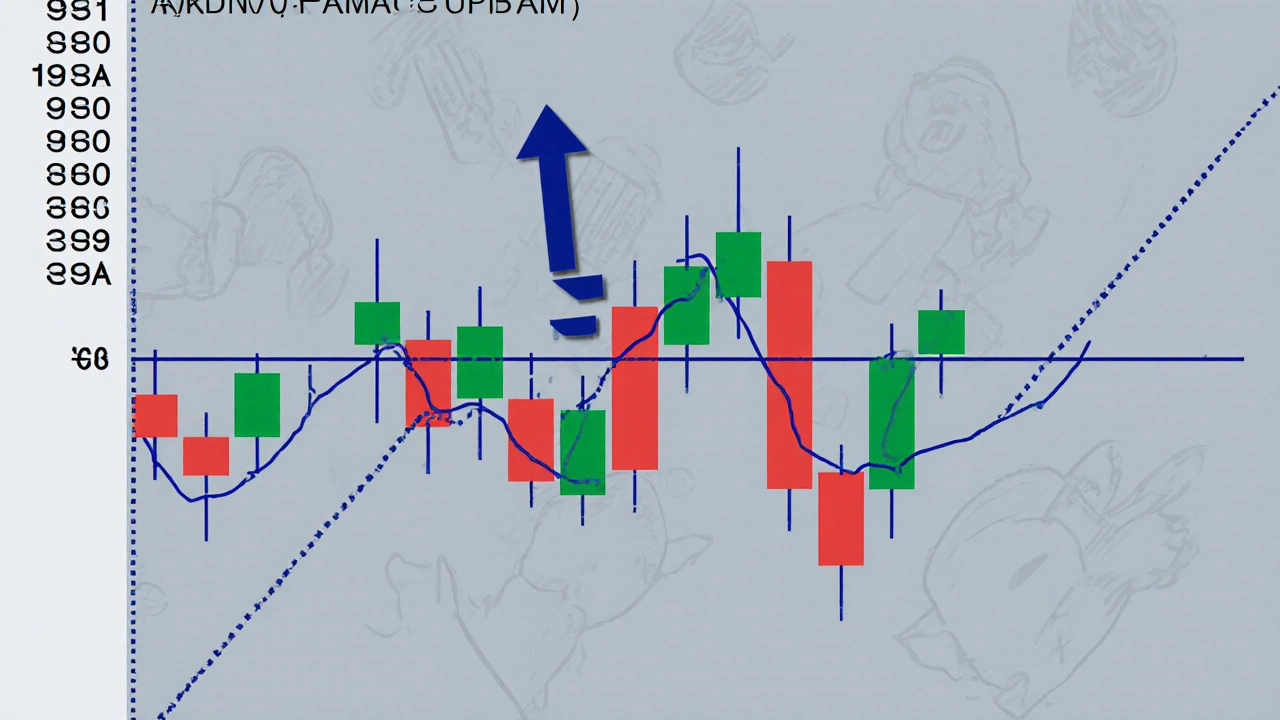

At its core, technical analysis relies on three things: price charts, visual representations of how an asset’s price has moved over time, chart patterns, repeating shapes like head and shoulders, flags, or triangles that signal potential future moves, and moving averages, smoothed lines that show the average price over a set period, helping filter out short-term noise. These aren’t magic spells—they’re tools. A head and shoulders pattern doesn’t guarantee a drop, but when it shows up with high volume, it’s a red flag traders watch closely. Moving averages help you see the trend: if the price is above the 50-day average, the short-term trend is up. Below it? Down. Simple, but powerful.

Traders don’t use these tools alone. They combine them. A breakout above a resistance level might mean nothing unless volume spikes. A bullish candlestick pattern means more when it lines up with a rising 200-day moving average. It’s like checking your GPS, traffic, and weather before driving—you don’t rely on just one signal. And while some people think this is all guesswork, the fact is, institutions and hedge funds use these methods daily. They’re not betting on luck; they’re reading the market’s fingerprints.

You won’t find perfect predictions here. But you will find patterns that show up again and again—because people still get greedy, scared, and impatient. That’s why technical analysis still works. The posts below show you exactly how real traders use these tools: spotting breakout setups, reading volume spikes, using support and resistance like a roadmap, and avoiding traps that look like opportunities. Whether you’re new to charts or just want to clean up your strategy, you’ll find practical, no-fluff examples that match what’s happening in today’s markets.