Taxable Accounts: How to Invest Smartly Outside Retirement Plans

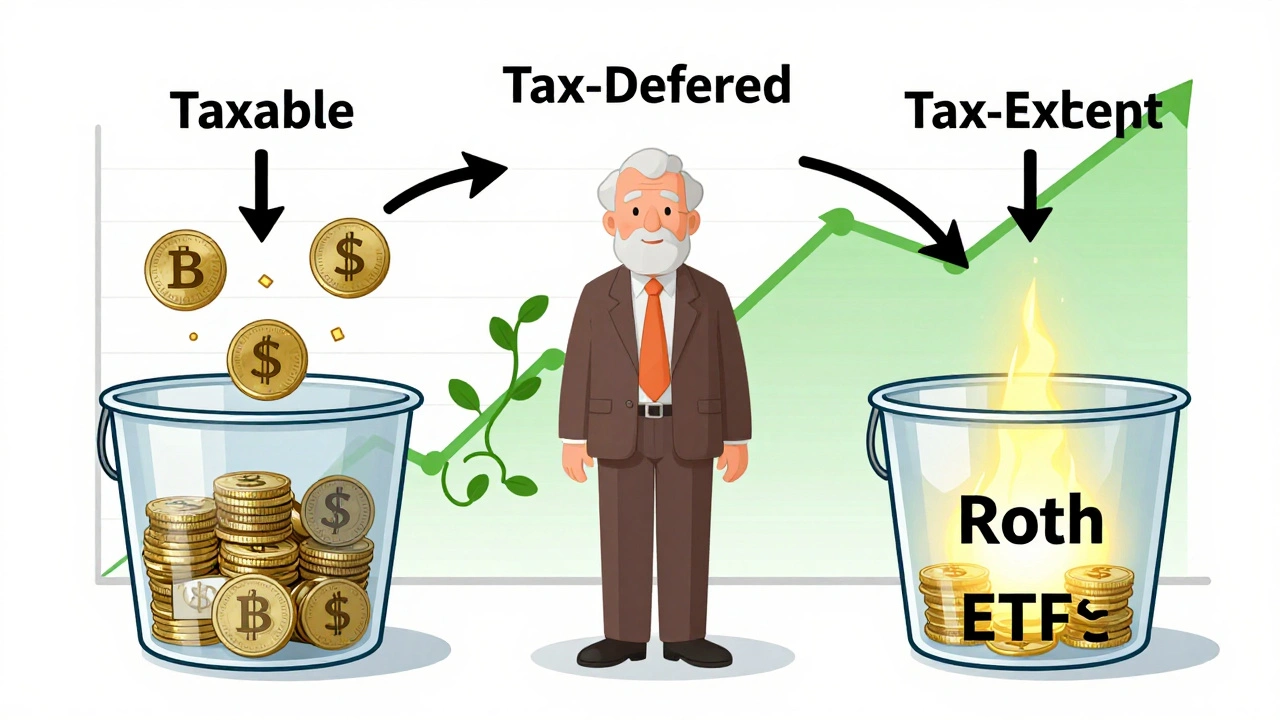

When you open a taxable account, a standard investment account where you pay taxes on earnings each year. Also known as a brokerage account, it gives you full control over when to buy, sell, or withdraw money—no early withdrawal penalties, no annual limits. Unlike a 401(k) or IRA, there’s no cap on how much you can put in. That’s why so many people use taxable accounts to save for goals like a home, college, or early retirement—anything that doesn’t fit inside retirement accounts.

But here’s the catch: every time you sell a stock for a profit, earn a dividend, or collect interest, the IRS takes a cut. Capital gains, the profit you make when you sell an asset for more than you paid are taxed differently depending on how long you held the investment. If you sell after a year, you pay the lower long-term rate. If you sell sooner, you’re hit with your regular income tax rate. Dividend taxes, the tax you pay on stock payouts also vary—qualified dividends get favorable rates, while non-qualified ones are taxed like regular income. Knowing this helps you choose the right investments for your taxable account: think low-turnover index funds, municipal bonds, or growth stocks that don’t pay dividends.

Many people make the mistake of putting high-yield bonds or REITs in taxable accounts because they’re easy to buy. But those generate ordinary income—taxed at your top rate every year. That’s why smart investors keep those in retirement accounts and use taxable accounts for assets that grow slowly and rarely distribute cash. It’s not about avoiding taxes—it’s about delaying them until you need the money, and paying the lowest rate possible when you do.

You’ll find posts here that show you how to build a taxable portfolio that works with your tax bracket, how to use tax-loss harvesting to offset gains, and which funds are designed to be tax-efficient. Whether you’re just starting out or looking to optimize an existing account, the tools and strategies below will help you keep more of what you earn.