Tax-Aware Asset Location: Where to Hold Investments to Keep More of Your Returns

When you invest, you don’t just care about how much your portfolio grows—you care about how much you keep. That’s where tax-aware asset location, the strategy of placing different types of investments in the most tax-efficient accounts to minimize your tax bill. Also known as tax-efficient asset placement, it’s not about picking winners—it’s about keeping more of what you already have. Many investors focus on returns but ignore how taxes eat into them. A bond fund in a taxable account can cost you hundreds or even thousands more in taxes each year than the same fund in a tax-deferred account. It’s not magic. It’s math.

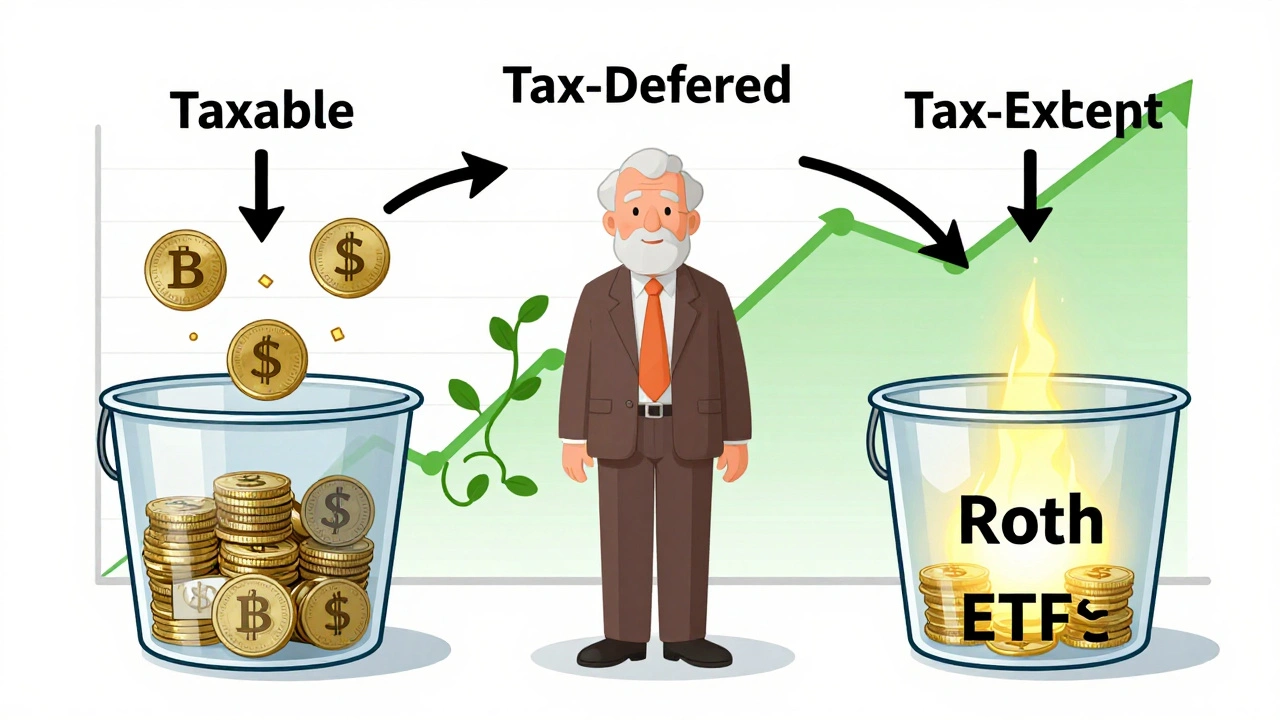

Think of your accounts as different containers: taxable accounts, IRAs, 401(k)s, and Roth accounts. Each has its own tax rules. taxable accounts, accounts where you pay taxes on interest, dividends, and capital gains every year are the most expensive places to hold investments that generate regular income. That means bonds, REITs, and high-dividend stocks? Keep them out of here if you can. Instead, put them in IRAs or 401(k)s where they grow without annual tax drag. Meanwhile, tax-efficient investing, the practice of choosing investments and account types that minimize your tax burden over time means putting growth stocks and index funds—those that generate mostly long-term capital gains—in your taxable accounts. Those gains are taxed at lower rates, and you only pay when you sell. And if you hold them long enough? You might never pay taxes on them at all, especially if you use tax-loss harvesting to offset gains.

This isn’t just theory. People who use tax-aware asset location regularly add tens of thousands to their retirement savings over time. One study showed a simple shift—moving high-yield bonds from a taxable account to a Roth IRA—could boost a 30-year portfolio by over $80,000 in after-tax value. That’s not because they picked better stocks. It’s because they moved the right assets to the right places. You don’t need a fancy advisor to do this. You just need to know which assets are tax-heavy and which are tax-light. And you need to know what your accounts can and can’t do.

What you’ll find below are real, practical guides that break this down step by step. From how to spot which funds are dragging down your returns with taxes, to how to use tax-loss harvesting without triggering the wash sale rule, to why holding a dividend stock in a Roth IRA might be a waste of space—these posts cut through the noise. You’ll learn how to match your investments to your accounts like puzzle pieces, not guesswork. No jargon. No fluff. Just what works.