Record Date: What It Means for Dividend Investors and When You Get Paid

When a company pays a dividend, the record date, the official cutoff date used to identify shareholders eligible for a dividend payout. Also known as the date of record, it’s the moment the company locks in its list of owners who will receive cash—no more, no less. If you buy the stock on or after the record date, you won’t get the dividend. It doesn’t matter if you owned it yesterday. What matters is whether your name was on the shareholder list at the exact time the company closed its books.

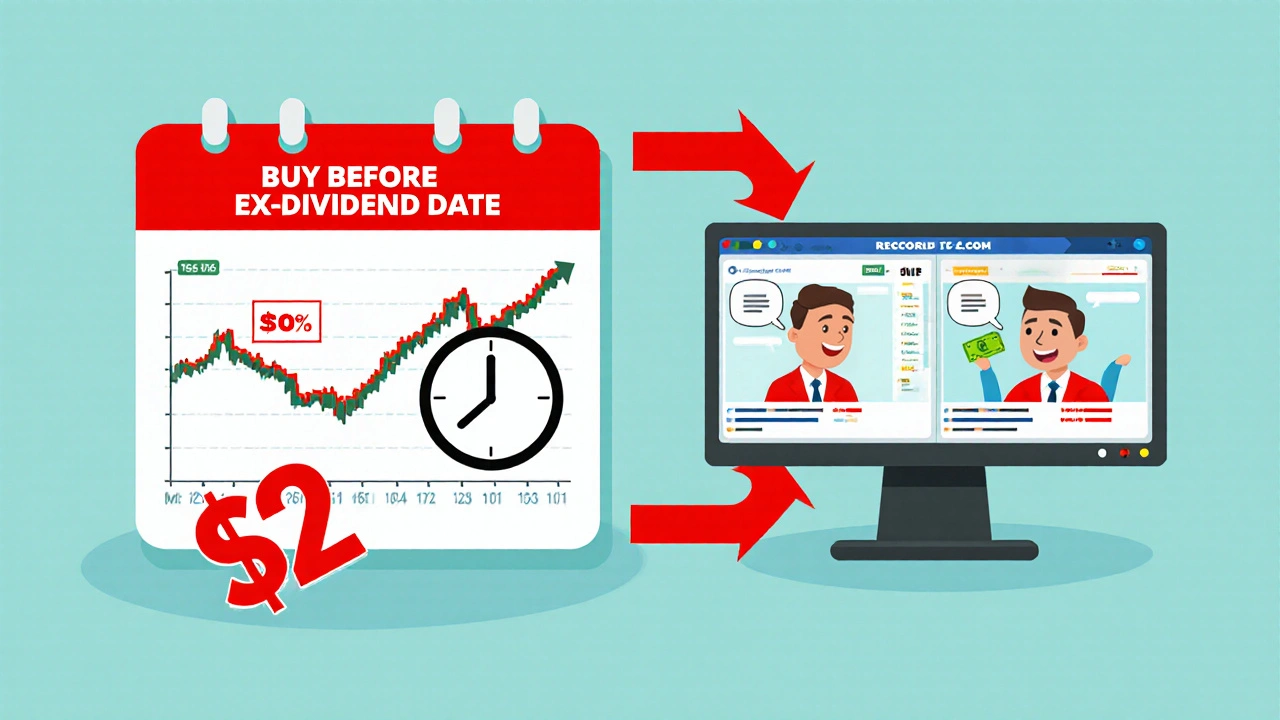

This isn’t just paperwork. The ex-dividend date, the day the stock starts trading without the upcoming dividend. Also known as XD date, it’s usually one business day before the record date. If you buy on or after the ex-dividend date, the seller gets the dividend, not you. That’s why smart investors track both dates like a clock. The dividend payment date, when the actual cash lands in your brokerage account. Also known as pay date, it’s when the money hits your account—sometimes weeks after the record date. You can own the stock on the record date and still wait 30 days to see the cash. Meanwhile, the stock price often drops by roughly the dividend amount on the ex-dividend date, because the company’s value decreases once it commits to paying out cash.

Why does this matter? Because dividend investors rely on predictable income. If you’re counting on that check to cover bills, missing the record date means a month of uncertainty. Companies like Coca-Cola or Johnson & Johnson don’t change their dates often, but smaller firms might. And if you’re trading options or using dividend strategies like the dividend capture method, timing the record date wrong can cost you more than just a few dollars—it can break your whole plan.

You’ll see this come up in posts about dividend cut risks—because companies that slash dividends often do it after missing cash flow targets, and shareholders who held through the record date still get the reduced payout. You’ll also see it in guides about dividend-paying stocks vs growth stocks, where income seekers treat the record date like a deadline. Even taxable brokerage accounts are affected: the IRS cares about when you received the dividend, not when you bought the stock. So if you’re tracking capital gains and dividend income together, the record date helps you sort out what’s taxable and when.

There’s no magic to it. It’s a simple system: name on the list = check in the mail. But that simplicity hides a trap. Many new investors think buying right before the payout is a free lunch. It’s not. The market adjusts. The real edge isn’t timing the record date—it’s knowing which companies have the cash to keep paying it long after the date passes.

Below, you’ll find real-world examples of how record dates connect to dividend safety scores, broker reporting, and even how fintech tools now auto-track these dates for you. Whether you’re holding for income or just trying to avoid a surprise, this is the kind of detail that separates confident investors from those who guess.