MACD Indicator: How to Use Moving Average Convergence Divergence for Better Trading Decisions

When you're trying to figure out if a stock is about to move up or down, the MACD indicator, a technical analysis tool that shows the relationship between two moving averages of a price. Also known as moving average convergence divergence, it helps traders see when momentum is building or fading—without guessing. Unlike simple price charts, the MACD turns price action into a clear signal you can act on. It’s not magic, but it’s one of the most used tools by traders who want to avoid emotional decisions.

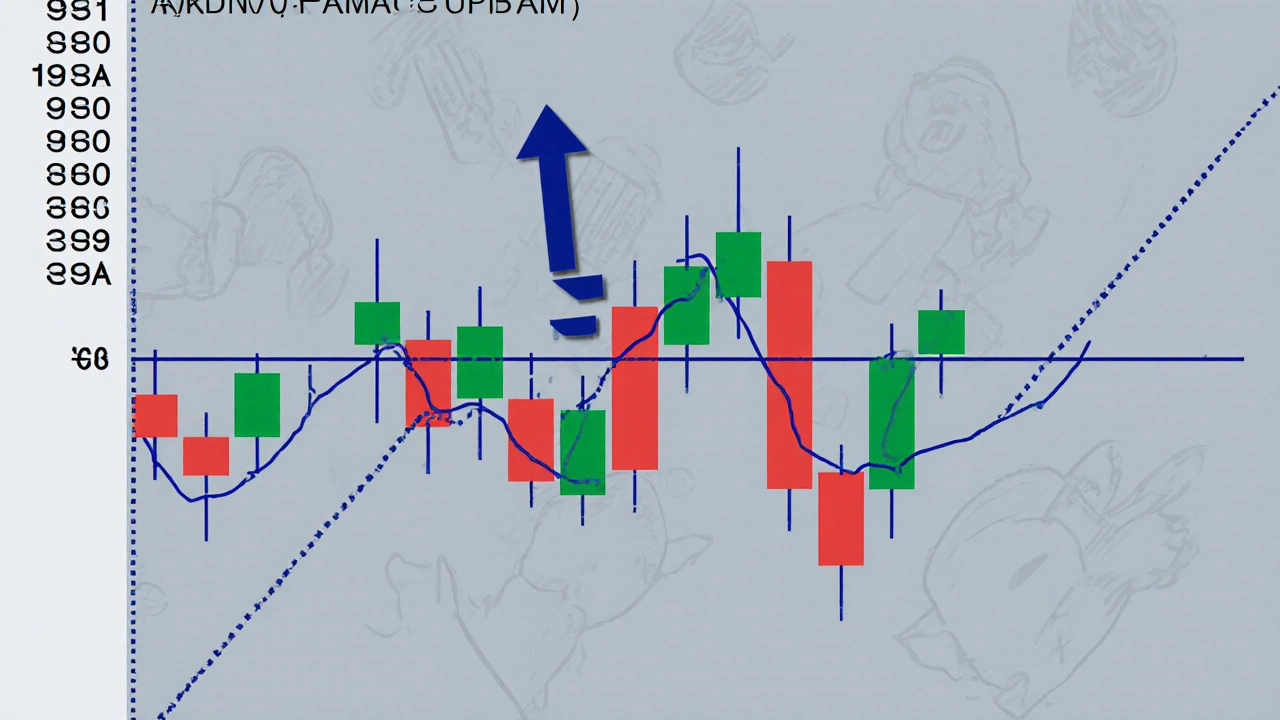

The MACD indicator works by comparing two moving averages: a fast one (usually 12 days) and a slow one (26 days). The difference between them becomes the MACD line. Then there’s a signal line—a 9-day moving average of that MACD line. When the MACD line crosses above the signal line, it often means buying pressure is increasing. When it drops below, sellers are gaining control. Traders also watch for divergence, when price moves one way but the MACD moves the opposite way—that’s a red flag that the trend might be losing steam. And the histogram? That’s just the gap between the MACD line and the signal line, showing how strong the momentum is at any moment.

You’ll see the MACD indicator pop up in almost every trading platform because it’s simple, reliable, and works across time frames—from day trading to long-term investing. It doesn’t tell you what to buy, but it helps you decide when to act. For example, if you’re watching a stock that’s been rising for weeks, but the MACD histogram starts shrinking, that’s not a sign to jump in—it’s a sign to check if the rally is running out of gas. And when you combine it with volume or support levels, it becomes even sharper.

It’s not perfect. Like any tool, it gives false signals, especially in choppy markets. But used right, it cuts through the noise. The posts below show how real traders apply the MACD indicator to spot entry points, avoid traps, and confirm trends with other indicators. You’ll find examples from actual trades, breakdowns of common mistakes, and how to adjust settings for different assets. Whether you’re new to charts or just trying to refine your strategy, these guides give you the practical side—no theory without action.