Economic Indicators: What They Really Tell You About Markets and Your Money

When you hear economic indicators, measurable statistics that reveal the health of an economy. Also known as macroeconomic data, they’re not just numbers on a screen—they’re the pulse of markets, jobs, and your portfolio. These stats don’t live in a vacuum. They shape interest rates, influence stock prices, and decide whether your paycheck keeps up with rent. If you’re investing, you need to know what these numbers mean—before the news hits.

Take GDP, the total value of all goods and services produced in a country over a period. It’s the big-picture metric everyone watches, but it doesn’t tell you if people are actually better off. A rising GDP can mean companies are booming while wages stay flat. That’s why you also need inflation rate, how fast prices for everyday items like gas, food, and rent are climbing. If your investments return 5% but inflation hits 6%, you’re losing money—even if your account balance goes up.

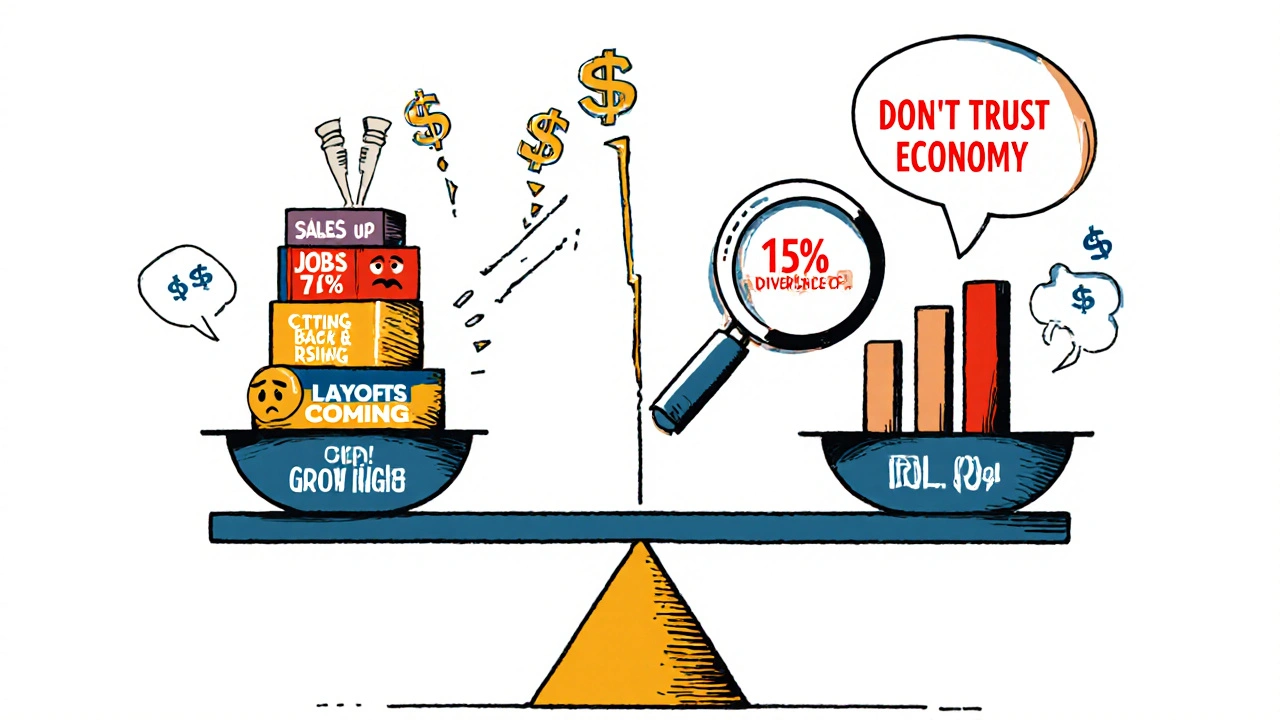

Then there’s the unemployment rate, the percentage of people actively looking for work but unable to find it. A low rate sounds good, but if it’s because people stopped looking, it’s a red flag. And don’t ignore consumer confidence, how optimistic people feel about spending and the economy. When people stop buying, companies pull back. That ripple affects earnings, dividends, and stock prices long before the headlines catch up.

These aren’t abstract ideas. They’re the hidden drivers behind every dividend cut, bond yield shift, and stock surge you see. The posts below break down exactly how these indicators connect to real investment decisions—like why a spike in inflation might make you rethink your bond holdings, or how falling consumer confidence could signal trouble for growth stocks. You’ll find clear explanations of what each number means, how to spot when it’s misleading, and what to do next. No jargon. No fluff. Just what you need to read the economy like a pro.