Dividend Stocks: How to Build Reliable Passive Income with Safe Payouts

When you buy dividend stocks, shares in companies that regularly pay a portion of their profits to shareholders. Also known as income stocks, they’re one of the most straightforward ways to get paid just for owning part of a business. Unlike stocks that only grow in price, dividend stocks give you cash every quarter—no selling needed. That’s why millions use them to fund retirement, cover bills, or build long-term wealth without touching the principal.

But not all dividend stocks are created equal. Some look great on paper but can slash payouts overnight. That’s where payout ratio, the percentage of earnings a company pays out as dividends becomes your first line of defense. If a company pays out more than it earns, the dividend is at risk. Combine that with dividend cut risks, early warning signs like falling cash flow or rising debt, and you start seeing which companies can actually keep paying. Then there’s the ex-dividend date, the cutoff day you must own the stock to get the next payout. Miss it by a day, and you get nothing—even if you buy the next morning.

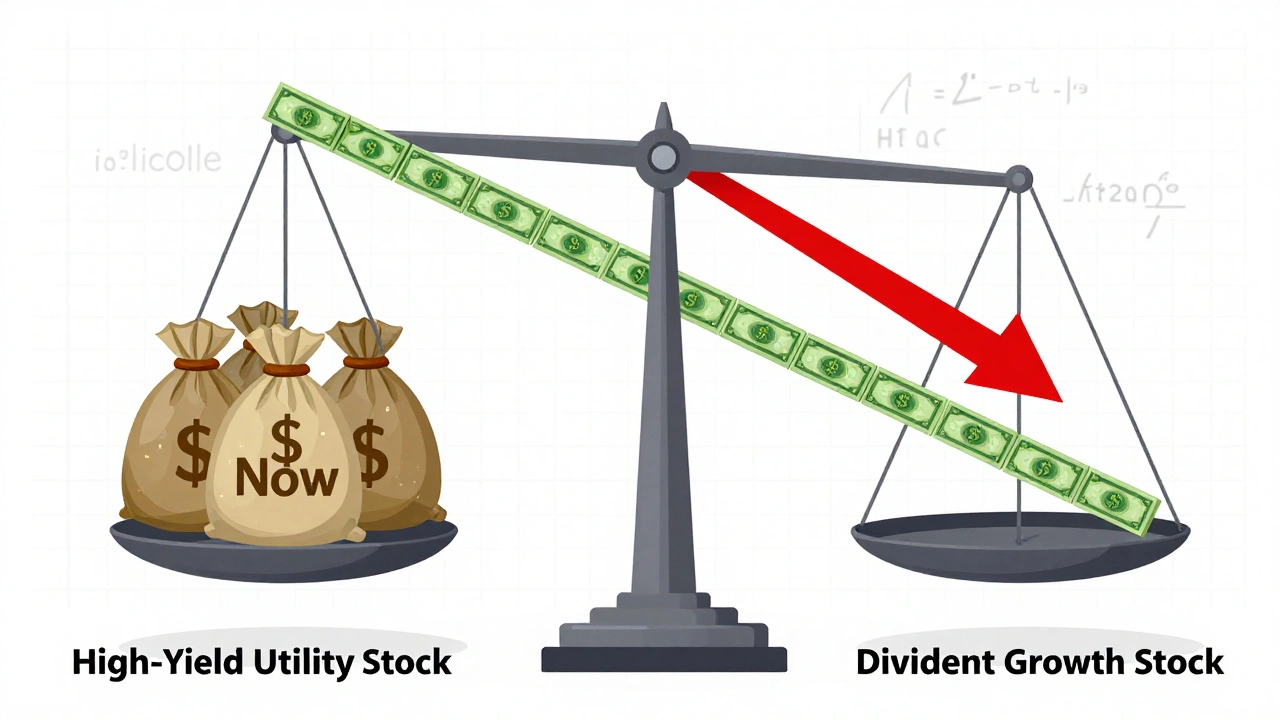

Most people think dividend investing is just about picking high-yield stocks. But the real winners focus on safety, consistency, and financial strength. Companies that raise dividends every year for a decade or more are often the ones that survive recessions and outlast the hype. You don’t need to chase 8% yields—those usually come with red flags. Instead, look for steady 2-4% payers with strong balance sheets and real earnings growth. The best dividend investors don’t trade frequently. They hold, collect, and reinvest. And they know exactly what to watch for before buying.

Below, you’ll find clear, no-fluff guides on how to spot dividend traps before they ruin your income, what the ex-dividend date really means in 2025, and how to use simple metrics like payout ratios to protect your cash flow. No jargon. No hype. Just what works.