Delayed Social Security: When to Claim and What It Really Means for Your Retirement

When you delayed Social Security, the decision to wait past your full retirement age to start receiving benefits, you’re not just pushing back a check—you’re locking in a higher monthly payout for life. For most people, waiting until age 70 increases your benefit by up to 8% per year after your full retirement age, which is 67 if you were born in 1960 or later. That’s not a small bump—it’s a guaranteed, inflation-adjusted raise that lasts as long as you live. And unlike stocks or bonds, this raise comes from the government with zero risk of loss.

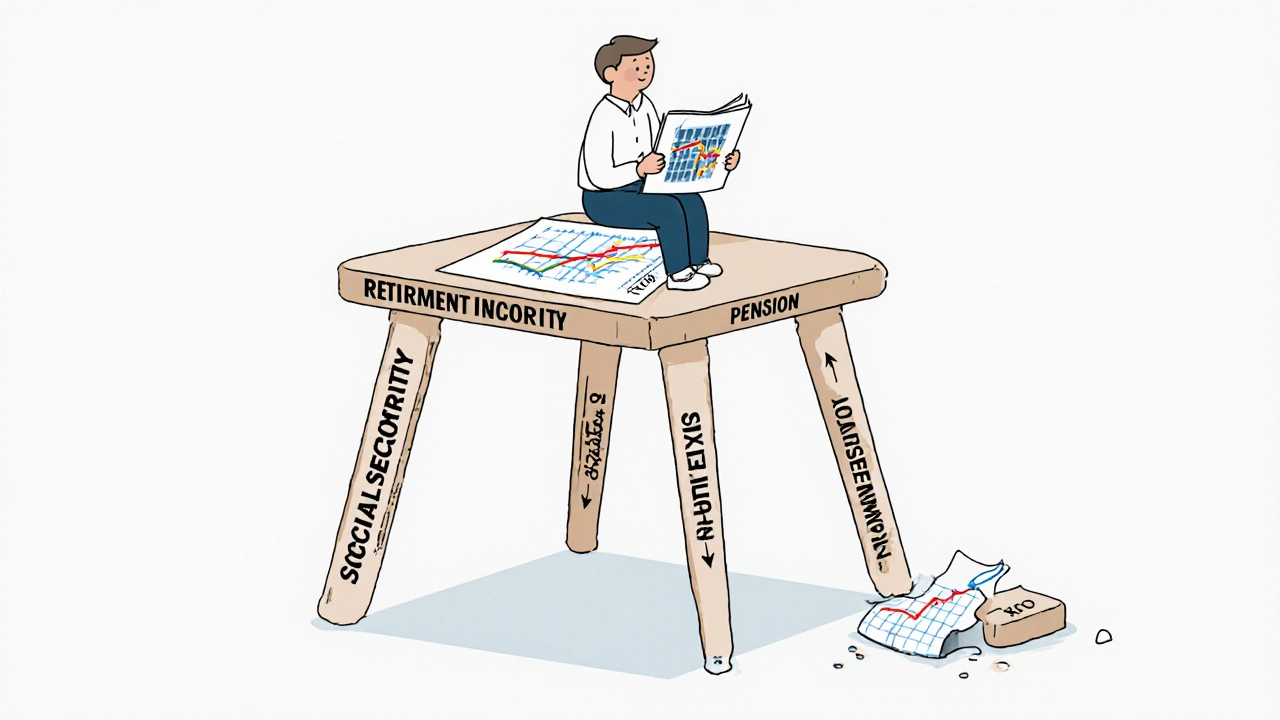

This choice doesn’t happen in a vacuum. It connects directly to retirement planning, how you structure your income streams after you stop working. If you’re still working, have other savings, or don’t need the money right away, delaying can make sense. But if you’re relying on Social Security to cover rent or medical bills, claiming early might be your only option. It’s not about being greedy—it’s about matching your timing to your life. And it’s not just about the number on the check. It affects your spouse’s survivor benefits, your tax bill, and even how long your retirement savings last. Many people don’t realize that full retirement age, the age at which you qualify for your full Social Security benefit without reduction varies by birth year, and claiming before it means a permanent cut. For example, claiming at 62 instead of 67 can reduce your benefit by 30%—and that reduction sticks forever.

There’s no one-size-fits-all answer. Some people delay because they’re healthy and expect to live long. Others delay because they’re still earning and want to avoid the earnings test (which cuts your benefits if you earn too much while claiming early). Some delay to leave a bigger legacy for their spouse. The posts below show real cases—people who waited and saw their monthly checks jump, people who regretted waiting too long, and people who used the extra time to pay off debt or build other income streams. You’ll find breakdowns of how delaying affects your taxes, how it plays with pensions, and why it’s not always the best move for everyone. There’s no magic age. But knowing the math, the rules, and how your personal situation fits into the bigger picture? That’s what turns confusion into confidence.