Asset Location: Where to Hold Investments for Maximum Tax Efficiency

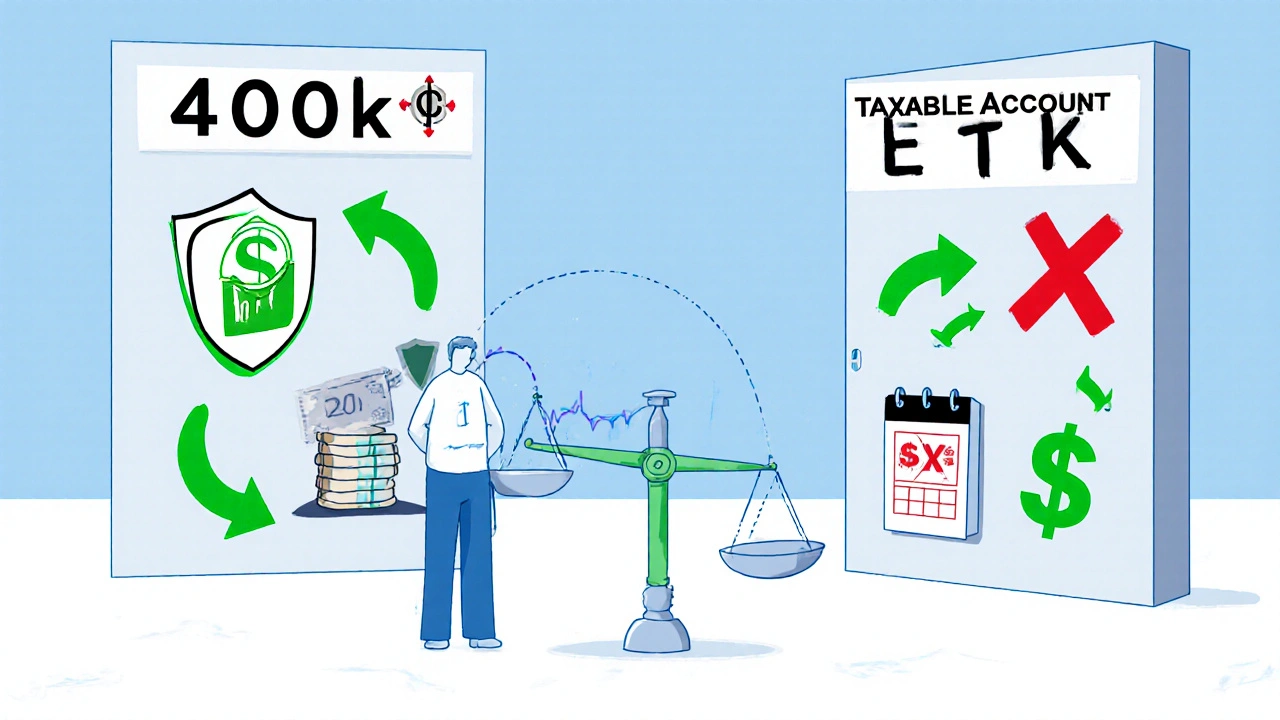

When you think about investing, you probably focus on asset allocation—which stocks, bonds, or funds to buy. But asset location, the strategic placement of investments in different types of accounts to minimize taxes. Also known as tax-efficient placement, it’s the quiet game-changer most investors ignore. You could own the exact same portfolio, but if you hold bonds in a taxable account and stocks in a Roth IRA, you’re leaving hundreds—maybe thousands—on the table every year.

Here’s the simple truth: not all investments are taxed the same. taxable brokerage accounts, standard investment accounts where you pay taxes on dividends and capital gains each year. They’re fine for long-term growth stocks that don’t pay much in dividends. But put bonds or REITs there? You’ll get hit with ordinary income tax rates every year. That’s where retirement accounts, tax-advantaged accounts like 401(k)s and IRAs that defer or eliminate taxes on growth. come in. Holding high-yield assets inside these accounts shields them from annual taxes. And if you’re using a Roth IRA, you get tax-free growth forever. It’s not magic—it’s math.

Most people don’t realize how much their account choices affect their net returns. A bond fund paying 4% in a taxable account might only net you 2.5% after taxes. The same fund in a Roth IRA? You keep the full 4%. Over 20 years, that difference compounds into tens of thousands. And it’s not just about retirement accounts. Even the order you use your accounts matters—withdraw from taxable accounts first, then tax-deferred, then Roth. It keeps your tax bill lower in retirement.

The posts below show you exactly how top investors use asset location to their advantage. You’ll see how taxable brokerage accounts fit into real portfolios, why retirement accounts aren’t one-size-fits-all, and how to avoid common mistakes that drain your returns. No theory. No fluff. Just clear, actionable steps anyone can follow to make their money work harder—without taking on more risk.