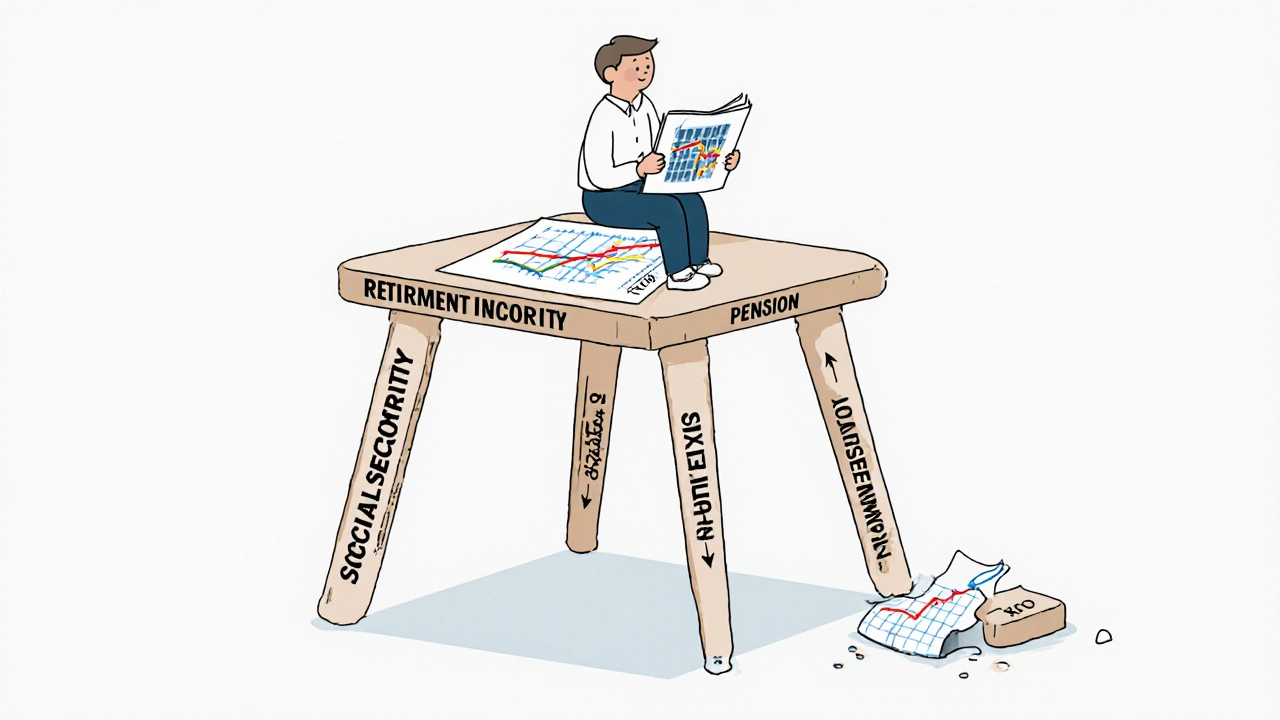

Social Security claiming: When to start and how to maximize your benefits

When you think about Social Security claiming, the decision of when to start receiving retirement benefits from the U.S. government. Also known as Social Security retirement benefits, it’s not just about turning 62—it’s about how long you’ll get paid, how much you’ll get, and whether you’ll outlive your money. Most people assume the earliest age—62—is the best choice. But that’s often the worst move if you’re healthy, working, or planning to live past 80. Claiming early locks you into a permanently reduced benefit, sometimes by as much as 30%. On the flip side, waiting until 70 can boost your monthly check by up to 8% for every year you delay past your full retirement age.

Your full retirement age, the age at which you qualify for 100% of your earned Social Security benefit. Also known as FRA, it ranges from 66 to 67 depending on your birth year is the tipping point. If you were born in 1960 or later, your FRA is 67. Claim at 62? You get 70% of your full benefit. Wait until 70? You get 124%. That’s not a guess—it’s a math rule set by the Social Security Administration. And if you keep working while claiming early, your benefits can be temporarily reduced if you earn over $21,240 in 2025. That penalty disappears once you hit FRA, but why lose money for years just to get it back later?

Delayed retirement credits, the extra money you earn by waiting to claim Social Security after your full retirement age are one of the safest, guaranteed returns you’ll ever get—8% per year, tax-free, adjusted for inflation. No bond, CD, or annuity offers that kind of security. And if you’re married, your claiming decision doesn’t just affect you—it affects your spouse’s survivor benefit. If you die first, your spouse gets the higher of your benefit or theirs. Waiting until 70 can mean tens of thousands more in lifetime payments for them.

This isn’t just about numbers. It’s about your health, your job, your family, and your risk tolerance. If you’re in poor health or work a physically demanding job, claiming early might make sense. If you’re still employed, have savings, or want to leave more behind, waiting could be the smarter play. And if you’re divorced but married for at least 10 years? You might be eligible for spousal benefits even if your ex hasn’t claimed yet.

The posts below break down exactly how to navigate this system. You’ll find clear guides on how to calculate your optimal claiming age, what happens if you work while collecting, how spousal and survivor benefits interact, and why the Social Security Administration’s own tools often give misleading advice. No fluff. No jargon. Just real-world strategies people are using right now to protect their retirement income.