Retirement Portfolio: Build a Steady Income Stream That Lasts

When you think about your retirement portfolio, a collection of investments designed to generate income and preserve capital during your later years. Also known as a retirement savings plan, it’s not just what you save—it’s how you invest it that determines whether you’ll live comfortably or worry about running out. Most people focus on how much they put into their 401(k), but the real question is: what’s in it? A retirement portfolio that leans too heavily on growth stocks might crash when you need it most. One that’s too conservative might lose value to inflation. The trick is balance—knowing which assets to hold, when to shift them, and how to protect your income.

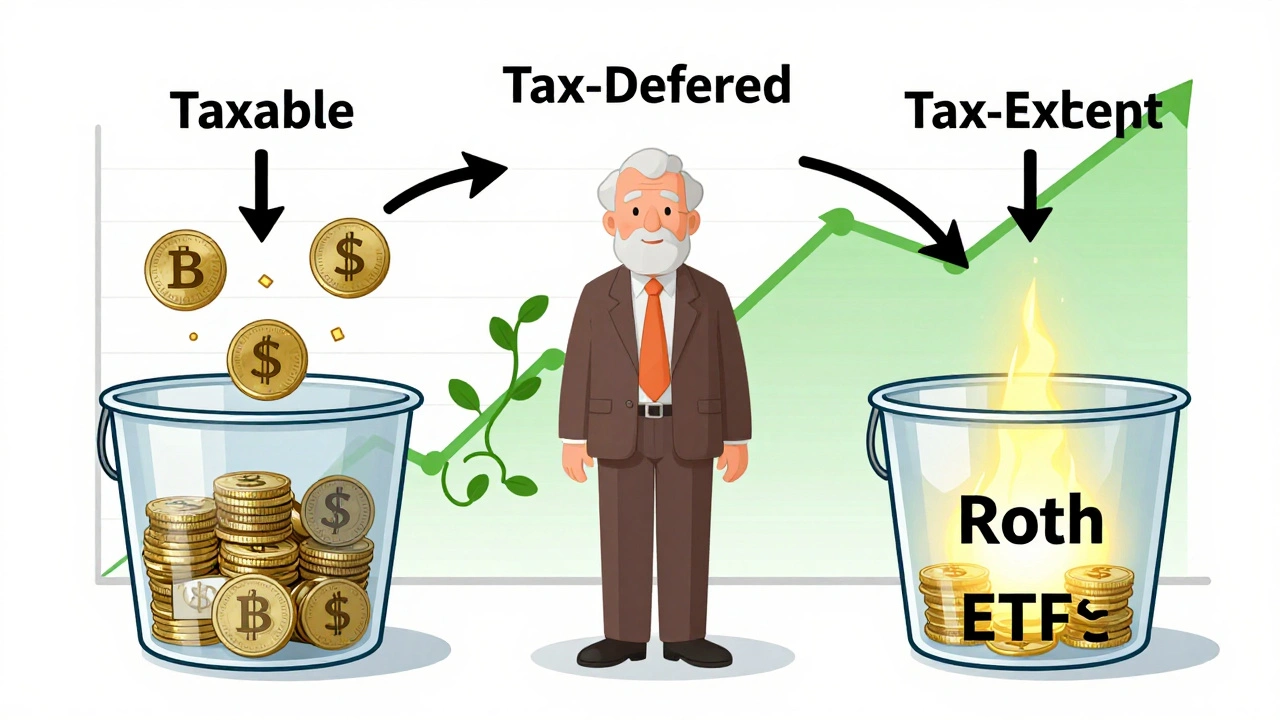

Your dividend stocks, companies that pay regular cash distributions to shareholders. Also known as income stocks, they’re a core part of many retirement portfolios because they don’t just grow—they pay you while you wait. Think of them like a paycheck from your investments. But not all dividends are safe. Some companies cut payouts when times get tough. That’s why you need to check payout ratios, cash flow, and dividend safety scores before buying. Your tax-efficient investing, the practice of placing investments in accounts to minimize taxes and keep more of your returns. Also known as asset location, it can add tens of thousands to your retirement savings over time. Holding bonds in a taxable account? That’s a mistake. Holding growth stocks in a Roth IRA? That’s smart. Where you put your money matters as much as what you buy.

And then there’s your risk tolerance, how much volatility you can handle emotionally and financially without panicking. Also known as investment personality, it’s not just about age—it’s about your sleep quality when the market drops. A 60-year-old might handle more risk than a 30-year-old if they’ve got a big emergency fund. A 30-year-old might be terrified of losses if they’ve never seen a bear market. Take a real quiz—not a flashy online test—to find your true number. Then build your retirement portfolio around it, not the other way around.

Asset allocation isn’t a one-time setup. It’s a living plan. You’ll need to rebalance every year, adjust for inflation, and watch for changes in interest rates that affect bond yields and dividend valuations. You’ll also need to know when to use Treasury bills for short-term safety, or how to avoid dividend traps that look great on paper but leave you empty-handed. This collection of posts gives you the tools to do it right—no fluff, no jargon, just clear strategies that work in real life. Whether you’re just starting out or fine-tuning an existing plan, you’ll find what you need here.