Retirement Income: How to Build Reliable Cash Flow in Your Golden Years

When you stop working, your retirement income, the steady stream of money you live on after leaving the workforce. Also known as passive income in retirement, it’s not about luck—it’s about what you set up years before. Most people think they need a huge nest egg, but the real secret is having money come to you regularly, without you having to sell assets or panic during market dips.

That’s where dividend stocks, shares in companies that pay out a portion of profits to shareholders each quarter come in. They turn your savings into a paycheck that can grow over time. Then there’s Treasury bills, short-term government loans that pay fixed interest with almost zero risk. They’re not flashy, but they’re the quiet backbone of safe retirement cash flow. And if you’re still working, you’re not too late—retirement planning, the process of deciding how much to save, where to invest, and when to start drawing income—is about making small, smart moves now that compound into big results later.

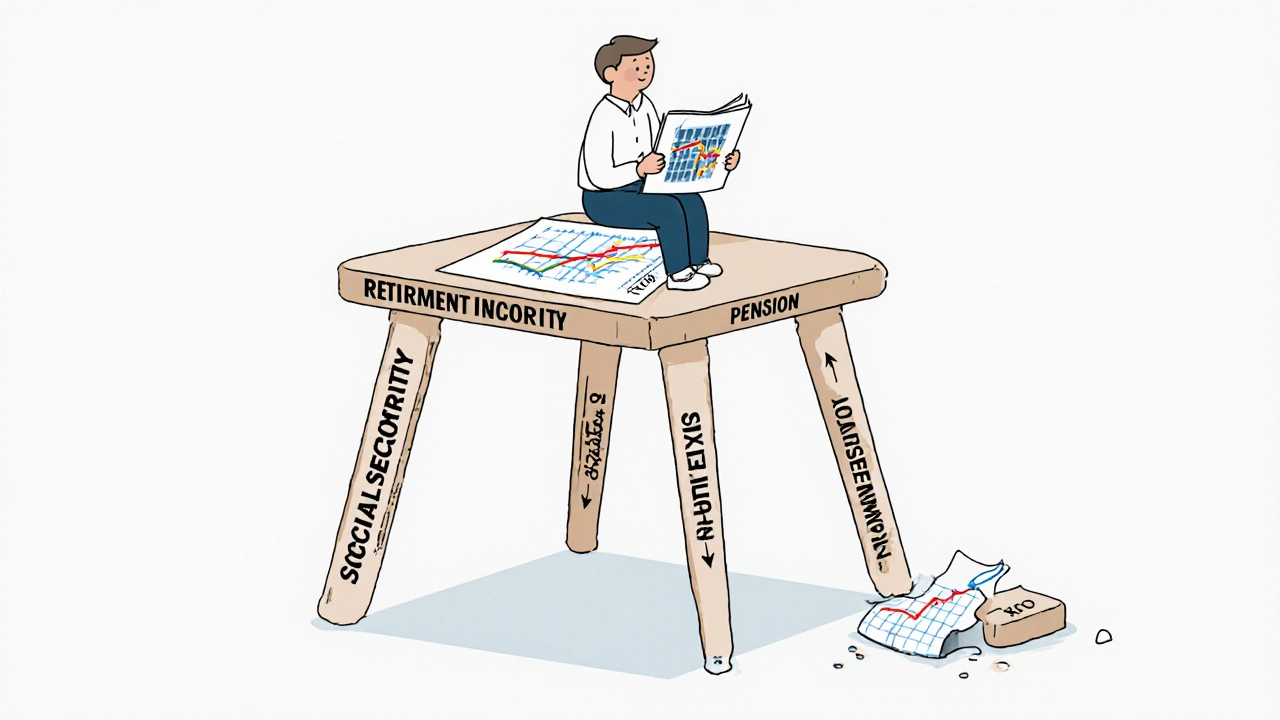

Real retirement income doesn’t rely on one source. It’s built from layers: dividends from stocks that pay reliably, interest from T-bills that don’t lose value, and maybe even income from rental properties or side businesses. It’s about avoiding traps like companies that cut dividends or bonds that get called away early. You need to know when to buy, when to hold, and how to spot trouble before it hits your pocket. The posts below show you exactly how to do that—no jargon, no fluff. You’ll find out how to check if a dividend is safe, why T-bills beat savings accounts right now, and how to build a system that keeps paying even when the market gets wild. This isn’t about getting rich. It’s about staying secure.