Options Trading Costs: What You Really Pay to Trade Options

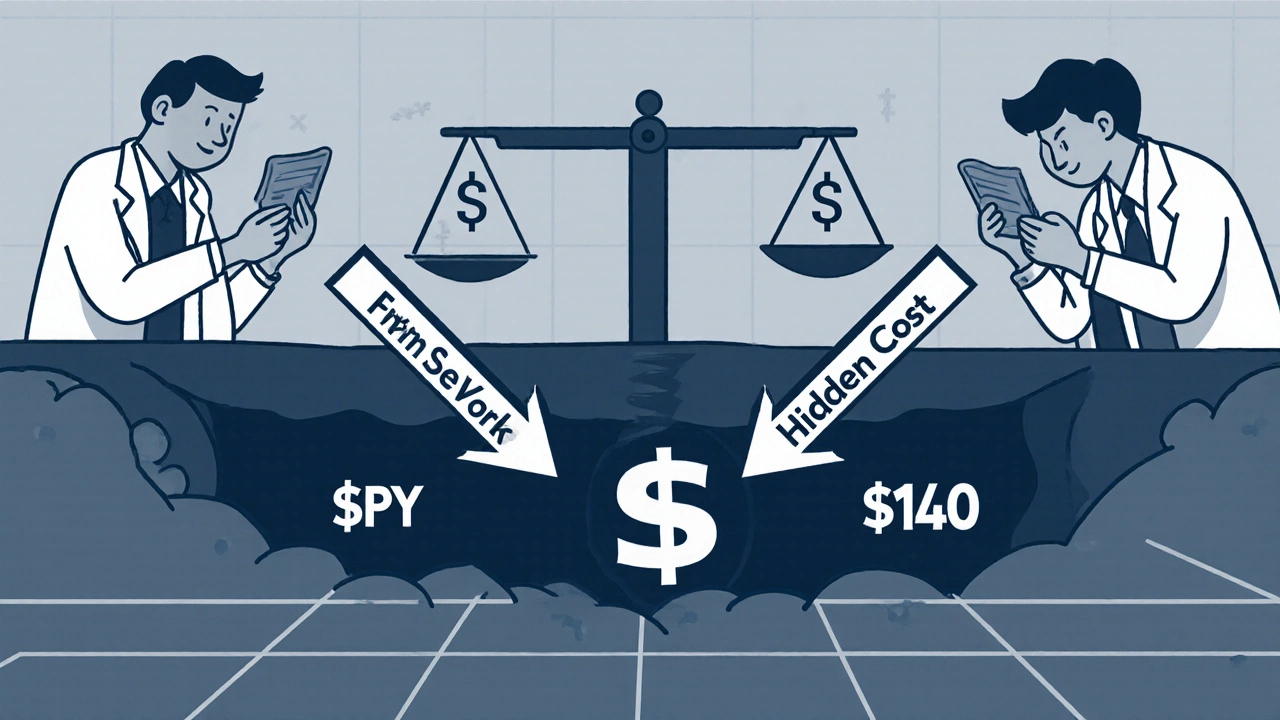

When you trade options trading costs, the total price you pay to buy or sell options contracts, including premiums, commissions, and exchange fees. Also known as options trade expenses, it’s not just the price of the contract—it’s everything stacked on top. Most beginners think they’re only paying for the option premium, but that’s just the start. Every trade comes with hidden fees that can turn a winning trade into a losing one if you don’t account for them.

Option premiums, the price you pay to buy an option, or receive when you sell one are the biggest chunk, but they’re not the only thing. Brokerage fees, charges your broker adds per trade, even if they say "zero commission" still exist in disguise—through markups on spreads, inactivity fees, or data subscription costs. And then there’s implied volatility, a market-driven factor that inflates or deflates option prices based on expected price swings. High volatility means higher premiums, which means higher costs to enter and exit. If you’re trading weekly options, you’re paying these costs every seven days. That’s not investing—it’s renting risk.

Many traders don’t realize how much they lose to options expiration, the point when an option becomes worthless if it’s out of the money. You buy a call option hoping the stock rises. If it doesn’t move enough before expiration, your entire premium vanishes. That’s not a loss on the stock—it’s a loss on the cost structure of the option itself. And if you roll positions to avoid expiration, you’re paying fees again. And again. And again.

Compare this to buying stock outright. You pay a one-time commission (if any), hold it, and only pay taxes when you sell. With options, you’re constantly paying to play. That’s why successful options traders don’t just predict price—they track every fee, every spread, every tick of volatility. They know the market doesn’t move against them—it moves through their costs.

What you’ll find below are real breakdowns from actual trades: how much one trader lost on fees alone, why some brokers charge more for index options than stock options, and how to spot when a "free" trade isn’t free at all. You’ll see how expiration cycles affect your bottom line, and why implied volatility isn’t just a buzzword—it’s your cost multiplier. These aren’t theory pieces. They’re receipts from the real world.