Options Liquidity: What It Is and Why It Matters for Your Trades

When you trade options liquidity, the ease with which option contracts can be bought or sold without causing a price change. Also known as market liquidity for derivatives, it’s what separates smooth trades from frustrating delays or slippage. If a stock has high options liquidity, you can enter or exit positions fast, at prices close to what you see. Low liquidity? You might get stuck waiting, pay wider spreads, or lose money just from the cost of trading.

This isn’t just about big names like Apple or Tesla. Even smaller companies can have liquid options if enough traders are active. What drives it? trading volume, the total number of contracts exchanged over time and open interest, the total number of outstanding contracts held by investors. High volume means buyers and sellers are constantly matching. High open interest means those contracts aren’t just fleeting—they’re held, watched, and traded repeatedly. Together, they signal a healthy market. Without them, you’re guessing at prices, not making informed moves.

Why does this matter to you? Because options liquidity directly impacts your risk and returns. A liquid option lets you cut losses fast if the trade goes south. It lets you lock in gains without a fight. It also means tighter bid-ask spreads—sometimes just a few cents—which adds up over time. You won’t find this in obscure, low-volume options. You’ll find it in contracts tied to popular stocks, near-term expirations, and strikes close to the current price. The most liquid options are usually the ones everyone else is watching.

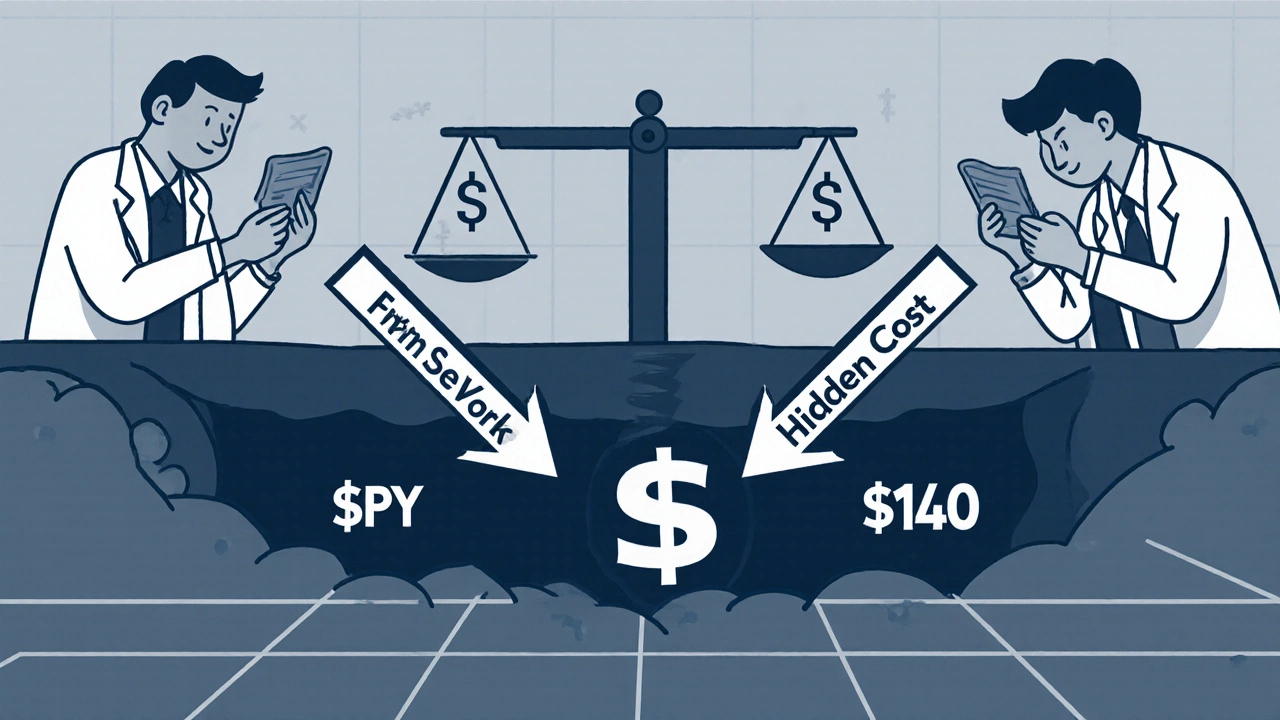

Some traders ignore liquidity until they get burned. They buy an option because the price looks cheap, only to realize they can’t sell it when they need to. That’s not a strategy—it’s a trap. The posts below show you how to spot liquid options before you trade, how volume and open interest interact, and how to avoid the hidden costs of illiquid markets. You’ll see real examples from live trading, not theory. Whether you’re new to options or you’ve been trading for years, this collection gives you the practical filters to separate good trades from risky ones.