MACD Trading: How to Use Moving Averages to Spot Trends and Time Your Trades

When you're trading stocks or other assets, MACD trading, a technical indicator that shows the relationship between two moving averages of a price. Also known as Moving Average Convergence Divergence, it helps you see when momentum is shifting—before the price moves too far. Unlike simple price charts, MACD gives you a clear signal when a trend is starting or losing steam. You don’t need to guess if a stock is overbought or oversold—you just follow the lines.

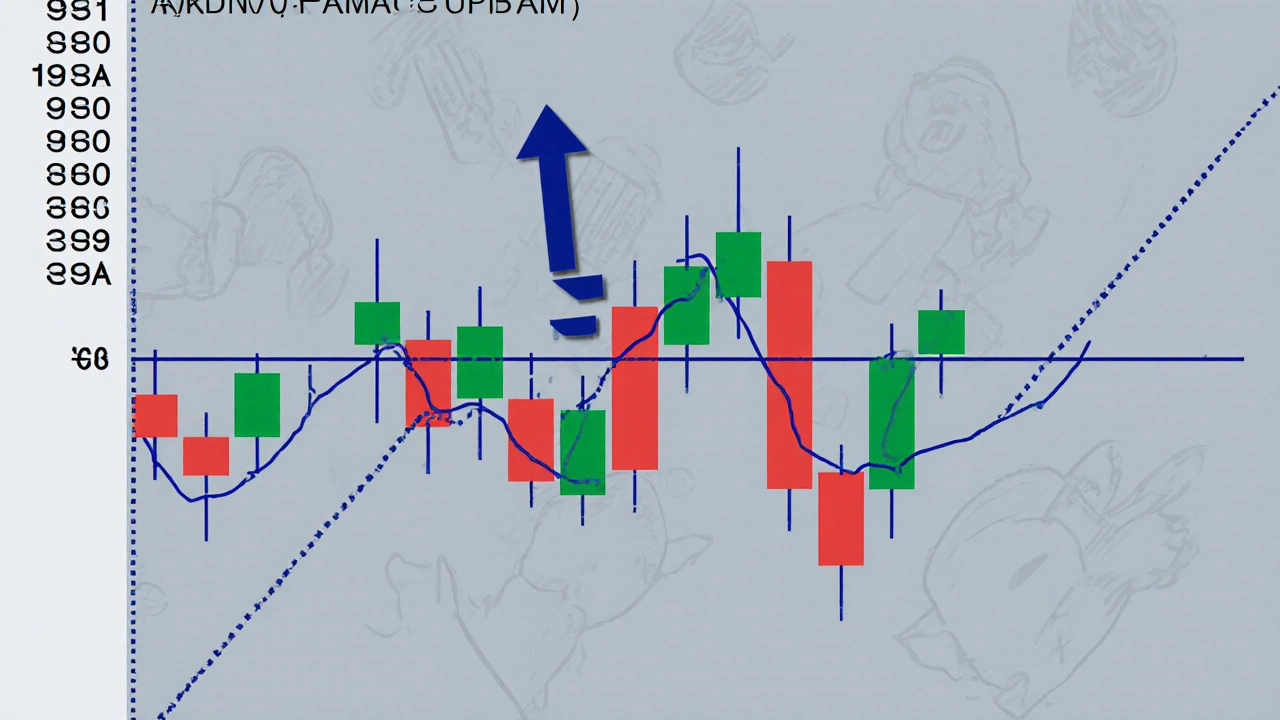

MACD trading relies on three key components: the MACD line, the signal line, and the histogram. The MACD line is the difference between the 12-day and 26-day exponential moving averages. The signal line is a 9-day average of that MACD line. When the MACD line crosses above the signal line, it’s often a buy signal. When it drops below, it’s a sell signal. The histogram shows the distance between those two lines—when it grows, momentum is strengthening; when it shrinks, the trend may be weakening. This isn’t magic—it’s math, and it’s been used by traders for decades because it works in real markets.

MACD trading doesn’t work in isolation. It’s most powerful when paired with other tools like volume checks or support/resistance levels. For example, if the MACD shows a bullish crossover but volume is falling, the move might be weak. Or if the histogram starts shrinking even as the price keeps rising, that’s a warning sign. Traders who ignore context often get burned. But those who use MACD as part of a simple, repeatable system—checking for confirmation, waiting for clear signals, and managing risk—tend to do better over time.

You’ll find MACD in almost every trading platform, from basic apps to professional terminals. It’s not flashy, but it’s reliable. And because it’s based on price data—something every trader already tracks—it doesn’t require extra inputs. That’s why it’s still popular even with AI-driven tools taking over other parts of trading. It’s simple, visual, and gives you a clear reason to act.

Some people think MACD is outdated, but that’s not true. It’s been tested in bull markets, bear markets, and sideways markets. It doesn’t predict the future, but it helps you see what’s happening right now. And in trading, that’s often enough. Whether you’re watching tech stocks, ETFs, or crypto, MACD gives you a consistent way to spot shifts in momentum without overcomplicating things.

Below, you’ll find real examples of how traders use MACD to time entries, avoid false signals, and protect their capital. You’ll see how it fits with other indicators, how to adjust settings for different assets, and what mistakes to avoid. No theory—just what works in practice.