Financial Literacy Games: Learn Money Skills Through Play

When you think of financial literacy games, interactive experiences designed to teach real money management through play. Also known as money simulation tools, they help people of all ages understand budgeting, investing, and debt without the risk of losing real cash. Most adults never learned how to handle money in school—yet we’re expected to manage mortgages, credit cards, and retirement accounts by age 25. Financial literacy games fix that gap by turning abstract concepts into clear, memorable actions.

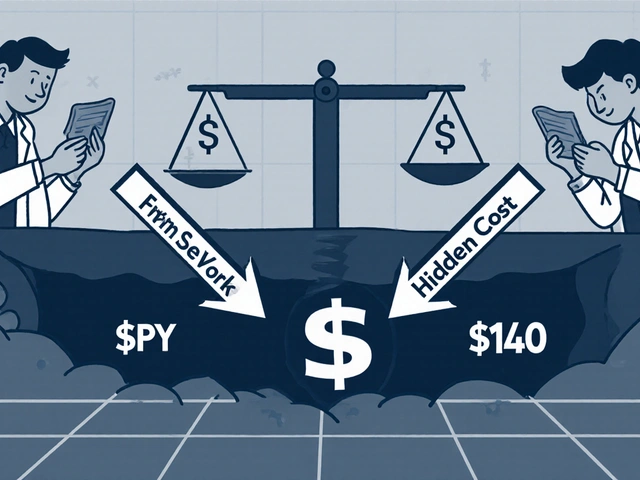

These games aren’t just for kids. Adults use them to practice budgeting, tracking income and expenses to avoid overspending before applying it to real life. Others simulate investing, buying stocks, bonds, or real estate with virtual money to see how markets behave over time. You’ll learn how compound interest works—not by reading a chart, but by watching your $1,000 grow over 10 virtual years. Some even mimic real-world traps like payday loans or medical bills that drain savings.

What makes these tools powerful is how they connect to what you already see in the news. The financial literacy games you play today mirror the same decisions behind the dividend cuts, T-bill yields, and embedded lending trends you’ll find in the posts below. You’ll see how payout ratios affect company survival, why ex-dividend dates matter for cash flow, and how emergency funds need to be liquid—not just saved. These aren’t abstract lessons. They’re practice rounds for real financial survival.

Whether you’re trying to teach your teen about credit cards, rebuild your own money habits after a setback, or just want to understand how fintech tools like budgeting apps or open banking actually work, these games give you a safe space to fail, adjust, and win. You won’t find a single post here that doesn’t tie back to one of these core skills. Below, you’ll find real guides on dividend safety scores, market cap basics, and T+1 settlement rules—all built on the same foundation: knowing how money moves, when to hold, and when to walk away.