Emergency Fund: Why You Need One and How to Build It

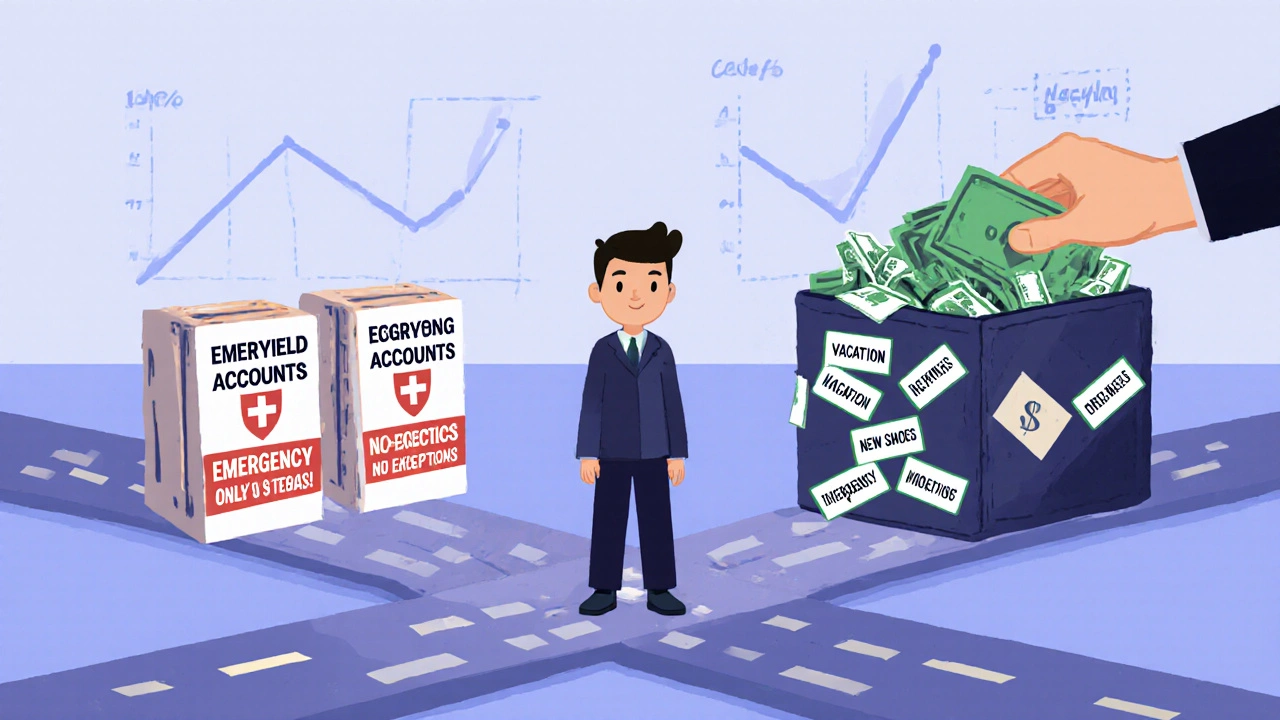

When life throws a curveball—a broken car, a medical bill, or a sudden job loss—you don’t want to be scrambling for cash. That’s where an emergency fund, a dedicated stash of cash meant for unexpected costs, not planned spending. Also known as a financial safety net, it’s the one thing that keeps you from turning to high-interest debt when things go sideways. Most people think they need three to six months of expenses saved up, but the truth? Even $500 can stop a small crisis from becoming a disaster.

Building an emergency fund isn’t about being rich—it’s about being ready. It connects directly to your taxable brokerage account, a flexible investment account where you can access money without penalties. You don’t keep your emergency fund there, though. That money needs to be safe, liquid, and instantly available. A high-yield savings account is the standard. It earns a little interest, stays FDIC-insured, and lets you pull cash out without waiting days or paying fees. Your cash reserve, the actual amount you’ve set aside for emergencies should live separately from your investment accounts. Mixing them turns your safety net into a gamble.

Why do so many people skip this? Because it feels boring. You’re not buying a new phone or taking a trip—you’re just putting money in a box you can’t touch. But here’s the real win: having an emergency fund means you don’t have to choose between paying rent and fixing your car. It gives you breathing room. It reduces stress. It lets you say no to predatory loans and credit card traps. And when you’re not drowning in debt, you can actually start building wealth—whether that’s through retirement accounts, side income, or smarter investing.

Looking at the posts below, you’ll see how this simple idea ties into bigger financial moves. Tax coordination, robo-advisor support, and even fintech lending all assume you’ve got your basics covered. If you’re using multiple account types to maximize returns, you better have a cash buffer first. If you’re automating loan approvals or tracking expenses, you’re probably trying to avoid falling into a hole. This isn’t just about saving money—it’s about keeping control.