Discount Rate: What It Is and How It Shapes Your Investment Decisions

When you hear discount rate, the percentage used to calculate the present value of future cash flows. Also known as required rate of return, it’s the invisible force that tells you whether a future payout is worth chasing today. If someone promises you $10,000 in five years, is that better than $8,000 right now? The answer depends entirely on the discount rate. It’s not just a number in a finance textbook—it’s the filter every smart investor uses to decide what’s truly valuable.

Think of the present value, the current worth of a future sum of money, adjusted for time and risk. A business that will earn $1 million over ten years isn’t worth $1 million today. Why? Because money today can earn interest. If you use a 7% discount rate, that $1 million future stream might only be worth $508,000 now. That’s the power of compounding in reverse. The higher the discount rate, the less future money is worth. And that’s why investors care so much about risk: higher risk means a higher discount rate, which slashes the value of future cash flows.

It’s not just about stocks or startups. The net present value, a calculation that subtracts initial costs from the present value of future cash flows to determine profitability is how you tell if a project makes sense. Should you spend $50,000 to upgrade your rental property? Only if the discounted future rent increases outweigh that cost. Same with retirement planning: if you’re counting on $50,000 a year from your portfolio starting in 2030, your discount rate decides if you’ve saved enough. Most people guess. Smart investors calculate.

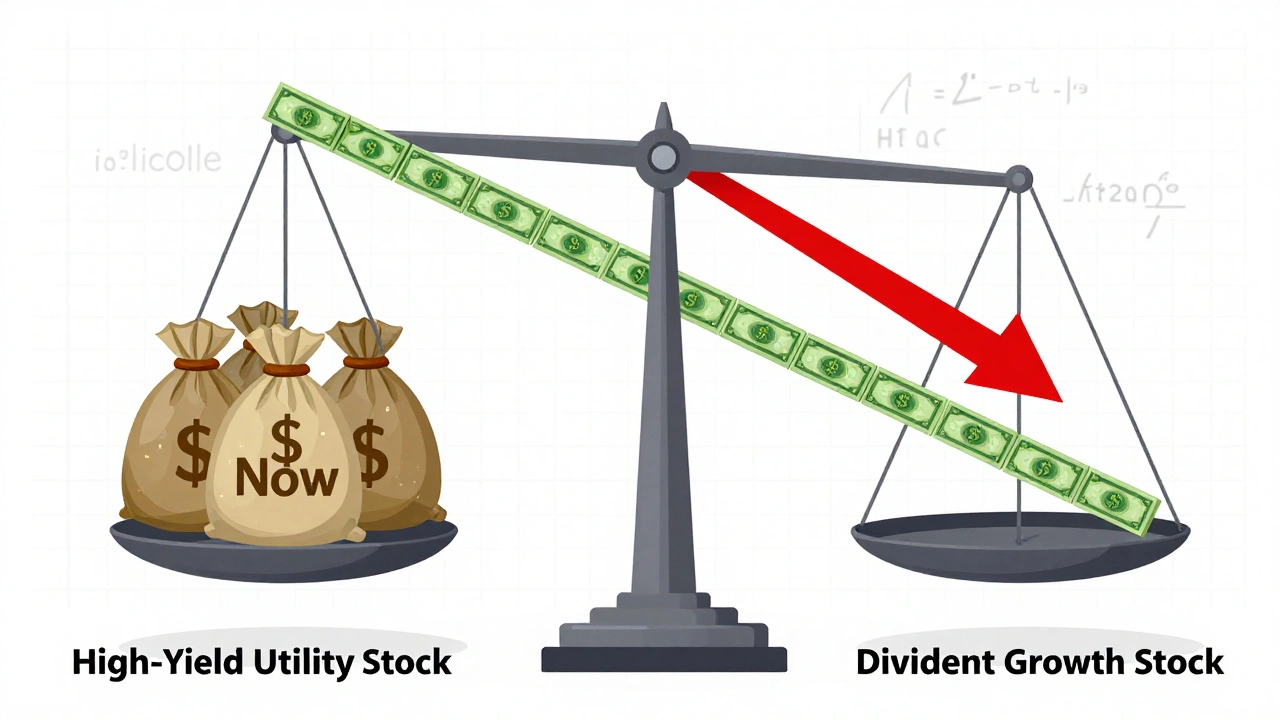

What’s the right rate to use? There’s no single answer. Some use the 10-year Treasury yield as a baseline. Others add a risk premium based on market volatility. If you’re evaluating a risky startup, you might use 20% or more. For a stable dividend stock, maybe 6%. The key isn’t picking the perfect number—it’s being consistent. Use the same rate across all your comparisons, or you’re just guessing.

And here’s the thing: your discount rate isn’t just about math. It’s about your mindset. If you’re impatient, you’ll use a high rate and ignore long-term plays. If you’re too optimistic, you’ll use a low rate and overpay. The best investors adjust their rate based on the asset, the economy, and their own risk tolerance. That’s why the discount rate isn’t just a tool—it’s a mirror. It shows you what you really believe about time, risk, and value.

Below, you’ll find real-world guides that show how this concept shows up in dividend investing, stock valuation, retirement planning, and even small business finance. You’ll see how experts use it to spot hidden value, avoid overpriced assets, and build portfolios that actually grow in real terms—not just nominal ones. No theory. No fluff. Just how it works when the numbers matter.