After-Tax Returns: Keep More of What You Earn

When you hear someone say they made 8% on their investments, they’re probably talking about after-tax returns, the real profit you walk away with after paying taxes on gains, dividends, and interest. It’s not what your portfolio says on paper—it’s what lands in your bank account. Many investors overlook this. They chase high pre-tax numbers, only to realize their net gain is half of what they expected. That’s because taxes don’t wait for you to retire—they hit you every year dividends are paid, every time you sell a stock at a profit, and even when you cash out bond interest.

Capital gains tax, the tax you pay when you sell an asset for more than you paid is the biggest thief here. Short-term gains (held less than a year) are taxed like regular income—sometimes over 37%. Long-term gains? Lower, but still significant. Then there’s taxable investments, any investment that generates income the IRS wants a cut of: dividends from stocks, interest from bonds, even real estate rentals. If you’re holding these in a regular brokerage account, you’re paying taxes every year, even if you didn’t touch the money.

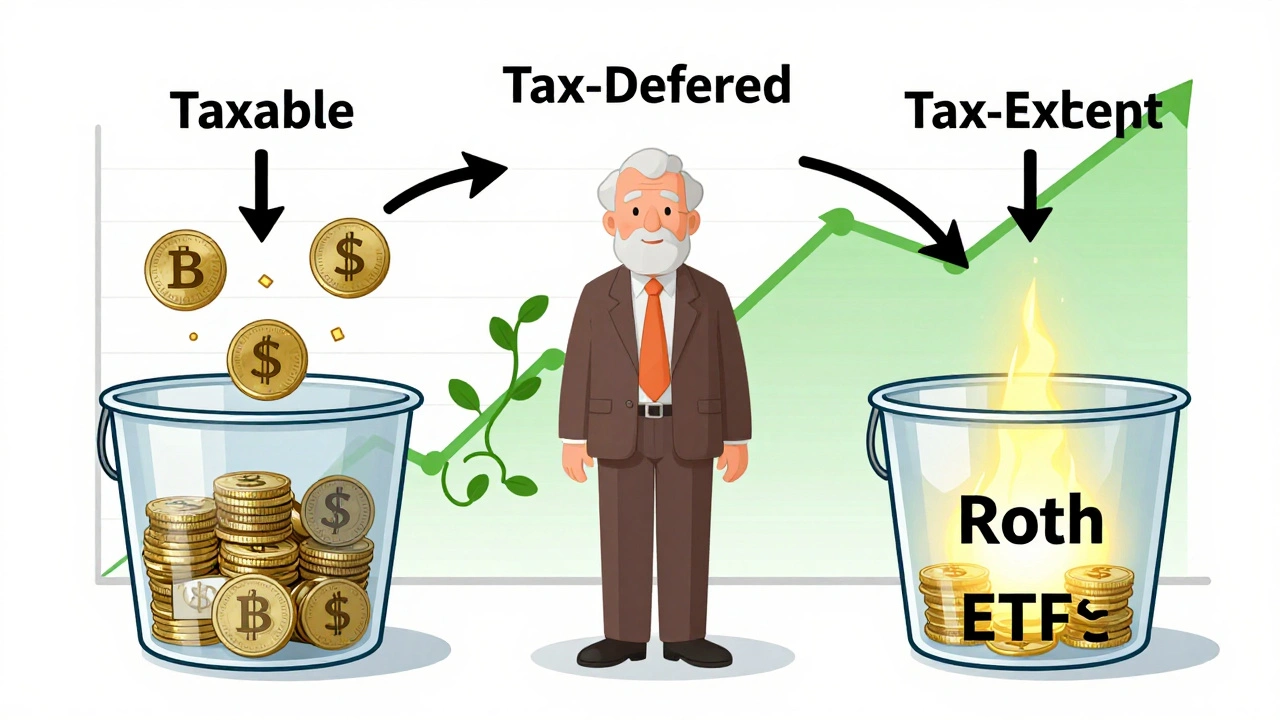

That’s why smart investors don’t just pick good assets—they pick the right accounts. A Roth IRA lets your gains grow tax-free. Municipal bonds pay interest that’s often exempt from federal tax. Index funds and ETFs tend to generate fewer taxable events than actively traded stocks. These aren’t just tricks—they’re structural advantages built into how the system works. You don’t need to be a tax expert to use them. You just need to know they exist.

And it’s not just about avoiding taxes—it’s about timing. Selling a stock in December? Maybe wait until January. Rebalancing your portfolio? Do it in a low-income year. These moves don’t change your strategy—they just change when you pay the bill. The difference between paying taxes now versus later can mean tens of thousands over a decade.

The posts below show you exactly how to spot hidden tax drains in your portfolio, compare after-tax returns across different assets, and use simple tools to track what you really keep. You’ll find guides on dividend investing that factor in tax rates, breakdowns of how bond yields change after taxes, and even how to use tax-loss harvesting without making costly mistakes. No jargon. No fluff. Just clear, practical ways to turn your investment returns into real, usable money.