Taxable Account Rebalancing: How to Stay on Track Without Paying More Taxes

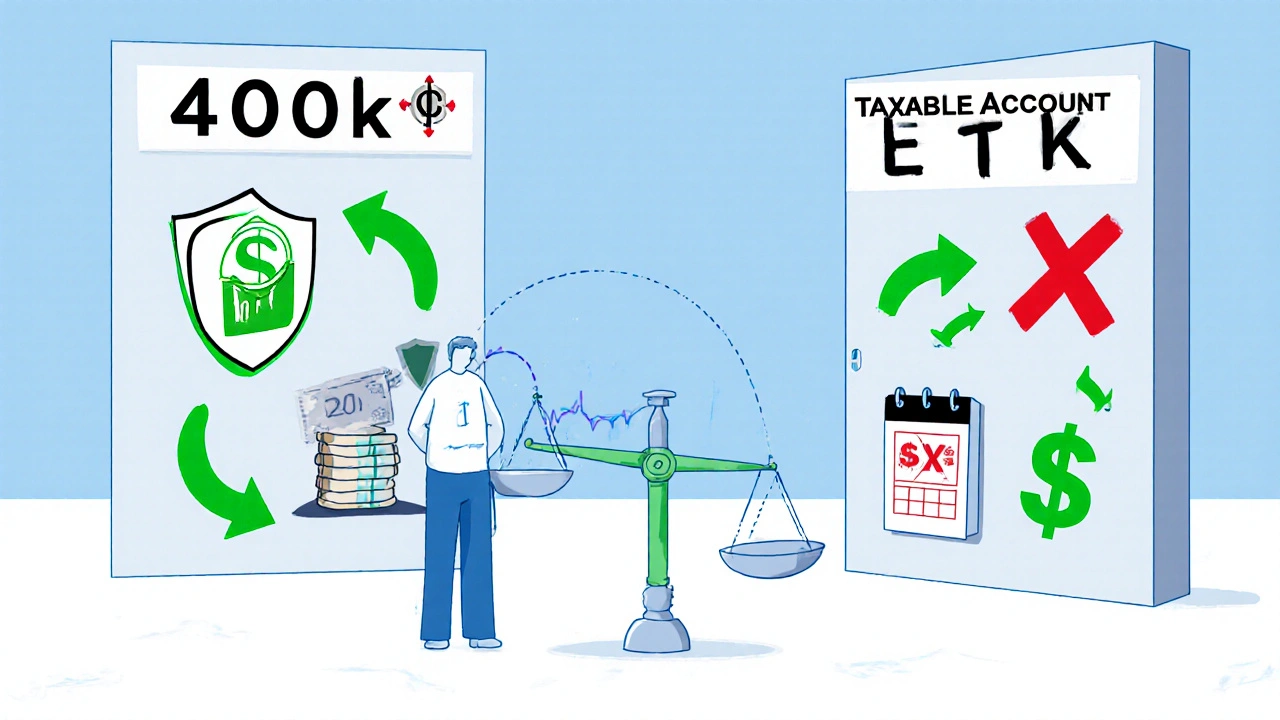

When you invest in a taxable account rebalancing, the process of adjusting your portfolio back to your original target weights in an account where gains are taxed. Also known as portfolio rebalancing in a taxable brokerage account, it’s not just about buying and selling—it’s about doing it in a way that keeps more money in your pocket. Most people think rebalancing means selling what’s up and buying what’s down. But in a taxable account, that simple move can trigger capital gains taxes you didn’t plan for.

That’s why taxable brokerage account, an investment account where you pay taxes on dividends and capital gains each year. Also known as non-retirement investment account, it requires a smarter approach than a 401(k) or Roth IRA. You can’t just flip assets whenever they drift. You need to use cash flow, new deposits, dividend reinvestments, and tax-loss harvesting to nudge your portfolio back in line. The goal isn’t perfection—it’s progress without unnecessary tax hits. Many investors lose 0.5% to 1% a year just from poorly timed rebalancing, according to real-world portfolio tracking data from users who’ve tested these methods.

Related concepts like asset location, where you place different types of investments across taxable, tax-deferred, and tax-free accounts. Also known as tax-efficient asset placement, it directly affects how often you even need to rebalance in your taxable account. If your bonds are in your IRA and your stocks are in your taxable account, you’re naturally avoiding frequent sales in the taxable space. That’s one reason why using capital gains tax, the tax you pay when you sell an investment for more than you paid for it. Also known as investment gain tax, it’s the silent cost that makes rebalancing tricky. matters. Short-term gains (on assets held less than a year) are taxed at your full income rate. Long-term gains (held over a year) are usually much lower. So timing matters. So does using dividends to buy more of the underweight assets instead of selling winners.

You’ll find posts here that show how to rebalance without touching your winners, how to use new money to correct imbalances, and how to spot when you’re better off waiting. Some strategies work for beginners who just started investing. Others are for people who’ve maxed out their retirement accounts and are now building wealth in taxable space. There’s no one-size-fits-all method—only smart, practical steps that match your situation. What follows are real examples, tested tactics, and clear explanations from people who’ve been there. No theory. No fluff. Just what works when taxes are on the line.