T-bills: What They Are, How They Work, and Why They Matter for Your Portfolio

When you hear T-bills, short-term U.S. government debt securities sold at a discount and redeemed at face value. Also known as Treasury bills, they're the go-to choice for investors who want safety without sacrificing liquidity. Unlike stocks or corporate bonds, T-bills come with the full faith and credit of the U.S. government backing them—meaning default risk is practically zero. They’re not flashy, but they’re the quiet backbone of every serious investor’s cash management strategy.

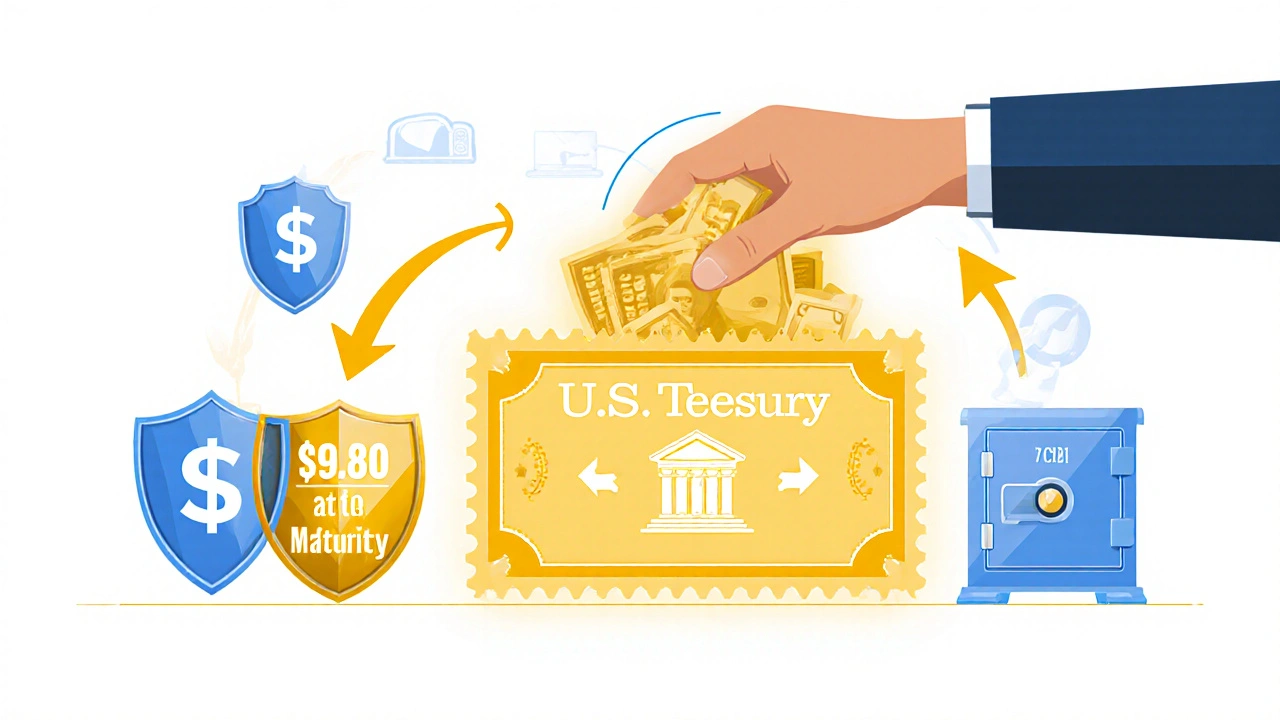

T-bills are a type of Treasury security, debt instruments issued by the U.S. Department of the Treasury to fund government operations. They come in three standard terms: 4 weeks, 13 weeks, and 26 weeks. You buy them at a discount—say, $98 for a $100 bill—and get the full $100 when they mature. The difference is your interest, called the discount yield. No coupon payments, no monthly checks. Just clean, simple returns. This makes them different from government bonds, longer-term debt instruments that pay periodic interest. Bonds are for income seekers; T-bills are for capital protectors.

Why does this matter? Because in uncertain markets, cash isn’t just sitting idle—it’s working. T-bills let you earn more than a high-yield savings account while keeping your money accessible within months. They’re the bridge between your checking account and your stock portfolio. When inflation spikes, or the market dips, T-bills become a safe harbor. You don’t need to time the market if you’re holding T-bills—you’re just preserving value until you’re ready to act.

They’re also used by institutions, hedge funds, and even large corporations to manage short-term cash. But you don’t need millions to use them. You can buy T-bills directly through TreasuryDirect.gov with as little as $100. No brokers, no fees, no hidden terms. That’s why they show up in posts about emergency funds, diversification, and risk management—they’re the ultimate low-risk asset.

And while you won’t get rich off T-bills, you also won’t lose money. That’s why they’re paired with dividend stocks, options, and even AI-driven investing tools in smart portfolios. They balance risk. They calm nerves. They give you room to breathe when everything else is moving fast.

Below, you’ll find real guides on how to use T-bills alongside other investments—from understanding how they fit into your emergency fund to comparing them with other short-term options. No fluff. Just clear, practical insights from investors who’ve been there.