Social Security Benefits: What You Really Get and How It Fits Into Your Retirement Plan

When you think about Social Security benefits, a federal program that provides monthly income to retired workers, disabled individuals, and survivors of deceased workers. Also known as OASDI, it’s not a savings account—it’s a pay-as-you-go system funded by payroll taxes. About 67 million people rely on it each month, and for nearly half of retirees, it makes up over half their income. But here’s the catch: the average monthly payout in 2024 was just $1,906. That’s not enough to cover rent, food, and healthcare in most places, especially if you’re living past 80.

What you get depends on your earnings history, when you start claiming, and whether you’re still working. If you claim at 62, your benefit drops by up to 30%. Wait until 70, and you get the maximum—about 76% more than if you’d started early. That’s not a bonus; it’s a huge difference in how long your money lasts. And if you’re married, your spouse might qualify for up to 50% of your benefit, or their own if it’s higher. Survivors can get even more—widows and widowers often get 100% of what their partner was receiving.

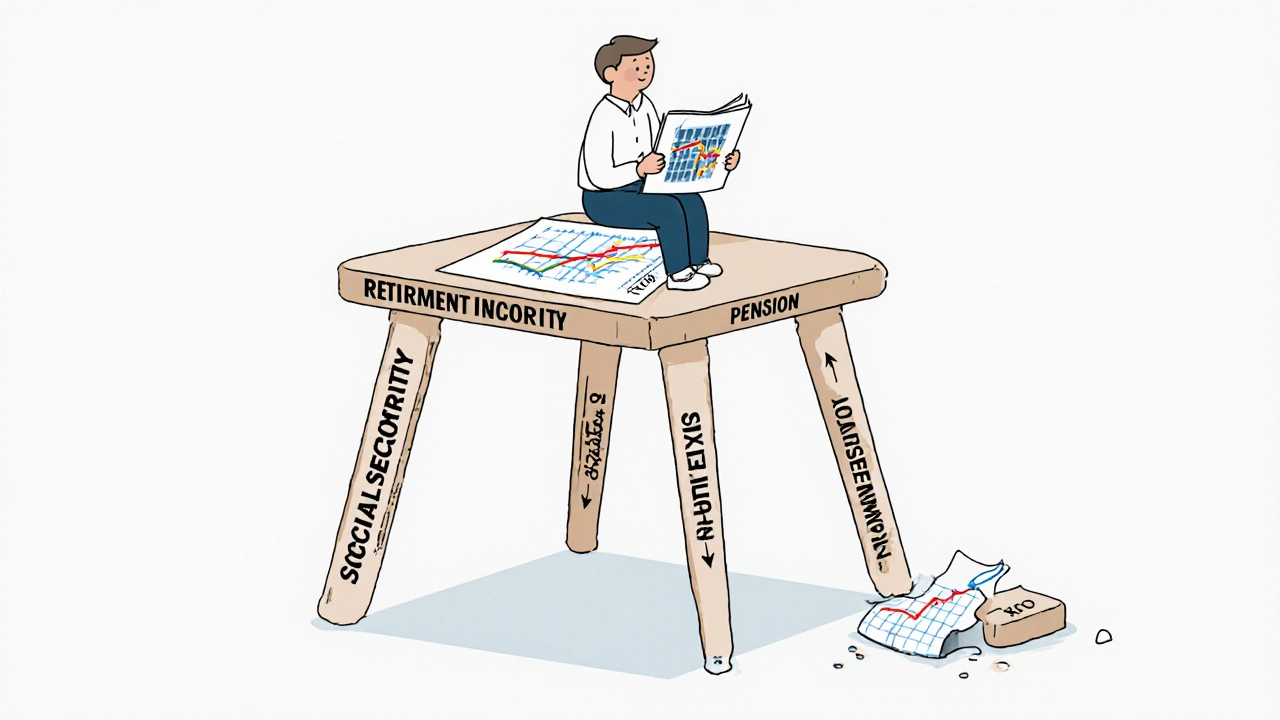

Social Security benefits are tied to inflation through cost-of-living adjustments, but those don’t always keep up with real healthcare or housing costs. That’s why pairing it with other income sources matters. Retirement savings, money you’ve set aside in 401(k)s, IRAs, or taxable brokerage accounts can fill the gap. Retirement income, any regular money you get after leaving work, including pensions, annuities, or rental income helps too. If you’re still working after claiming, your benefits might be reduced until you hit full retirement age. And if you’re divorced but married for at least 10 years, you might still qualify based on your ex’s record—no need to ask them.

There’s no one-size-fits-all plan. Someone who saved aggressively might treat Social Security as a safety net. Someone who never had a 401(k) might depend on it to avoid poverty. Either way, knowing how it works lets you make smarter choices—like delaying benefits to get more later, or coordinating with your spouse to maximize household income. The system isn’t perfect, but it’s the only guaranteed lifetime income most Americans will ever have. The real question isn’t whether you’ll get it—it’s whether you’ve planned for what comes after.

Below, you’ll find real guides on how to protect your income, avoid traps, and build a retirement that doesn’t rely on luck. Whether you’re 30 or 65, these posts help you turn uncertainty into control.